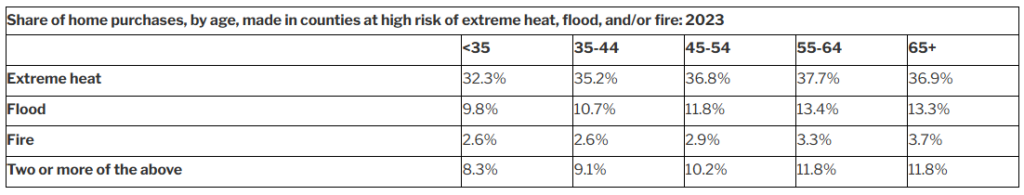

According to a new study from Redfin, older Americans are more likely than younger Americans to buy homes in places with significant climate risk. More than one-third (36.9%) of home purchases made by people 65 years of age and older last year were in counties with an elevated risk of extreme heat, compared with less than one-third (32.3%) of home purchases made by people under the age of 35.

That same trend holds true for areas of flood and fire risk, where 13.3% of purchases made by people 65+ were in counties with high risk of flooding, compared with 9.8% of purchases by those under 35. And 3.7% of purchases made by people 65+ were in counties with high fire risk, compared with 2.6% of purchases by people under 35.

For the study, Redfin analyzed climate risk scores from First Street, and Home Mortgage Disclosure Act (HMDA) data covering mortgage originations for primary homes. Redfin defines a high-risk county as one that ranks in the top 10% when it comes to the share of homes facing high fire or flood risk, and the top 33% for heat risk. Climate risk scores are based on a property’s current risk as well as how that risk is expected to grow over the next 30 years.

Reasons for Targeting High-Risk Areas

- Many of America’s retirement hotspots are risky for the same reason they’re desirable: These locations are exposed to the hot sun and/or the coast. For example, Arizona is prone to extreme heat and drought, and Florida is prone to hurricanes and rising sea levels. Florida is a top retirement destination in part because it doesn’t tax retirement income. But that benefit is beginning to be offset by a surge in insurance costs and HOA fees caused by intensifying natural disasters, along with rising property taxes. Florida’s housing market has been slowing for months as residents grapple with frequent natural disasters, along with a surge in home insurance costs and HOA fees fueled by intensifying climate risk. The latest shoe to drop was an especially devastating hurricane season, as Hurricane Helene hit northwestern Florida on September 26 and became the deadliest storm to hit mainland America in almost two decades. Then, roughly two weeks later, Hurricane Milton swept across the central Florida region.

- Young Americans often gravitate toward major urban job centers: As areas including Boston, Chicago, and, Minneapolis—face lower climate risk than retirement hotspots in places like Florida and Arizona. Though it’s worth noting that remote work and the growth of Sun Belt metros has upended this dynamic somewhat.

- Older Americans are less likely than younger Americans to factor climate change into their decisions about where to live: Over half (56%) of millennials and exactly half (50%) of Gen Zer’s say climate change impacts their choice to live, compared with less than one-third (31%) of baby boomers, according to a recent survey commissioned by Redfin. That may be because younger people will have to deal with the consequences of climate change for longer, and because climate change is a major topic in young social circles.

“Retirees understand the risks of moving to Florida, but many believe the pros still outweigh the cons,” said Rafael Corrales, a Redfin Premier Real Estate Agent in Miami. “When I explain to buyers that they can get more bang for their buck and lower flood risk a little further inland, they often tell me, ‘Rafael, we came to Florida for the waterfront views.’”

Corrales added that many homebuyers are now asking sellers how much they pay for insurance and, if it’s a good rate, requesting that the sellers pass along their insurance broker’s contact information. This gives buyers leverage when they’re negotiating with other insurers. Buyers are also considering how much they’ll have to pay for insurance when writing offers, he said.

Additional Findings

- Redfin broke the findings down by income level, and found that older people of all income levels—not just those who are affluent—are generally more likely to move to risky areas than younger people.

- Nearly 100% of homes face high heat risk in places where buyers skew older, compared with 59% of homes where buyers skew younger.

- Nearly all homes (96.2%) face high heat risk in the counties where 65+ buyers took out the largest share of mortgages last year, on average. That compares 59.2% of homes in the counties where buyers under 35 took out the largest share of mortgages.

- This trend also holds true for flood and fire risk. In the counties where 65+ buyers took out the largest share of mortgages, 24.6% of homes face high flood risk and 35.7% face high fire risk, on average. In the counties where buyers under 35 took out the largest share, 16% of homes face high flood risk and 19% face high fire risk.

Click here to view the full report on Redfin’s examination of migration and climate change.