Pending home sales fell 4.5% month over month in December on a seasonally adjusted basis—the largest decline since October 2022—and dropped 2.3% year-over-year, according to a new report from Redfin.

Homebuyer demand dipped at the end of the year as mortgage rates continued to climb. After inching downward at the beginning of the month, mortgage rates reversed course halfway through December and have been rising since—in part because the Federal Reserve projected fewer 2025 interest-rate cuts than anticipated.

According to Freddie Mac, 2024 closed out with the 30-year fixed-rate mortgage (FRM) at 6.91%, and have risen above the 7%-mark, currently sitting at 7.04%. This marks the highest level for the FRM since May 2024, after hitting an early-December low of 6.6%.

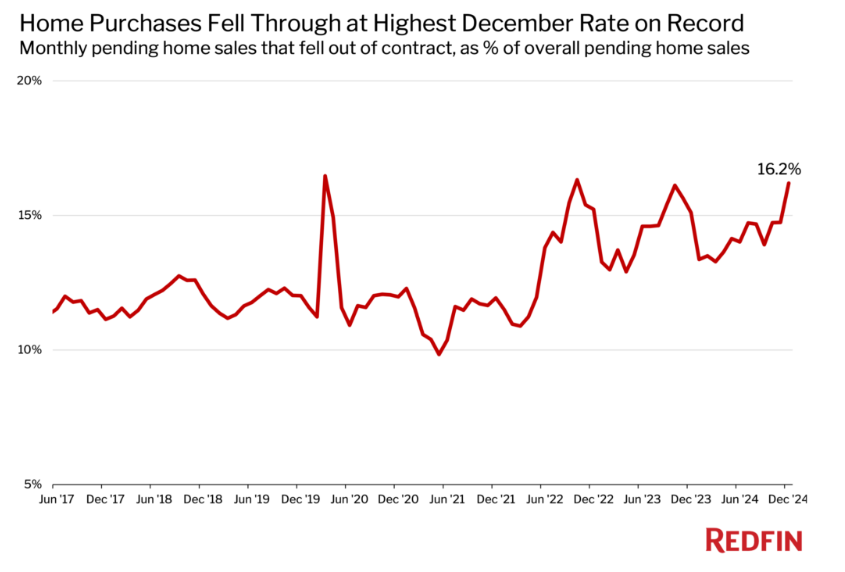

Home purchases fell through at the highest December rate on record, which likely contributed to the decline in pending sales. Nearly 40,000 home-purchase agreements were canceled in December, equal to 16.2% of homes that went under contract that month. That’s the highest December percentage in records dating back to 2017, and is up from 15.1% a year earlier.

“Homebuying activity will likely slow further in January due to the wildfires impacting Los Angeles—the nation’s second most populous metro area—and winter storms impacting the Mid-Atlantic and Southeast,” said Redfin Senior Economist Elijah de la Campa. “Rent prices, on the other hand, may tick up as people who have been displaced by the fires seek alternative housing.”

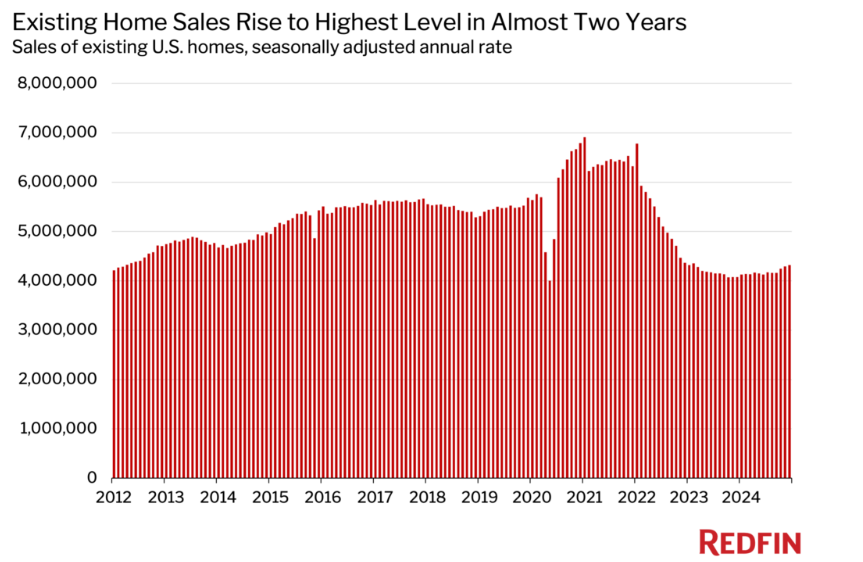

Existing Home Sales Rise to Two-Year High

While pending home sales rose to 24-month highs in December, the nation’s existing-home sales followed suit and rose 0.7% month-over-month in December to a seasonally adjusted annual rate of 4,317,683—the highest level reported since February 2023, and a 6% year-over-year jump—the largest annual increase since July 2021.

According to Redfin, a seasonally adjusted annual rate is not a measurement of actual total sales for the year, but rather, the pace of sales at a given time. A seasonally adjusted annual rate of 4,317,683 in December means that existing-home sales would end the year at that level if homes were sold at the December pace for each month of 2024. For the full year of 2024, actual existing-home sales came in at 4,189,268—roughly in line with 2023.

Overall home sales, a metric that includes sales of both existing and newly built homes, rose 1.9% month-over-month on a seasonally adjusted basis—jumping 9.3% year-over-year, the largest annual gain reported since June 2021.

“Homebuyers pumped the brakes when mortgage rates ticked back up and are now in wait-and-see mode,” said Jesse Landin, a Redfin Premier Real Estate Agent in San Antonio. “Everyone is just trying to figure out when rates are going to come down again. In the meantime, a lot of house hunters are opting to rent.”

Homes Sold at the Slowest December Pace in Five Years

The study also found that the typical home that went under contract in December was on the market for 49 days—the slowest December pace since 2019. That’s up from 43 days a year earlier. Just 25.1% of homes went under contract within two weeks—the lowest share in five years. That’s down from 28.4% in December 2023.

Home Prices Post Largest Gain in Nearly a Year

The median U.S. home sale price increased 6.3% year-over-year to $427,670 in December, the biggest annual gain since February. Prices continue climbing because there’s still a shortage of homes for sale. New listings fell 1.6% month-over-month on a seasonally adjusted basis and declined 1.5% year-over-year.

Meanwhile, active listings, a measure of all homes on the market, fell a slight 0.3% month-over-month—the first decline on a seasonally adjusted basis in five months. They rose 7% year-over-year, but that was the smallest annual increase in nearly a year. One reason active listings are rising is that some homes are taking a long time to sell, causing stale supply to pile up.

A Regional Look

- Median sale prices rose most from a year earlier in Cleveland, Ohio (15%); Milwaukee, Wisconsin (14.5%); and Philadelphia, Pennsylvania (14%). They rose the least in three Florida metros, including Tampa, Florida (0.5%); Orlando, Florida (1.3%); and Jacksonville, Florida (1.3%).

- Pending sales rose most in Anaheim, California (9.7%); Phoenix, Arizona (9.4%); and New Brunswick, New Jersey (6.9%), and fell the most in Newark, New Jersey (-12.5%); New York, New York (-9.3%); and Orlando, Florida (-9.1%).

- Closed home sales rose the most in San Diego, California (28.4%); San Jose, California (25.8%); and Anaheim, California (24%). They fell in three metros: West Palm Beach, Florida (-9.8%); Fort Lauderdale, Florida (-3.5%); and Detroit, Michigan (-1.3%).

- New listings rose most in San Francisco, California (26.8%); Oakland, California (21.1%); and Anaheim, California (16%). They fell most in San Antonio, Texas (-16.8%); Newark, New Jersey (-10.6%); and Austin, Texas (-10.2%).

- Active listings rose the most in Cincinnati, Ohio (37.3%); Fort Lauderdale, Florida (33%); and San Diego, California (26.3%). They fell most in Newark, New Jersey (-9.5%); San Francisco, California (-5.1%); and San Antonio, Texas (-3.3%).

- In Newark, New Jersey 60.5% of homes sold above their final list price, the highest share among the metros Redfin analyzed. Next came San Jose, California (52.1%); and Nassau County, New York (50.9%). The lowest shares were reported in West Palm Beach, Florida (6%); Miami, Florida (6.9%); and Fort Lauderdale, Florida (9%).

Click here for more on Redfin’s analysis of December 2024 home sales.