According to Redfin, the median U.S. asking rent fell 0.7% year-over-year in November to $1,595, the lowest level since March 2022. Rents were down 1.1% on a month-over-month basis. The median rent is now 6.2% lower than when it hit an all-time high of $1,700 in August 2022.

Highlighting improved rental affordability, November marked the 19th consecutive month where the median asking rent price per square foot (PPSF) fell year-over-year, down 2.2% to $1.79. That’s the first time the median PPSF has been below $1.80 since November 2021.

While the rental market has remained essentially flat over the past two years, rents have started to tick down slightly in recent months, thanks in part to the record number of new apartments that have been completed this year. Apartment completions nationwide rose 22.6% year-over-year to the highest level in over 12 years in Q2. As a result, the vacancy rate for buildings with five or more units rose to 8% in Q3, the highest level since early 2021.

“Renters in areas where construction has boomed are in a sweet spot right now. Affordability is improving as rents fall and wages rise, and there is increased choice with more and more new apartment buildings opening,” said Redfin Senior Economist Sheharyar Bokhari. “As construction starts to slow, rents will eventually tick back up, but 2025 is shaping up as a renter’s market with potential for the affordability gap between buying and renting to widen.”

With a major boost in supply, November marked the fifth consecutive month that asking rents fell across all bedroom counts.

Median asking rents for zero- to one-bedroom apartments fell 1.7% year-over-year to $1,450 a month, the lowest level since November 2021. Rents for two-bedroom apartments fell 1.1% (to $1,671) and three-plus-bedroom apartments fell 2.3% (to $1,955).

On a price per square foot basis, the decline was more apparent, with zero- to one-bedroom apartments falling the most (-2.5%), followed by three-plus-bedroom apartments (-2.4%), and two-bedroom apartments (-1.2%).

Major Metros Reporting the Highest Rent Decreases

As has been the case for most of 2024, of the 44 major metros Redfin analyzes, Sun Belt metros saw the most significant declines in median rents, led by Austin, Texas (-12.4%); Tampa, Florida (-11.3%); Raleigh, North Carolina (-8.4%); Jacksonville, Florida (-7.5%); and Nashville, Tennessee (-7%).

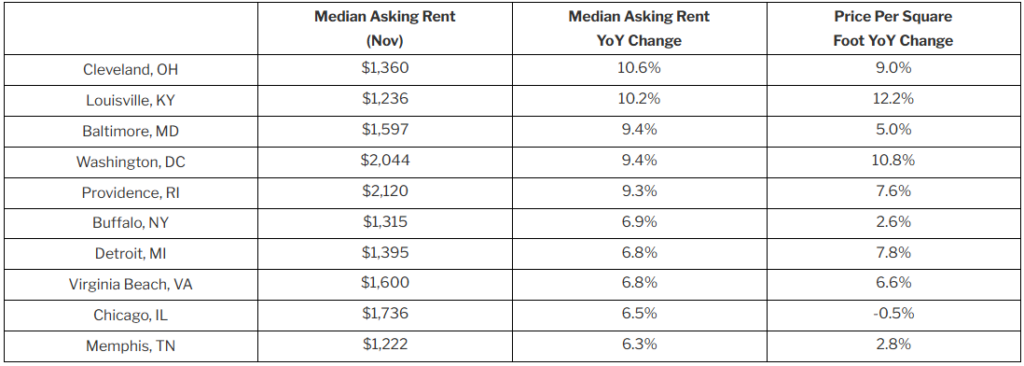

Major Metros Reporting the Highest Rent Increases

Rents rose the most in Midwest and East Coast metros, where there has been less new construction compared to the Sun Belt. Cleveland posted the biggest increase at 10.6%, followed by Louisville, Kentucky at 10.2%; Baltimore at 9.4%; Washington, D.C. at 9.4%; and Providence, Rhode Island at 9.3%.