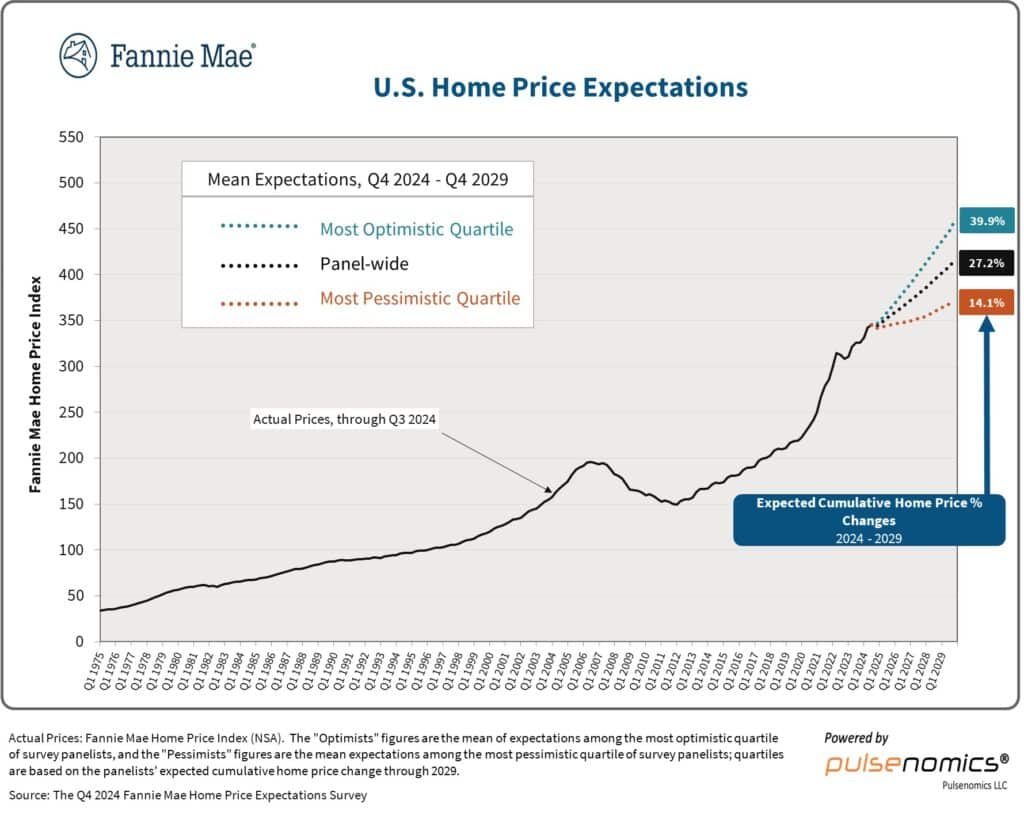

According to the Q4 2024 Fannie Mae Home Price Expectations Survey (HPES), following an average expectation for national home price growth of 5.2% in 2024, a panel of more than 100 housing experts forecasts home price growth to decelerate to 3.8% in 2025 and 3.6% in 2026.

The panel’s estimates of national home price growth represent an upward revision from last quarter’s expectations of 4.7% for 2024, 3.1% for 2025, and 3.3% for 2026, as measured by the Fannie Mae Home Price Index (FNM-HPI).

Fannie Mae’s Economic & Strategic Research (ESR) Group also surveyed panelists on their general housing outlook for 2025. On average, the panelists expect existing home sales to remain sluggish for another year, new home sales to trend slightly upward, and mortgage rates to remain elevated but modestly decline over the course of the year to 6.3%. Additionally, depending on their expectations for accelerating or decelerating home prices in 2025, the ESR Group also asked for the major factors driving their home price forecast. The largest group, which represents roughly 80% of respondents, expects home price growth to decelerate, citing continued high mortgage rates, rising for-sale housing inventory, and slower wage growth as the main drivers. The minority of panelists who expect faster home price appreciation most commonly cited strong pent-up demand from first-time homebuyers, continued tightening of inventory of homes for sale, and easing mortgage rates.

“While home price growth is expected to ease next year, HPES panelists’ big-picture view for 2025 appears to be little changed compared to 2024, with most seeing another year of elevated mortgage rates and weak home sales,” said Mark Palim, Fannie Mae SVP and Chief Economist. “We share our panelists’ view that home price growth is likely to decelerate next year, as the mix of continued elevated mortgage rates and the run-up in home prices of the past four years will likely continue to strain affordability and remain an impediment to many would-be homebuyers.”

Fannie Mae’s HPES is produced in partnership with Pulsenomics, and polls more than 100 housing experts across the housing and mortgage industry and academia for forecasts of national home price percentage changes in each of the coming five calendar years, with the Fannie Mae Home Price Index as the benchmark. On a quarterly basis, Fannie Mae plans to publish the latest panelist-level expectations, as well as a special topic report that includes respondent feedback on topical questions designed to help inform the broader housing industry. The Q4 2024 HPES had 115 respondents, and was conducted by Pulsenomics between November 12-22, 2024.

“Although a significant majority of experts expect the nationwide home value appreciation rate will diminish from recent levels, the panelists’ annual average projected price increase through 2029 is still well above expectations for economy-wide inflation, suggesting that they expect affordability problems to persist well beyond 2025,” added Terry Loebs, Founder of Pulsenomics.