The National Association of Realtors reports that existing-home sales increased in November. Three major U.S. regions saw growth in sales, but the West saw no change. All four regions saw an increase in sales year over year.

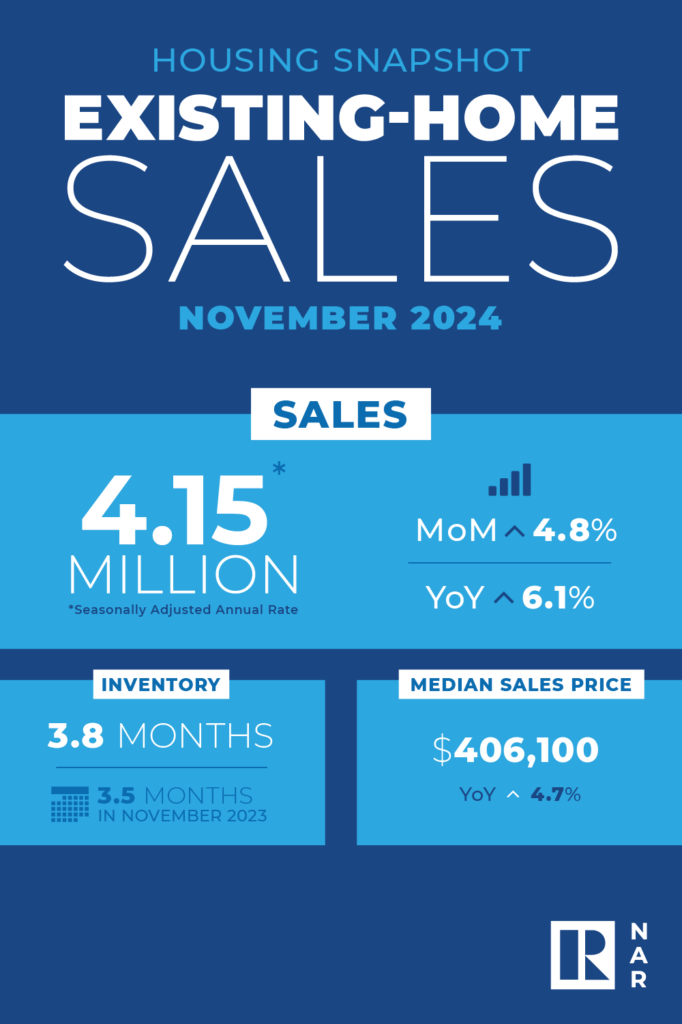

The seasonally adjusted annual rate of existing-home sales, which includes completed transactions of single-family homes, townhomes, condominiums, and cooperatives, increased 4.8% from October to 4.15 million in November. Sales increased 6.1% year-over-year (from 3.91 million in November 2023).

“Home sales momentum is building,” said Lawrence Yun, Chief Economist at NAR. “More buyers have entered the market as the economy continues to add jobs, housing inventory grows compared to a year ago, and consumers get used to a new normal of mortgage rates between 6% and 7%.”

At the end of November, there were 1.33 million units in total housing inventory, which was 2.9% less than in October but 17.7% more than a year earlier (1.13 million). At the current sales pace, unsold inventory is at a 3.8-month supply, which is higher than the 3.5-month supply in November 2023 but lower than the 4.2-month supply in October.

Lisa Sturtevant, Chief Economist for Bright MLS, revealed her thoughts on the Existing Home Sales report:

“The National Association of Realtors reported this morning that existing home sales were at a seasonally-adjusted rate of 4.15 million in November, the fastest pace of sales activity since March,” Sturtevant said. “Sales rose 6.8% from a year ago and were 4.8% higher than October. Historically, there is a drop-off in the number of closed sales between October and November. But this year, buyers jumped on mortgage rates that dipped in early October, bringing more contracts which closed in November. Assuming December sales are generally good, 2024 U.S. existing home sales should be above 2023 levels—though still only slightly.”

All property types combined had a median existing-home price of $406,100 in November, a 4.7% increase from $387,800 a year earlier. Price hikes were reported in all four U.S. regions.

“Existing homeowners are capitalizing on the collective $15 trillion rise in housing equity over the past four years to look for homes better suited to their changing life circumstances,” Yun said.

Key Findings of the REALTORS Confidence Index:

- Properties were on the market for an average of 32 days in November, compared to 29 days in October and 25 days in November 2023, according to the monthly REALTORS Confidence Index.

- In November, 30% of sales were made by first-time customers, which is an increase from 27% in October but a decrease from 31% in November 2023. The annual percentage of first-time buyers was 24%, the lowest ever recorded, according to NAR’s 2024 Profile of Home Buyers and Sellers, which was published in November 2024.

- In November, 25% of transactions were cash sales, compared to 27% in October 2024 and November 2023.

- In November, 13% of properties were bought by individual investors or second-home purchasers, who account for a large portion of cash sales. This is a decrease from 17% in October and 18% in November 2023.

- Foreclosures and short sales, or distressed sales, accounted for 2% of sales in November, essentially staying the same from the previous month and year.

- As of December 12, the 30-year fixed-rate mortgage averaged 6.6%, according to Freddie Mac. That is a decrease from 6.95% a year ago and 6.69% a week ago.

“Existing home sales picked up in November to 4.15 million, notching a second consecutive year-over-year gain after a streak of declines stretching back to August 2021,” said Danielle Hale, Chief Economist at Realtor.com. “This is the first time in 6 months that home sales exceeded the 4 million mark. Home sales rose 6.1% from last year and were also 4.8% higher than October. Homes with November closings generally went under contract in September and October, when shoppers benefited from an uptick in newly-listed for-sale homes. Increased buying power, as mortgage rates declined to a 2-year low in September, brought shoppers to the market, and the late September surge in rates created a sense of urgency that likely contributed to the uptick.”

Single-Family and Condo/Co-Op Sales Progress

In November, sales of single-family homes increased 5.0% to a seasonally adjusted annual pace of 3.76 million, which was 7.4% higher than the previous year. In November of 2023, the median price of an existing single-family home was $410,900, a 4.8% increase.

November saw a 2.6% increase in existing condominium and cooperative sales to a seasonally adjusted annual pace of 390,000 units, which was 4.9% lower than the 410,000 units sold a year earlier. In November, the median price of an existing condo was $359,800, which was 2.8% more than the previous year ($350,100).

“The main constraints in the housing market have been inventory and affordability,” Sturtevant said. “In November, the median sold price was up again, increasing by 4.7% compared to a year ago. Home prices are now about 50% higher than they were five years ago. It has been a difficult market for would-be home buyers. Some of the obstacles in the market will ease somewhat in 2025 as listing activity increases and mortgage rates come down slightly. Pent-up demand that has been building over the past two years will be unleashed and 2025 sales should outpace 2024. Buyers should still expect to encounter a competitive market in the year ahead.”

In the Northeast, existing-home sales in November increased 6.3% from November 2023 and 8.5% from October to an annual rate of 510,000. In the Northeast, the median price increased 9.9% from the previous year to $475,500.

The median home sales price likely moved higher compared to one year ago, climbing 4.7% to $406,100, notching an 8th straight month above $400,000.

“We could see home sales falter again in the months ahead as Fall’s higher rates are felt,” Hale said, “but mortgage rates have already turned the corner again, dropping back to 6.6% as of mid-December. While Fed policy and inflation trends may lead to upticks in interest rates from time to time, as the reaction to the December Fed meeting and updated Fed projections shows, in the medium run, more mortgage rate declines are expected.”

In November, existing-home sales in the Midwest increased 5.3% from the previous year to an annual rate of 1 million. In the Midwest, the median price increased 7.3% from November 2023 to $302,000.

In the South, existing-home sales increased 3.3% from the previous year to an annual rate of 1.87 million in November, up 5.6% from October. In the South, the median price increased 2.8% from the previous year to $361,300.

In November, existing-home sales in the West remained steady at an annual rate of 770,000, up 14.9% from the previous year. In the West, the median price increased 4.0% from November 2023 to $628,200.

“This outlook already boosted buyer sentiment and is likely to propel modest home sales growth in the year ahead according to the Realtor.com 2025 Housing Forecast,” Hale said. “These gains won’t be distributed evenly across markets. Recent sales momentum, relatively lower costs, more plentiful inventory in areas where builders can build, and more younger households are commonalities across markets in the South and West that are expected to see outsized home sales and price growth according to the Realtor.com 2025 Top Housing Markets report.”

Note: Existing-Home Sales for December 2024 will be released on Friday, January 24, 2025 at 10:00 a.m. Eastern.

To read the full report, including more data, charts, and methodology, click here.