A new report from the National Association of Realtors (NAR) has found that pending home sales gained 2.2% in November–the fourth consecutive month of such increases and the highest level since February 2023.

Regionally, the Midwest, South and West experienced month-over-month gains in transactions, while the Northeast region reports decreases. Year-over-year, contract signings increased in all four U.S. regions, with the West leading the pack.

“Despite higher mortgage rates in November and persistent affordability challengers, buyers took advantage of more inventory as pending home sales reached the highest level in nearly two years,” said First American Deputy Chief Economist Odeta Kushi.

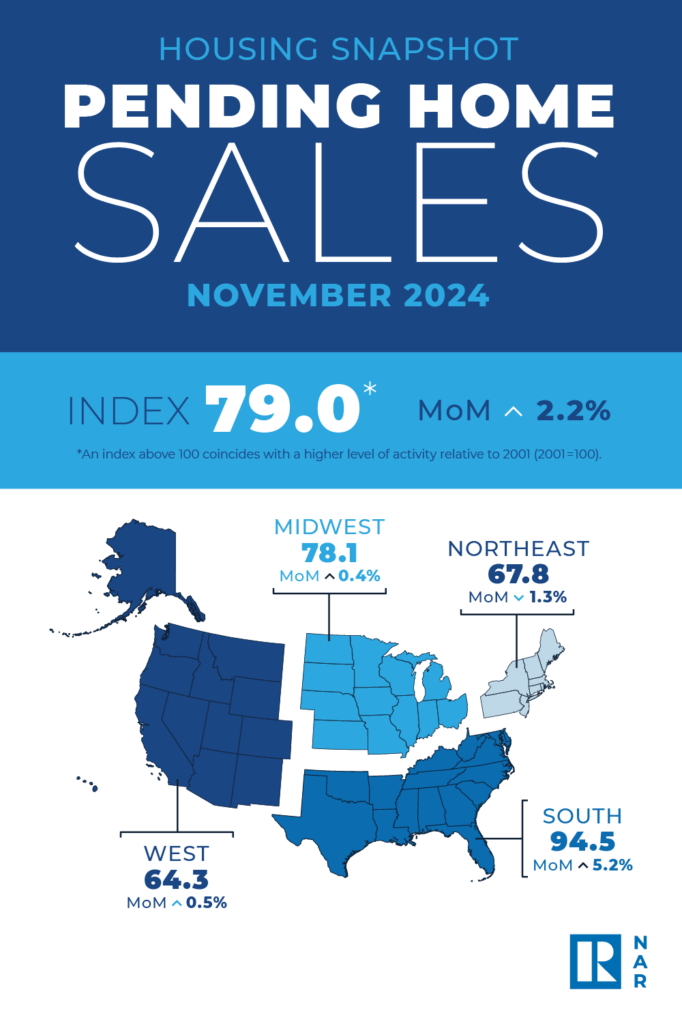

NAR’s Pending Home Sales Index (PHSI)–a forward-looking indicator of home sales based on contract signings–advanced 2.2% to 79.0 in November. Year-over-year, pending transactions improved 6.9%. A PHSI reading of 100 is equal to the level of contract activity in 2001.

“Consumers appeared to have recalibrated expectations regarding mortgage rates and are taking advantage of more available inventory,” said NAR Chief Economist Lawrence Yun. “Mortgage rates have averaged above 6% for the past 24 months. Buyers are no longer waiting for or expecting mortgage rates to fall substantially. Furthermore, buyers are in a better position to negotiate as the market shifts away from a seller’s market.”

A Regional Breakdown

NAR’s Northeast PHSI fell 1.3% from last month to 67.8, up 5.6% from November 2023. The Midwest Index increased 0.4% to 78.1 in November, up 1.6% from the previous year. The South PHSI improved 5.2% to 94.5 in November, up 8.5% from a year ago. The West Index rose by 0.5% from the prior month to 64.3, up 11.8% from November 2023.

“It appears that some markets will outperform, driven primarily by local job gains and the flow of new inventory supply,” explained Yun.

Kushi added, “We find the strongest supply surges in Southern and Western markets, but more muted improvements in the Northeast and Midwest. Where supply surges, improving affordability often follows, which may bring buyers off the sidelines, unlocking pent up demand and reinvigorating market activity in the new year.”

Redfin recently reported that active home listings—the total number of homes for sale—climbed to their highest levels since 2020 in November on a seasonally adjusted basis, rising 0.5% month-over-month, and 12.1% year-over-year. A major reason for the jump in housing inventory is a pileup of unsold homes, many of which buyers have deemed undesirable because they seem overpriced. More than half (54.5%) of home listings in November sat on the market for at least 60 days without going under contract—marketing the highest share for any November since 2019, and is up from 49.9% a year earlier. The typical home that did go under contract in November did so in 43 days, the slowest November pace since 2019.

“Pending home sales, or contract signings, measure the first formal step in the home sale transaction, namely, the point when a buyer and seller have agreed on the price and terms,” noted Realtor.com Senior Economic Research Analyst Hannah Jones. “Pending home sales tend to lead existing home sales by roughly one-to-two months and are a good indicator of market conditions. The late fall market has suffered from climbing mortgage rates, but buyers seem eager to take advantage of the favorable seasonal dynamics. The South and West are leading the annual rebound in contract signings, aligning with our Top Market expectations for 2025.”

Click here for more on NAR’s PHSI report.