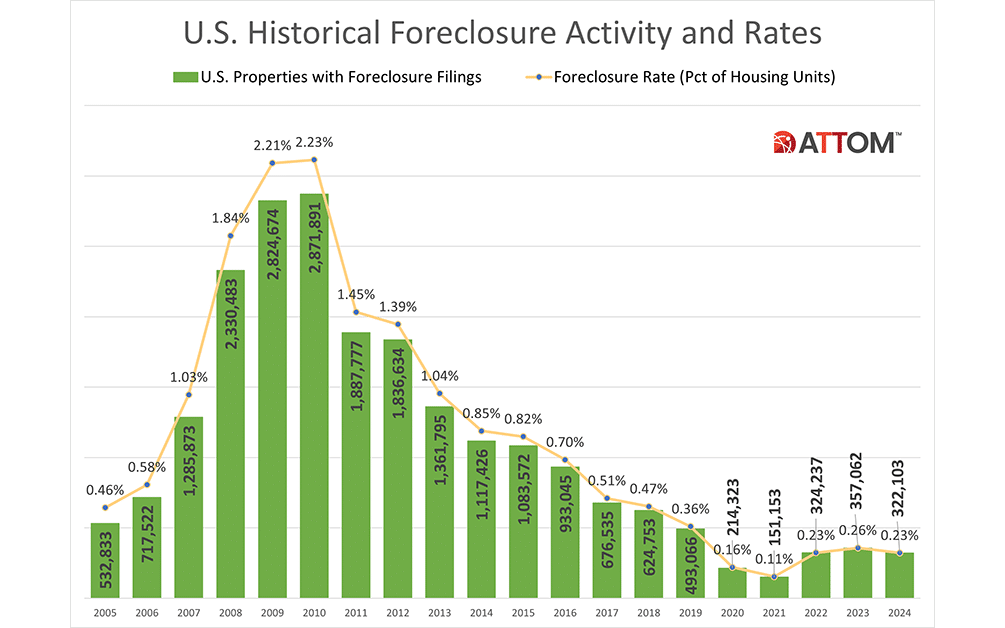

ATTOM’s Year-End 2024 U.S. Foreclosure Market Report—a measure of foreclosure filings, including default notices, scheduled auctions, and bank repossessions—were reported on 322,103 U.S. properties in 2024, down 10% from 2023, down 1% from 2022, and down 35% from 2019, before the pandemic shook up the market. Foreclosure filings in 2024 were also down 89% from a peak of nearly 2.9 million in 2010.

The 322,103 properties with foreclosure filings reported on in 2024 represented 0.23% of all U.S. housing units, down slightly from 0.25% in 2023, and down from 0.36% in 2019, and down from a peak of 2.23% in 2010.

“The continued decline in foreclosure activity throughout 2024 suggests a housing market that may be stabilizing, even as economic uncertainties persist,” said Rob Barber, CEO at ATTOM. “This year’s data points to foreclosure trends potentially returning to more predictable levels, offering some clarity for industry professionals, investors, and homeowners. While foreclosure filings remain a critical metric for understanding market health, current trends may point to a more balanced landscape, potentially shaped by careful lending practices and ongoing homeowner resilience.”

Foreclosure Starts Dip Nationwide

The nation’s mortgage lenders started the foreclosure process on 253,306 U.S. properties in 2024, down 6% from 2023, up 174% from 2021, but down 25% from 2019, and down 88% from a peak of 2,139,005 in 2009.

States reporting the greatest number of foreclosure starts in 2024 included:

- California (29,529 foreclosure starts)

- Florida (29,239 foreclosure starts)

- Texas (28,946 foreclosure starts)

- New York (14,436 foreclosure starts)

- Illinois (13,082 foreclosure starts)

Those metropolitan statistical areas (MSAs) with a population greater than one million that saw the greatest number of foreclosure starts in 2024, included:

- New York, New York (15,327 foreclosure starts)

- Chicago, Illinois (11,508 foreclosure starts)

- Houston, Texas (10,197 foreclosure starts)

- Los Angeles, California (8,790 foreclosure starts)

- Miami, Florida (8,603 foreclosure starts)

Bank Repossessions Continue Second Year of Decline

Lenders repossessed 36,505 properties through foreclosures (REO) in 2024, down 13% from 2023, and down 75% from 2019 (143,955), and down 97% from peak levels of 1,050,500 reported in 2010.

States reporting the greatest number of REO filings in 2024 included:

- California (3,466 REOs)

- Illinois (2,858 REOs)

- Pennsylvania (2,828 REOs)

- Michigan (2,629 REOs)

- Texas (2,501 REOs)

Metropolitan statistical areas (MSAs) with a population greater than one million that saw the greatest number of REOs in 2024 included:

- Chicago, Illinois (1,976 REOs)

- New York, New York (1,815 REOs)

- Detroit, Michigan (1,575 REOs)

- Philadelphia, Pennsylvania (946 REOs)

- Baltimore, Maryland (905 REOs)

What States Posted the Highest Foreclosure Rates?

States with the highest foreclosure rates in 2024 were Florida, where one in every 267 housing units reported a foreclosure filing; New Jersey, where one in every 267 housing units reported a foreclosure filing; Nevada, where one in every 273 housing units reported a foreclosure filing; Illinois, where one in every 278 housing units reported a foreclosure filing; and South Carolina, where one in every 304 housing units reported a foreclosure filing.

Among the 224 MSAs with a population of at least 200,000, those with the highest foreclosure rates in 2024 were found in:

- Lakeland, Florida (one in every 172 housing units with a foreclosure filing)

- Atlantic City, New Jersey (one in every 200 housing units)

- Columbia, South Carolina (one in every 204 housing units)

- Cleveland, Ohio (one in every 208 housing units)

- Las Vegas, Nevada (one in every 231 housing units)

MSAs with a population greater than one million, including Cleveland, Ohio and Las Vegas, Nevada that had the highest foreclosure rates in 2024 were:

- Orlando, Florida (one in every 234 housing units)

- Jacksonville, Florida (one in every 241 housing units)

- Chicago, Illinois (one in every 245 housing units)

- Miami, Florida (one in every 247 housing units)

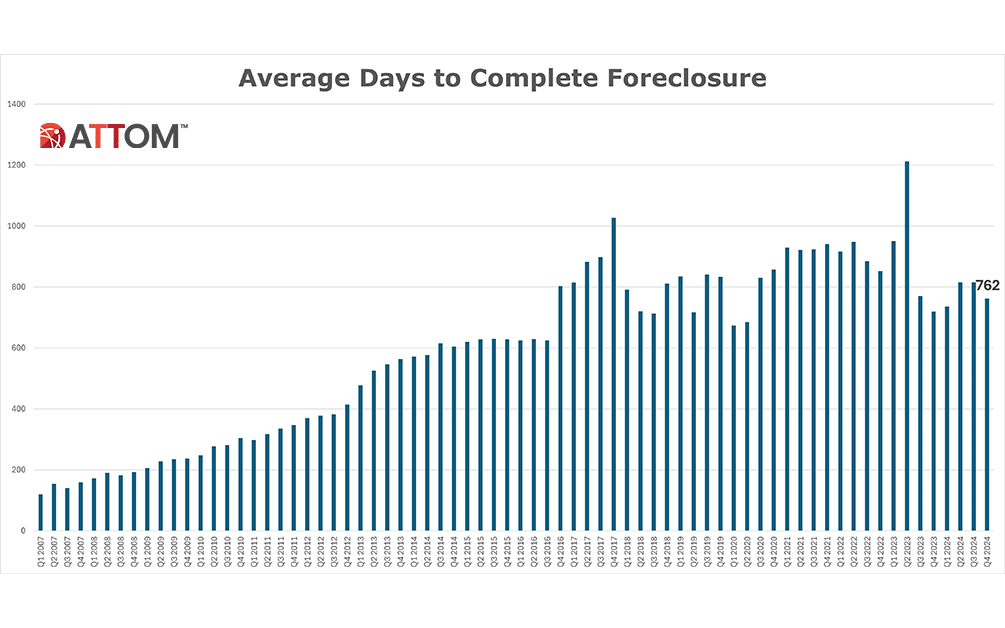

Measuring Foreclosure Timelines

U.S. properties foreclosed in Q4 of 2024 had been in the foreclosure process an average of 762 days, a 6% decrease from the previous quarter, but a 6% increase from a year ago. States reporting the longest average time to foreclose in Q4 2024 included:

- Louisiana (3,015 days)

- Hawaii (2,505 days)

- New York (2,099 days)

- Wisconsin (1,989 days)

- Nevada (1,750 days)

ATTOM’s year-end foreclosure report provides a unique count of properties with a foreclosure filing during the year based on publicly recorded and published foreclosure filings collected in more than 3,000 counties nationwide, accounting for more than 99% of the U.S. population–also available for licensing or customized reporting.