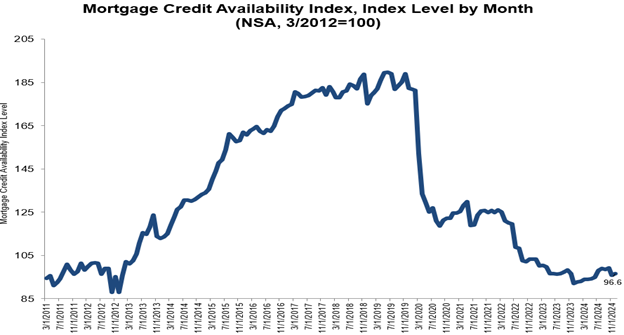

The Mortgage Credit Availability Index (MCAI), a survey from the Mortgage Bankers Association (MBA) that examines data from ICE Mortgage Technology, indicates that mortgage credit availability rose in December.

In December, the MCAI increased by 0.7% to 96.6. While an increase in the index signifies loosening credit, a decrease in the MCAI suggests tightening lending rules. In March 2012, the index was benchmarked at 100. The Government MCAI did not change, however the Conventional MCAI rose by 1.3%. The Conforming MCAI decreased by 0.7 percent, while the Jumbo MCAI rose by 2.3% among the Conventional MCAI’s component indices.

“Credit availability increased slightly in December, driven by more offerings for ARMs and cash out refinances that are primarily for borrowers with better credit,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “These factors led to a slight rebound in conventional credit compared to the previous month. Additionally, the jumbo index rose to its highest level since August 2024.”

The MCAI rose by 0.7 percent to 96.6 in December. The Conventional MCAI increased 1.3 percent, while the Government MCAI remained unchanged. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.3%, and the Conforming MCAI fell by 0.7%.

To read the full report, including more data, charts, and methodology, click here.