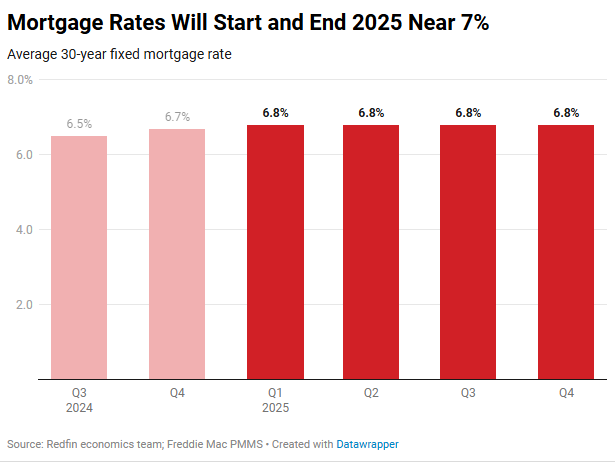

Given the pent-up demand, Redfin‘s economists predict more home sales in 2025. Due to rising housing prices and mortgage rates that are still close to 7%, some prospective homeowners will still be priced out, according to Redfin.

According to Redfin, the median price of a home sold in the United States would increase gradually throughout 2025, finishing the year 4% higher than it did in 2024. Because there won’t be enough new inventory to meet demand, prices will increase at a rate comparable to that of the second half of 2024. Many Americans will not be able to afford homeownership due to rising costs, which will force some prospective homeowners to rent instead.

According to Redfin, the median price of a home sold in the U.S. would increase gradually throughout 2025, finishing the year 4% higher than it did in 2024. Because there won’t be enough new inventory to meet demand, prices will increase at a rate comparable to that of the second half of 2024. Many Americans will not be able to afford homeownership due to rising costs, which will force some prospective homeowners to rent instead.

However, if the economy deteriorates and/or if proposals for tax cuts and tariffs are retracted, mortgage rates may fall to the low-6% area. Any year that sees a transition in the president’s office is unpredictable, but this one might be particularly so.

2025 Will See Higher Home Sales Than 2024

Existing home sales will increase slightly in 2025, reaching a yearly rate of 4.1 million to 4.4 million by the end of the year. That is an estimated 2% to 9% increase from the previous year. Although high housing costs may turn off some potential buyers, there is also a fair amount of pent-up demand in the market, which is why Redfin is showing an exceptionally wide sales range this year.

As homeowners continue to hold onto their homes, poor inventory and high mortgage rates will be the cause of any slight improvement in sales.

If mortgage rates drop more than anticipated and/or if the recent surge in demand for homebuying persists, sales might show a larger gain. Despite mortgage rates remaining at about 7%, demand for home purchases surged in the weeks following the November election. This was partially due to consumers waiting for uncertainty to subside before making a significant purchase, and also because the prospect of a Republican-led government gave many individuals greater financial confidence.

Due in part to the fact that many Americans have been acclimated to high mortgage rates, Redfin’s research even before to the election indicated that rising mortgage rates did not dissuade purchasers as much as anticipated. Sales would increase if the economy continued to grow and enough individuals could afford the high cost of housing in the upcoming year.

Will 2025 Will Be a Renter’s Market?

Many Americans will either rent or continue to rent. Although purchasing a home will become more expensive, renting will become more affordable. According to Redfin, in 2025, the median asking rent in the United States will not change from year to year. Because salaries would increase, the average American will be able to pay their rent more easily.

Additionally, more rental units will be available for purchase, as many of the apartments that builders began construction on during the pandemic apartment boom are now complete. Because there will be more supply than demand, landlords will be compelled to make concessions in order to keep tenants, such as providing free parking, a free month’s rent, additional amenities, or a break from rent hikes.

Homebuilding to Increase Due to Construction Regulations

Though it may take a few years before the surge in homebuilding makes purchasing a home noticeably more cheap, Redfin projects that more single-family houses will be built in 2025. Because of the newfound hope that regulatory burdens may be reduced, the Republican sweep of the White House, Senate, and House has increased builder confidence. Additionally, builders will rely on the fact that the lock-in impact of mortgage rates will limit the amount of existing inventory that can compete with new construction.

A recovery in multifamily housing starts should also result from loosening rules. That will be a reversal from 2024, when the supply surplus caused builders to reduce the number of apartment starts.

The warning is that there are some obstacles for builders to overcome. First, interest rates are probably going to remain high. Second, since immigrants account for almost 30% of the nation’s construction workforce, the incoming administration has stated that it will reduce immigration, which is likely to result in fewer residential development.

Redfin anticipates a small decrease in real estate commissions during the first full year of the new National Association of Realtors (NAR) commission regulations. In competitive housing markets, where costs are frequently a subject of negotiation in a bidding war, this is particularly true for luxury houses, where brokers have the most leeway to lower their fees.

How far the incoming administration’s antitrust enforcers will push for more reforms in the real estate sector is still up in the air. Although it’s unclear if it would take any official action, the Department of Justice stated in a recent filing that it “continues to scrutinize policies and practices in the residential real estate industry that may stifle competition.”

The Federal Trade Commission will be more inclined to authorize mergers and acquisitions between big businesses under the incoming government. The U.S. real estate market has historically been fragmented, with numerous brokerages and real estate search sites of all sizes and business models vying for agents and clients, in contrast to other sectors with a small number of dominating firms. We’re likely to see more roll-ups of brokerages, lenders, and title businesses hoping to increase business from every client, even though it’s not unusual for larger brokerages to have connected mortgage or title services.

Individual Homes Will Be Priced to Reflect Climate Risks

In climate-risky areas, such as coastal Florida, wildfire-prone areas of California, and hurricane-prone areas of Texas, the likelihood of natural disasters will begin to drive down property prices or restrict price growth. The riskiness of each property will inevitably increase the knowledge of homebuyers and their agents. Due to their relative affordability and relative protection from climate-related calamities, the Midwest and Northeast will see an increase in the number of homebuyers.

For many middle- and lower-class homeowners in Florida, Hurricanes Helene and Milton marked a sea change. Compared to the previous year, fewer out-of-town purchasers sought to relocate to Florida this fall, but more homebuyers sought to depart the state. Only the wealthy who can afford to rebuild or pay exorbitant insurance rates may be able to afford to reside in coastal Florida. The luxury market around Florida’s coast is expected to remain robust, according to Redfin.

Compared to higher-priced homes, lower-priced homes will increase in 2025, but not because more young Americans or members of the working class are becoming homeowners. Rather, older purchasers who are priced out of higher price tiers will buy inexpensive homes. In contrast, Gen Zers will continue to rent or live with family long into their 30s, choosing instead to accumulate money in other ways.

To read the full report, including more data, charts, and methodology, click here.