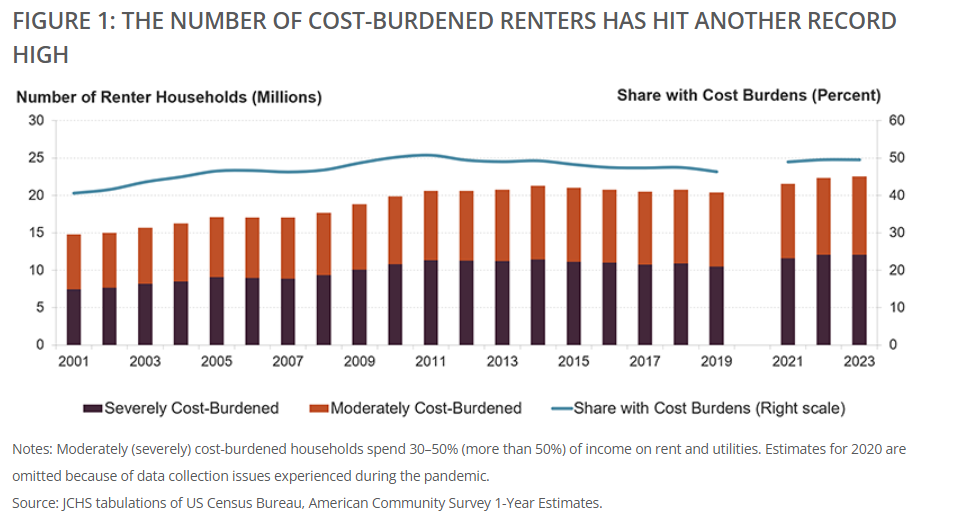

Affordability challenges for renters reached unprecedented levels in 2023, as the number of cost-burdened households hit a record high of 22.6 million, according to the latest data from the American Community Survey analyzed by the Harvard Joint Center for Housing Studies. Among these households, 12.1 million were severely burdened, spending more than 50% of their income on rent and utilities. These figures highlight a worsening crisis that continues to affect renters across all income levels.

Cost Burdens Climb Across the Board

In 2023, half of all renter households were cost-burdened, a rate that has remained steady since 2021 but marks a 3.2 percentage point increase from pre-pandemic levels. This trend represents a sharp rise from 2001, when 41% of renters were cost-burdened. Notably, the number of severely burdened households has surged by 2.2 million since 2019 and by 7.8 million since 2001.

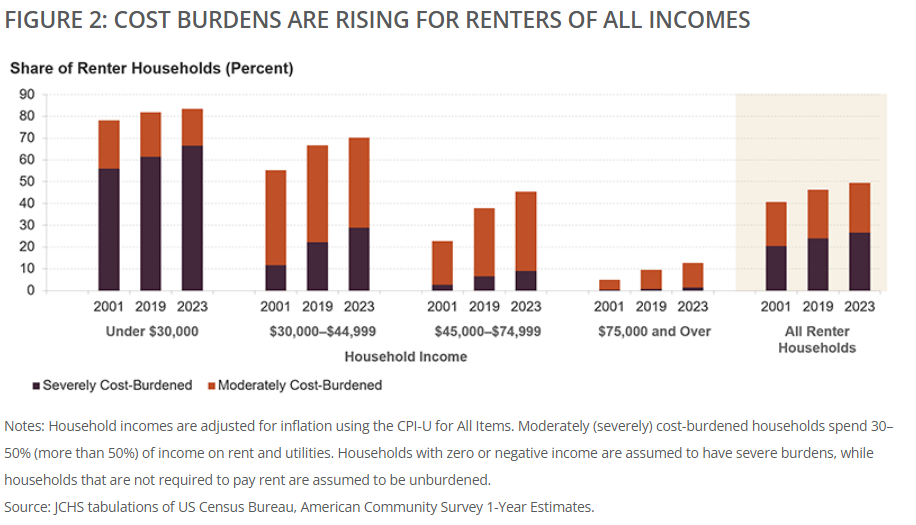

Lower-income households continue to bear the brunt of the affordability crisis, with 83% of renters earning less than $30,000 classified as cost-burdened. However, middle-income renters are experiencing the fastest increases in cost burdens. In 2023, 70% of renters earning between $30,000 and $44,999 were burdened, up 15 percentage points from 2001. Even households earning more than $75,000 have not been immune, with 13% now cost-burdened—a rise of 7.8 percentage points since 2001.

Residual Incomes Hit Record Lows

The crisis has left many renters with little money for other expenses. Among households earning less than $30,000, residual incomes—the amount left after paying rent and utilities—plummeted to a record low of $250 in 2023, a 55% decline since 2001. Over the same period, median rents for this group rose 18% while incomes fell 12%, all adjusted for inflation. For middle-income renters, residual incomes have declined by about 10% since 2001, while higher-income households have seen little to no change.

Erosion of Affordable Housing

The diminishing supply of affordable rental units has compounded the problem. Since 2013, the number of units renting for less than $1,000 per month (adjusted for inflation) has declined by 7.5 million. Meanwhile, the stock of higher-cost units has ballooned, with rentals priced above $1,400 growing by nearly 10.5 million. These shifts have forced lower-income renters into higher-priced housing, further exacerbating their financial struggles.

Employment and Income Trends Exacerbate the Crisis

Full-time work is no longer a reliable safeguard against housing cost burdens. In 2023, 36% of fully employed renters were cost-burdened, up from under 25% in 2001. Workers in personal care services and food preparation face the highest burden rates, with over half spending more than 30% of their income on rent. Even renters in higher-paying fields like office administration and education are increasingly affected, with burden rates of 42% and 38%, respectively.

Lower-income households have been hit particularly hard. Since 2001, the share of income these renters allocate to housing has jumped from 60% to 80%. This increase has significantly reduced their ability to cover other essential expenses, driving many into financial precarity.

The Road Ahead

While a surge in multifamily construction has helped slow rent growth in some markets, this relief may be temporary. The pace of new development has already slowed, and renter household growth is picking up, creating conditions for tighter markets and renewed upward pressure on rents.

Addressing the affordability crisis will require a multifaceted approach. Increasing the supply of affordable housing, expanding rental subsidies for lower-income households, and implementing policies to boost incomes through wages or tax benefits are crucial. Employment opportunities that provide sustainable wages will also play a vital role in improving affordability for millions of renters.

As policymakers and industry leaders navigate this growing crisis, solutions that balance supply expansion with targeted financial support will be critical to ensuring housing stability for the nation’s renters.