In a newly released report, according to a recent survey from Redfin, the Homebuyer Demand Index is close to its highest level seen since September 2023.

A seasonally adjusted indicator of tours and other purchasing services from Redfin agents, the Homebuyer Demand Index, is up approximately 7% over the previous year. Applications for mortgage purchases are at their highest level since late January, rising 17% month-over-month.

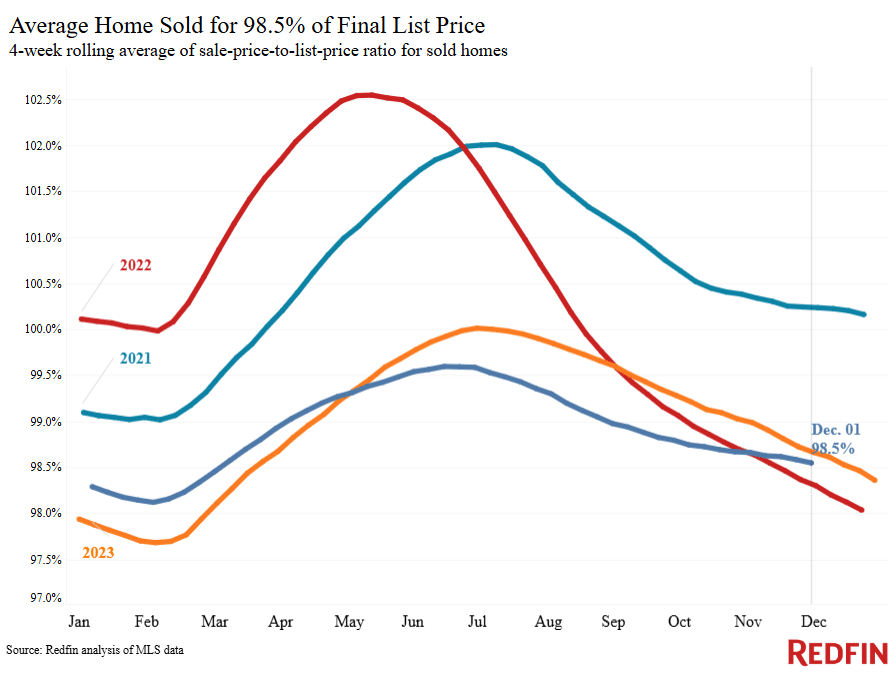

The four weeks ending December 1 saw an estimated 6.5% increase in pending home sales compared to the same period last year, which is comparable to the annual increases Redfin has witnessed over the past two months.

Despite high property prices and mortgage rates, there are a few reasons why homebuyers are emerging from the sidelines and easing their way into the market. Before taking the decision to purchase a property seriously, many Americans waited for the election to be over. Following the election, Redfin witnessed a surge in early-stage homebuying activities, such as home tours, and this trend has persisted.

Purchasers have been used to high mortgage rates, and many have come to terms with the fact that they are unlikely to decrease very soon. With a current weekly average rate of 6.81%, it is approximately in the middle of the two-year range of 6% to 7.8%.

“The market is strong, with a lot of pent-up demand after a slow summer and early fall,” said Mimi Trieu, a Redfin Premier agent in the Bay Area. “Buyers realized mortgage rates may not drop below 5%, and probably not below 6%, in the near future. They are also noticing there are not many desirable, move-in ready homes for sale that are priced reasonably, so they’re pushing forward and negotiating for good deals. Homes that have been sitting on the market since the summer or early fall are finally selling.”

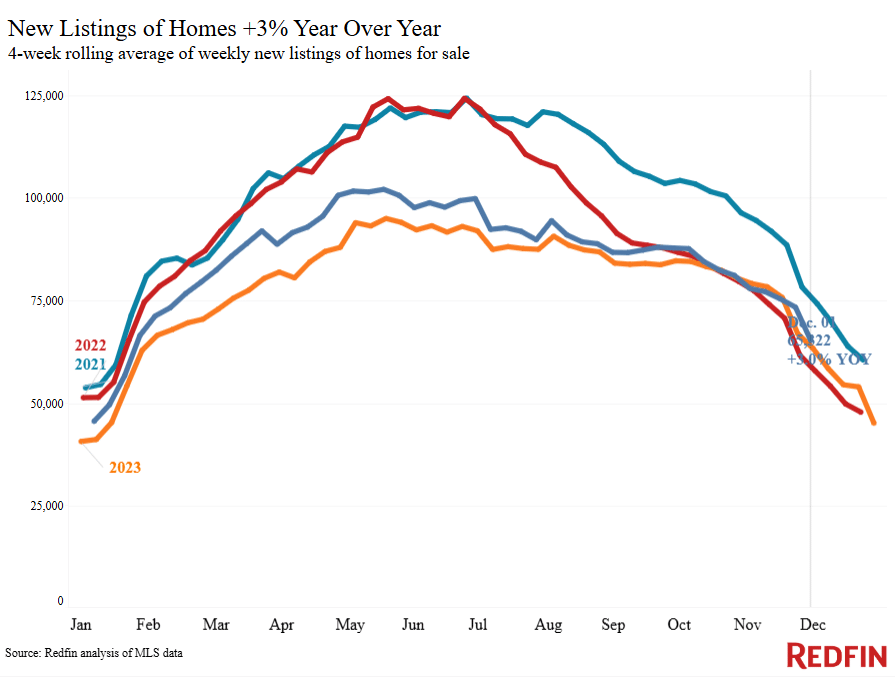

New listings on the for-sale market have increased by 3% annually. Even though it’s a slight gain, it’s the largest in two months (except for the previous four weeks, when Thanksgiving inflated the year-over-year growth).

Metro-Level Highlights for Four Weeks Ending December 1, 2024

Metros with biggest year-over-year (YoY) increases in median sale price:

- Detroit (14%)

- Newark, NJ (13%)

- Warren, MI (12.1%)

- Miami (11.5%)

- Montgomery County, PA (11.1%)

Overall, the U.S. median sale price declined in only three major metros.

Metros with biggest YoY decreases in median sale price:

- Tampa, FL (-1.5%)

- Dallas (-0.5%)

- San Antonio (-0.4%)

Metros with biggest YoY increases in pending sales:

- San Jose, CA (20.1%)

- Cincinnati (15.9%)

- San Francisco (15.5%)

- Jacksonville, FL (13.7%)

- Tampa, FL (13.6%)

The report also found that U.S. pending sales declined seven metros.

The top five metros with biggest YoY decreases in pending sales are:

- Miami (-11%)

- West Palm Beach, FL (-6.5%)

- Fort Lauderdale, FL (-4.9%)

- Houston (-3.3%)

- Atlanta (-1.8%)

While the report found that new listings declined in 16 U.S. metros, some of the most major saw significant increases.

The top five metros with biggest year-over-year (YoY) increases in new listings are:

- Washington, D.C. (14.6%)

- Philadelphia (13.3%)

- Baltimore (11.8%)

- Jacksonville, FL (11.3%)

- Phoenix (9.5%)

The top five metros with biggest year-over-year (YoY) decreases in new listings are:

- San Antonio (-19.8%)

- Austin, TX (-18.7%)

- Portland, OR (-10.3)

- Atlanta (-9.6%)

- Newark, NJ (-8.3%)

Note: The 50 most populated metro areas in the U.S. are included in Redfin’s metro-level data. To maintain the accuracy of the data, some metros may occasionally be excluded.

To read the full report, including more data, charts, and methodology, click here.