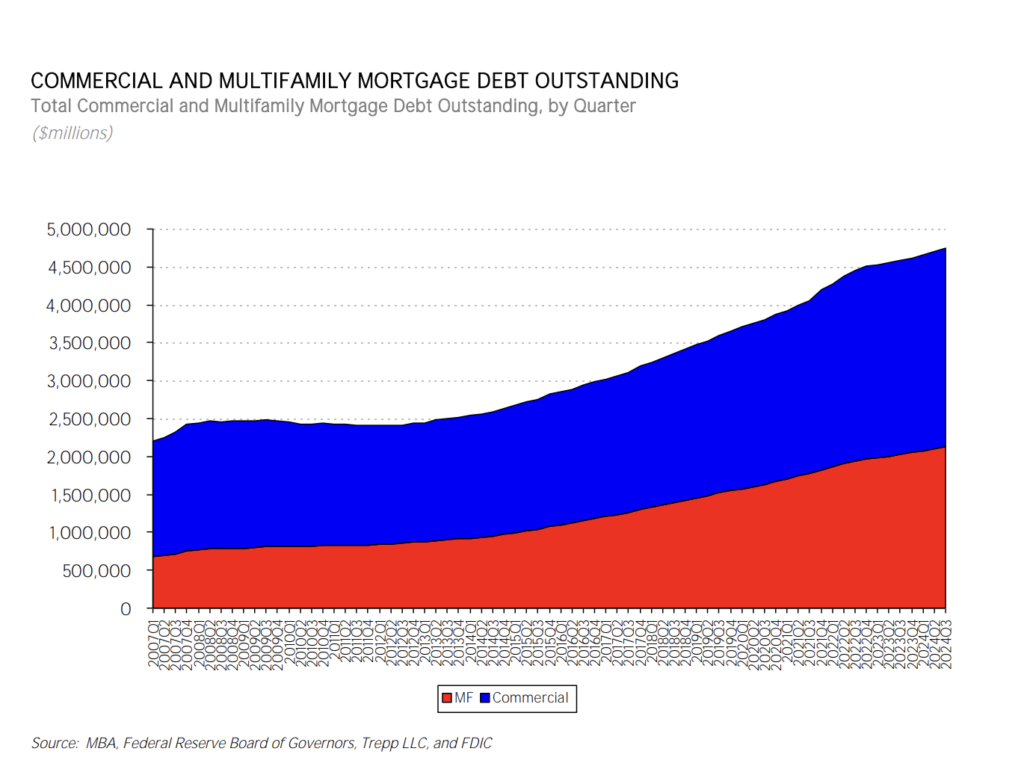

According to the most recent Commercial/Multifamily Mortgage Debt Outstanding quarterly report from the Mortgage Bankers Association (MBA), the amount of outstanding commercial/multifamily mortgage debt rose by $47.7 billion (1.0%) in Q3 of 2024.

By the conclusion of Q3, the total amount of outstanding commercial and multifamily mortgage debt had increased to $4.75 trillion. From Q2 of 2024, multifamily mortgage debt alone climbed $29.8 billion (1.4%) to $2.12 trillion.

”Every major capital source for commercial mortgage debt increased its holdings of mortgages during the third quarter of 2024,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “Life insurance companies led the way, accounting for 44 percent of the quarterly increase and boosting their commercial mortgage holdings by nearly three percent. That increase contrasts with banks, which increased their balances of CRE mortgages during the quarter by only 0.3 percent. For the ninth quarter in a row, aggregate balances backed by multifamily properties increased more than those backed by other property types.”

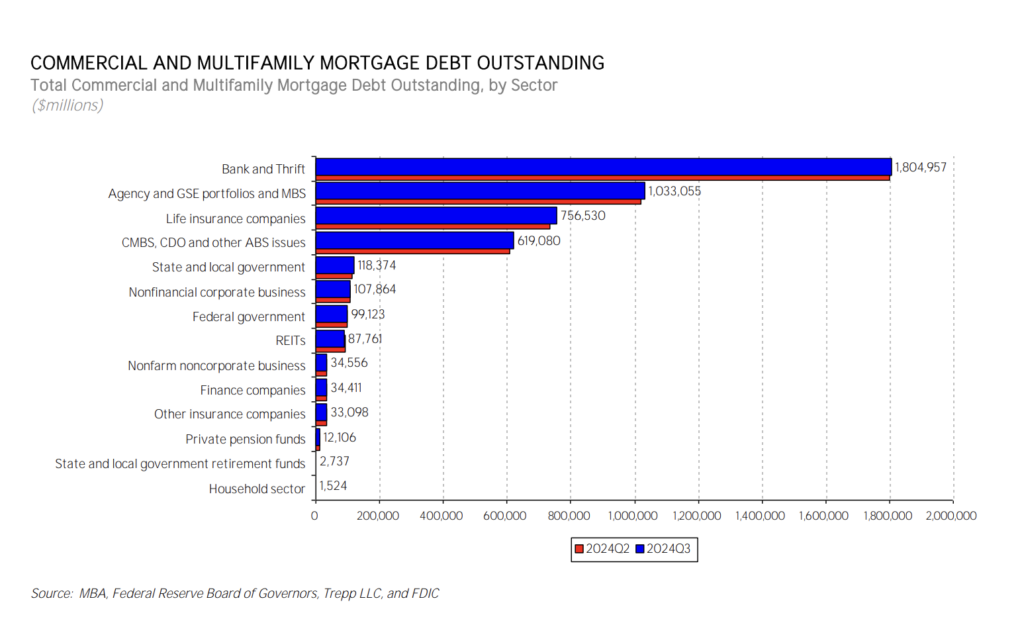

Banks and thrifts, government-sponsored enterprise (GSE) and federal agency portfolios, mortgage-backed securities (MBS), life insurance companies, and commercial mortgage-backed securities (CMBS), collateralized debt obligation (CDO), and other asset-backed securities (ABS) issues are the four biggest investor groups.

With $1.8 trillion in commercial/multifamily mortgages, commercial banks still maintain the greatest proportion (38%) of the market. At $1.03 trillion, agency and GSE portfolios and MBS constitute the second-largest share of commercial/multifamily mortgages (22%). CMBS, CDO, and other ABS concerns hold $619 billion (13%), while life insurance companies possess $757 billion (16%). CMBS, CDO, and other ABS issues are bought and held by numerous banks, life insurance companies, and the GSEs. These loans fall under the “CMBS, CDO and other ABS” category in the report.

MBA’s analysis provides a summary of the loan holdings or, in the event that the loans are securitized, the type of security. Many life insurance companies, for instance, invest in both whole loans for which they own the mortgage note (which are listed under Life Insurance Companies in this data) and in CMBS, CDOs, and other ABS for which the note is held by the trustees and security issuers (which are listed under CMBS, CDO, and other ABS issues in this data).

Examining Outstanding Multifamily Mortgage Debt

In Q3 of 2024, if we only look at multifamily mortgages, agency and GSE portfolios and MBS made up 49% of the total amount of multifamily debt outstanding, with $630 billion (30%) coming from banks and thrifts, $244 billion (12%) from life insurance companies, $99 billion (5%) from state and local government, and $68 billion (3%) from CMBS, CDO, and other ABS issues.

Measuring Changes in U.S. Commercial, Multifamily Outstanding Mortgage Debt

In terms of cash gains, life insurance companies’ holdings of commercial and multifamily mortgage debt increased by $21.2 billion (2.9%) in the third quarter. Their holdings climbed by $12.3 billion (1.2%) for agency and GSE portfolios and MBS, $9.6 billion (1.6%) for CMBS, CDO, and other ABS issues, and $6.1 billion (0.3%) for banks and thrifts.

The biggest gain in percentage terms was seen by life insurance firms, whose holdings of commercial and multifamily mortgages increased by 2.9%. On the other hand, assets held by private pension funds fell by 8.8%.

Identifying Significant Changes in Multifamily Mortgage Debt Outstanding

A quarterly gain of 1.4% is represented by the $29.8 billion rise in multifamily mortgage debt outstanding from Q2 of 2024. The highest gain in terms of dollars was $12.3 billion (1.2%) for agency and GSE portfolios and MBS offerings in their holdings of multifamily mortgage debt. Banks and thrifts had an increase of $4.7 billion (0.8%), while life insurance firms saw a gain of $10.0 billion (4.3%).

The biggest percentage rise in multifamily mortgage loan holdings was 4.3% for life insurance businesses. The biggest drop in multifamily mortgage loan holdings was 6.8% for private pension funds.

To read the full report, including more data, charts, and methodology, click here.