As the new year draws near, Fannie Mae anticipates that many of the housing trends from 2024 will persist in 2025, with the “lock-in effect” of mortgage rates and housing affordability continuing to be major obstacles for countless Americans. The GSE provides five forecasts for the housing market in 2025 below, along with our housing and economic outlook.

According to the report, the economy looks to be well-positioned to close out 2024: Although the labor market is gradually cooling, consumer spending has remained strong, unemployment is still low, and job creation is now occurring at a solid rate according to demographic trends. The GSE predicts no significant drop in the 10-year Treasury rate in 2025, which will keep mortgage rates high and home sales “muted”, especially if inflation measures are still stickier than markets anticipated earlier in 2024.

Fannie Mae revealed that uncertainty surrounds this dynamic, including whether strong labor productivity can support GDP in the upcoming year, whether inflation will soften, and if not, whether interest rates will stay structurally higher for an extended period of time.

Although they have not yet included any specific policy changes in their predictions as consumers await further information, changes to immigration, trade, fiscal, and regulatory policies could all have a significant impact on our prognosis for economic growth, inflation, interest rates, and housing.

Key Findings from the Fannie Mae Forecast:

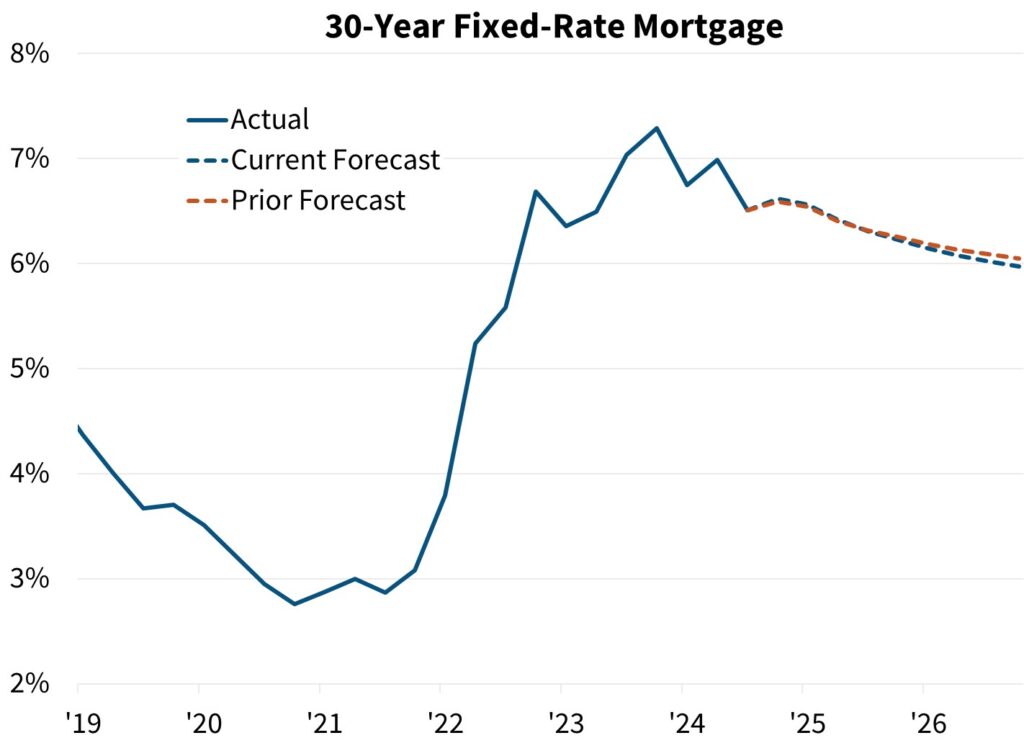

There will probably be periods of volatility, but average mortgage rates will decrease slightly while staying above 6%.

In 2025, economists predict that the average mortgage rate will continue to be higher than 6%. Sticky inflation and a seemingly stable labor environment have dampened the environmental expectations for further interest rate decreases. The GSE anticipates that mortgage rates will stay high compared to pre-pandemic levels and only marginally decline to about 6% by the end of 2025 unless economic growth begins to slow considerably. Bond markets have increased 10-year yields in response to election outcomes and better data. However, it’s anticipated that periods of volatility in mortgage rates in the upcoming year due to persistent uncertainty regarding the robustness of economic growth, the stickiness of inflation, and potential policy adjustments.

The 10-year Treasury yield has fluctuated significantly during the last six months in response to both positive and negative inflation and economic statistics. In addition to navigating uncertainty around present and future economic development, financial markets are attempting to ascertain the final “neutral” rate for the fed funds rate. We anticipate periods of financial market volatility when bond markets revalue interest rate expectations as additional data is released and information about possible policy adjustments emerges.

According to their baseline forecast, core inflation will continue to decline and economic growth and employment increases will slow slightly in the upcoming year, but it won’t achieve the Fed’s target until 2026. However, the possibility of sustained consumer spending resilience and higher-than-expected productivity growth poses a significant upside risk to their economic outlook. Significant tariffs or a noticeable slowdown in immigration, however, indicate both an upside risk to inflation measures and a downward risk to economic development. Interest rates may be impacted by both positive and downside risks associated with potential changes to tax and regulatory policies.

Although location is important, current home sales will continue to hover around 30-year lows.

Fannie Mae predicts that existing home sales will reach 4.25 million in 2025, which is an estimated 4.8% more than the 4.06 million we anticipate in 2024 but still 20.3% lower than in 2019. They anticipate a small increase in current home sales in the upcoming year due to the larger number of homes on the market. At the end of November, there were 1.37 million properties for sale, up 19.1% over the same period last year, according to the National Association of Realtors. However, it’s expected that the lock-in effect and limited affordability circumstances will remain the main factors restricting the recovery of existing home sales in 2025, especially as it’s forecast that mortgage rates will remain above 6%.

Since the middle of the 1980s, affordability circumstances have remained at their most restricted levels. Furthermore, even if mortgage rates approach 6%, we anticipate that the lock-in effect will continue to be significant. Some 14% of Fannie Mae single-family loans with a 30-year fixed rate mortgage had a rate higher than 6% at the end of September, while 58% had a rate lower than 4%. As predicted, the lock-in impact will eventually diminish, but economists think the process will be gradual given the downward slope in the fraction of single-family loans with a rate below 4% and the higher slope in the share with a rate larger than 6%.

Only a small and transient increase in mortgage applications and home sales took place in September, even while interest rates momentarily dropped to about 6%. Because of this sluggish reaction, we think that mortgage rates close to 6% are probably not going to be enough to generate enough new demand or to motivate enough homeowners to sell, both of which are necessary to “defrost” the housing market.

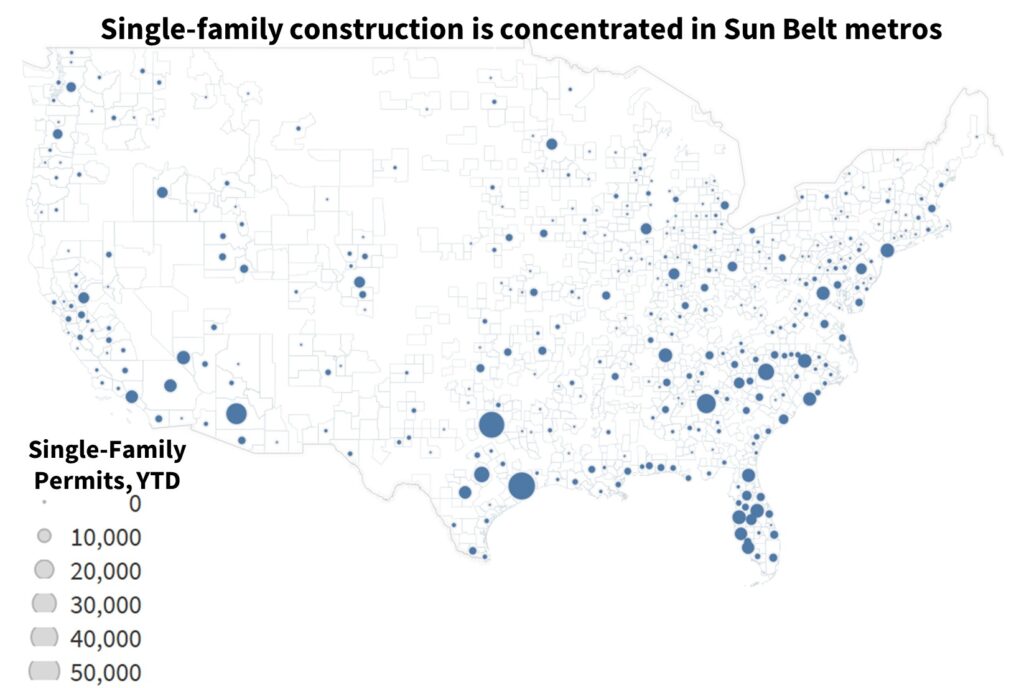

However, as was previously mentioned, the amount of properties for sale varies significantly by region, and some areas are probably going to have higher sales in 2025 than in 2024. Strong homebuilding in recent years tends to be associated with relatively free markets. According to Realtor.com, inventory levels are close to or higher than pre-pandemic norms in many Sun Belt states, such as Florida and Texas, as well as in portions of the Mountain West area and Pacific Northwest.

On the other hand, compared to 2019, there are far less properties for sale in the Midwest and Northeast. Overall, it’s estimated that inventory levels will continue to gradually increase across the country, with Sun Belt inventories continuing to be looser than those in the Northeast and Midwest.

The housing market will continue to see growth in the sales of new homes (in areas where they can be built).

The year 2025 is projected to be another strong one for new home sales due to the ongoing shortage of available existing homes and the positive demographic-based demand for housing. In 2024, through October, the average annualized sales pace of new home sales was an estimated 682,000, which is higher than the average sales pace of 595,000 from 2015 to 2019. Homebuilders are nevertheless eager to provide incentives, such as interest rate buydowns, to move their inventory of new homes for sale and to switch to smaller, more affordable homes in the face of high mortgage rates.

The median sales price of new homes has historically been significantly higher than the median sales price of older homes, although in recent years, the difference has decreased. Between 2015 and 2019, the median price difference between the sale of a new and existing home averaged roughly 4%, whereas between 2015 and 2019, it averaged 28%. Sun Belt metro areas have a higher concentration of single-family homes. Although the geographic distribution of newly sold homes is not taken into account by this measure, the median square footage of new homes has decreased from a peak of 2,519 square feet in Q1 of 2015 to 2,158 square feet as of Q3 of 2024, contributing to the lower price premium.

However, new home sales differ significantly by area. The majority of sales occur in the South and Mountain West, where regulations and land permit more construction. The metropolitan statistical regions of Houston, Dallas, Phoenix, Atlanta, and Charlotte, NC, accounted for 20% of the almost 750,000 single-family home permits issued so far this year through October. It’s forecast that there will be a lot of homebuilding in the Sun Belt in 2025.

The overall increase of home prices nationwide will slow in the coming year.

Home price rises will continue to slow down into 2025, even if the persistent shortage of available homes has kept it strong. According to the Fannie Mae Home Price Index, they predict that home prices will increase by 3.6% in 2025 as opposed to 5.8% in 2024. A slow improvement in homeowner affordability conditions may begin in 2025 if home price appreciation softens, allowing nominal income growth to surpass home price increases for the first time since 2011. Mortgage rates will still be a barrier to affordability.

However, there will probably be significant geographical variations. A divergent home price story is currently being driven by regional differences in for-sale inventory. Except for the Great Financial Crisis and Q3 of 2022, when home prices fell nationally, 75 of the FHFA top 100 metro areas saw positive seasonally adjusted quarter-over-quarter home price growth in both the second and third quarters of 2024. In comparison to the national average, it’s likely that areas with a larger stock of homes for sale will continue to see poorer home price dynamics in 2025.

The holding pattern for multifamily housing will continue.

We anticipate that 2025 will resemble 2024 in the multifamily market. Below-average rent growth in the near term as more units are constructed is expected, even though longer-term demographic trends continue to support multifamily building over the next ten years as the prime renter-aged population is predicted to continue growing. The projections for rent growth in 2025 range from 2 to 2.5%, depending on the metric. Renter affordability will benefit from this since it will be the second year in a row that nominal salary growth has outpaced rent growth in several metro areas. However, given the persistently high longer-term borrowing rates, slower rent increase will result in fewer new development projects.

Furthermore, a large portion of the geographical variance found in single-family building also exists in multifamily construction: Following the epidemic, there was a building boom in several Sun Belt metro areas, and the increase in supply is influencing prospective homeowners’ “buy-vs-rent” calculations. In many areas, renting is becoming more financially attractive than purchasing a home compared to several years ago, which means many would-be buyers are likely to decide to keep renting.

To read the full report, including more data, charts, and methodology, click here.