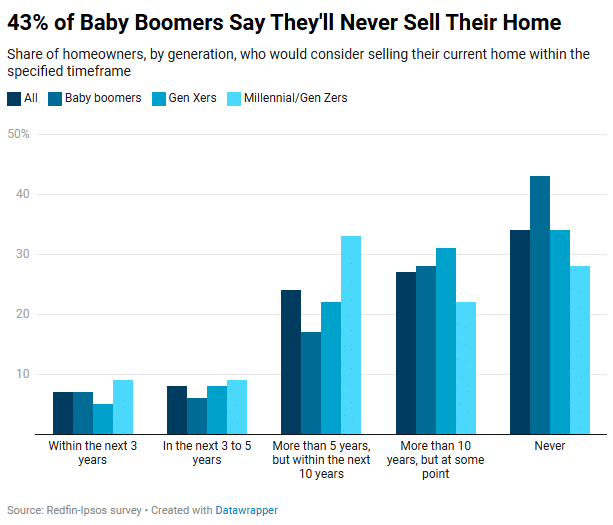

A third of American homeowners (34%) say they will never sell their house, while another 27% say they won’t think about doing so for at least 10 years. According to a recent survey that Redfin commissioned, that is. Only 8% of homebuyers intend to sell in three to five years, and 7% within the following three years, whereas nearly one-quarter (24%) of them aim to sell in five to 10 years.

When compared to younger homeowners, senior homeowners are more likely to claim they will never sell. Compared to 34% of Gen X homeowners and 28% of millennial/Gen Z homeowners, some 43% of baby boomer homeowners say they will never sell.

Despite a little increase in recent months, new postings are still below pre-pandemic levels in parts of the country because the majority of homeowners say they will never sell. According to a recent Redfin report, the first eight months of 2024 saw the lowest turnover rate in decades, with only 25 out of 1,000 U.S. homes changing hands.

Key Findings from September’s Housing Turnover Analysis:

- Only 2.5% of U.S. homes changed hands in the first eight months of 2024.

- The rate of home sales and home listings are both down at least 30% from 2019.

- California metros lead the list of areas with the lowest turnover, while Sun Belt and New York commuter metros posted highest turnovers.

- Some 31% fewer homes were sold this year than in the previous pre-pandemic year in 2019 (36 of every 1,000)

- An estimated 37.5% fewer homes were sold this year than during the peak of the pandemic buying frenzy in 2021 (40 of every 1,000).

Despite a small spike in recent months, new listings of homes for sale are still below pre-pandemic levels in parts of the country because the majority of homeowners say they will never sell.

There are several significant reasons why home sales are at historically low rates, including:

- Elevated mortgage rates: The rates accessible this year, which peaked at 7.52% in April, are much higher than the 5% rate that more than three-quarters of mortgaged U.S. homeowners have obtained. A phenomenon known as the “lock-in effect” has resulted in many homeowners delaying the sale of their current property in favor of purchasing a new one at a higher rate. In August, rates dropped to the low 6% area, although sales haven’t increased significantly as a result of the decline.

- Rising prices and low supply: This year, home prices in the U.S. have reached all-time highs, and there is just enough demand from buyers to keep prices rising steadily. There are much fewer properties for sale than there were before to the pandemic, even if the number of residences on the market has increased from a year earlier.

- Economic and political uncertainty: Amidst concerns about a potential recession and a fiercely contested U.S. presidential race between two candidates with opposing economic and housing agendas, many buyers and sellers have adopted a wait-and-see strategy this year. Additionally, a lot of people are taking their time to learn more about the new regulations regarding real estate agent fees.

“Mortgage rates have already fallen more than one percentage point from their 2024 peak, but we have not yet seen a significant increase in the number of homes changing hands. Of the homes listed this year, many have gone stale because of the lack of demand—especially homes which needed a little extra work,” said Elijah de la Campa, Senior Economist at Redfin. “With the majority of homeowners locked into low mortgages, rates will need to keep falling consistently for many to feel comfortable moving on from the deals they secured years ago.”

Homeowners Reveal Why They’re Choosing to Stay Put

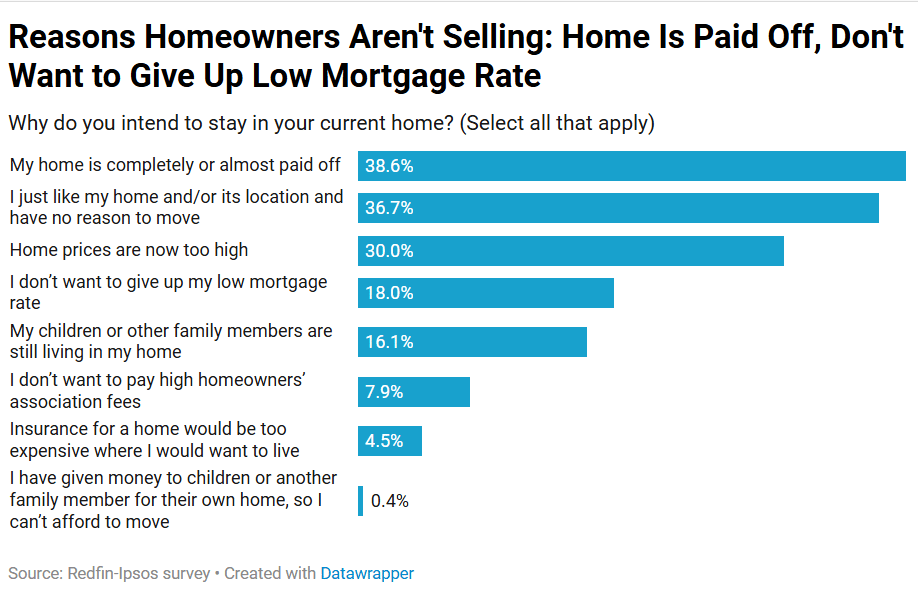

The most frequently given explanation for not wanting to sell is because their house is nearly or fully paid off, as reported by nearly two out of five (39%) homeowners. After paying off their mortgage, homeowners are encouraged to remain in their current residence because they are now free and clear to occupy, with only property taxes and homeowners association dues to pay. Nearly as many respondents (37%) stated that they had no plans to sell since they just like their house and don’t see any need to move.

Another important factor influencing homeowners’ reluctance to sell is affordability. 18% of respondents stated they don’t want to give up their cheap mortgage rate, while almost one-third (30%) stated they are staying in their existing residence because current property prices are too expensive. Respondents who have owned their house for at least six years and do not plan to sell within the next five years were asked this survey question.

Home prices have increased by about 40% since the pandemic began, and the average weekly mortgage rate has increased from less than 4% in 2019 to 6.91%. More than 85% of American homeowners with mortgages have interest rates under 6%, according to a new Redfin analysis.

“The just-because movers—those who just want a bigger or nicer house—are staying put, mostly because it’s so expensive to buy a new house,” said Marije Kruythoff, a Redfin Premier agent in Los Angeles. “The people who are selling are doing so because they need to. Either they’re relocating to a different part of the country, or they’re moving due to a major life event like having a baby or taking a new job on the opposite side of the city.”

This report’s poll results are from an Ipsos survey that was commissioned by Redfin and administered to 1,802 Americans between the ages of 18 and 65 in September 2024. This study focuses on the 267 homeowners who responded, “You mentioned you have lived in your house for several years and do not plan on selling soon,” and the 471 homeowners who responded, “When would you consider selling your current home?” Why do you plan to remain in your present residence? 127 baby boomers (60–65 years old), 203 Gen Xers (45–59 years old), and 141 millennials/Gen Zers (ages 18–43) answered the first question.

To read the full report, including more data, charts, and methodology, click here.