Over the past five decades, real estate development in the U.S. has surged, with Southern and Southwestern cities seeing the most growth, according to a recent study from StorageCafe. Residential, industrial, and self-storage industries have all expanded significantly, driven by urbanization and population growth.

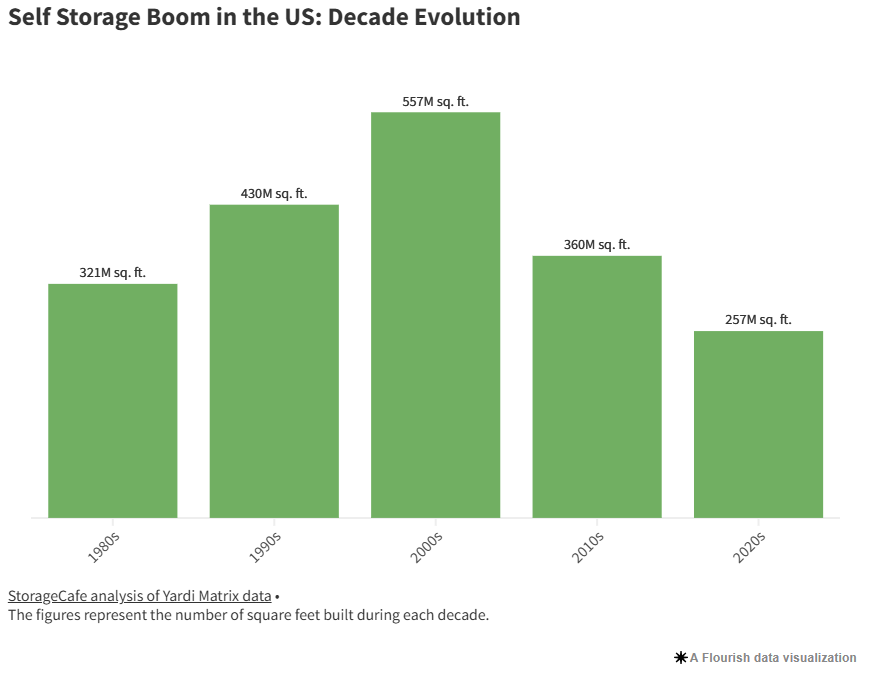

One key finding is that self-storage has seen a 91% increase in inventory since the 1980s. The industrial sector has also exploded, with over 292-million square feet of new industrial space built in Houston alone since 1980. By comparison, retail construction has slowed dramatically, averaging just 41-million square feet annually in recent years due to the rise of e-commerce.

Residential Real Estate and Housing Shortages

The construction of single-family homes peaked in the early 2000s with around 1.3 million building permits issued annually, but the financial crisis of 2008 led to a sharp decline. However, the market is recovering, and cities like Phoenix, Arizona have issued 215,000 permits for single-family homes since 1980, while Houston, Texas and San Antonio, Texas have also contributed to the rebound.

Despite this recovery, the U.S. still faces a housing deficit of around 3.8 million units, keeping demand high and driving up home prices. Multifamily construction, on the other hand, has seen more consistent growth. This decade is averaging 603,000 building permits per year for multifamily units, a 56% increase over the previous decade. Major cities such as New York and Los Angeles have led this surge in multifamily housing.

Industrial and Self-Storage Boom

The industrial sector has added an average of 516 million square feet annually in the 2020s, a reflection of the growing need for logistics hubs to support the rise of e-commerce. Companies like Amazon and Walmart are fueling demand for warehouses and distribution centers.

Meanwhile, the self-storage sector has grown rapidly, with a 91% increase in inventory since 1980. Cities like Houston, Phoenix, and San Antonio are among the top contributors to this growth, driven by rising urban populations and the need for additional storage.

Looking Forward: Shifting Trends in U.S. Real Estate

Real estate development in the U.S. has undergone significant shifts over the last 50 years. While retail spaces and office parks dominated the landscape in the 1980s, today’s trends are focused on multifamily housing and self-storage. Cities like Houston and Phoenix remain at the forefront of this growth, shaping the future of U.S. real estate.

Click here for more on StorageCafe’s study.