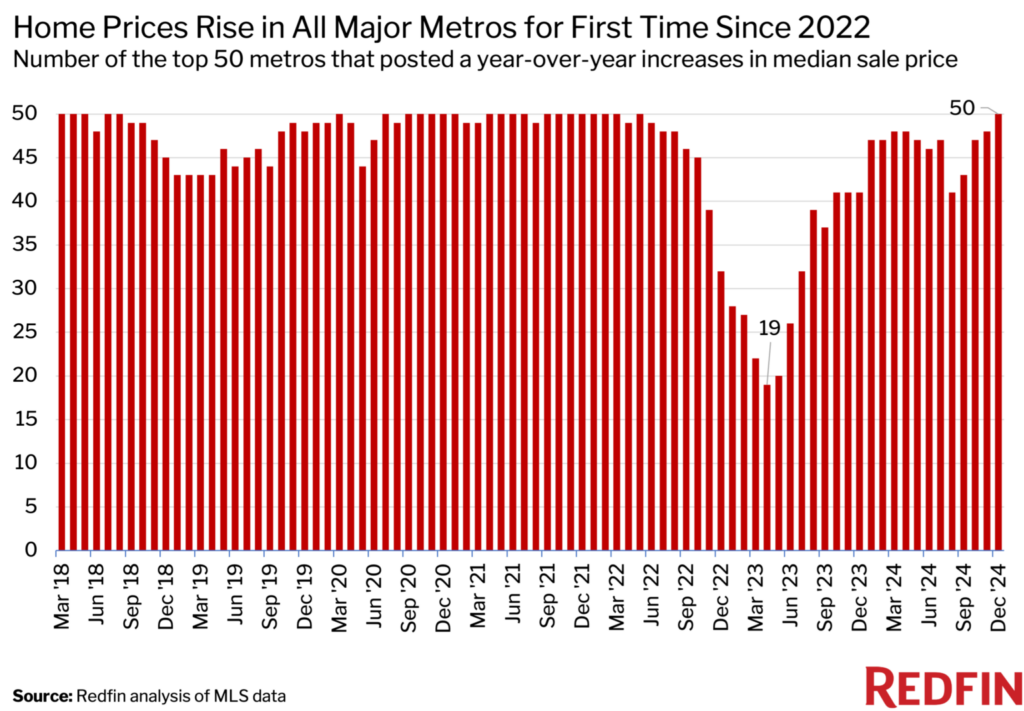

In December, for the first time since May 2022, home prices increased from a year earlier in all 50 of the most populated U.S. metro areas, according to a new Redfin analysis. In contrast, 41 metro areas saw increases in housing prices in December 2023.

“Places that have long been known as affordable places to live, like Cleveland and Milwaukee, are now seeing double-digit price increases—and that’s after home prices skyrocketed during the pandemic,” said Elijah de la Campa, Senior Economist at Redfin. “Affordable housing havens have become harder and harder to come by; even places that saw some price relief last year, like Texas and Florida, are now seeing prices tick back up. Many people looking to move this year will likely opt to rent because it’s the more affordable option and rental affordability is expected to improve as more supply comes on the market.”

As record-low mortgage rates spurred demand from homebuyers during the pandemic, home values surged. However, in 2023, they declined as rates rose again to a two-decade high. Only 19 metros saw price increases in April 2023, the fewest since 2012. As purchasers have gotten used to higher mortgage rates, prices have increased over the past 12 months. Additionally, the lack of available dwellings is contributing to their rise.

Last month, home prices jumped 6.3% year-over-year to a median of $427,670, the largest increase in almost a year.

Florida Seeing the Slowest Price Increases, Opposed to Midwest Growth

In Cleveland, the median home sale price rose 15% year over year in December—the biggest increase among the 50 most populous metros. Next came Milwaukee (14.5%), Philadelphia (14%), Miami (11.8%) and Chicago (11.1%).

“A lot of sellers have a very specific number in mind because they saw their neighbor sell for $40,000 over the asking price during the pandemic. They’re willing to walk away if they don’t get that number, which is one factor keeping prices high,” said Bonnie Phillips, a Redfin Premier real estate agent in Cleveland. “With affordability so strained, buyers are feeling empowered to ask for discounts, but they’re often getting shut down by sellers—even for small asks.”

The Top 10 Metros with the Biggest YoY Change in Median Sale Price:

| U.S. metro area | Year-over-year change in median sale price | Median sale price |

|---|---|---|

| Cleveland | 15.0% | $229,900 |

| Milwaukee | 14.5% | $320,000 |

| Philadelphia | 14.0% | $285,000 |

| Miami | 11.8% | $570,000 |

| Chicago | 11.1% | $340,000 |

| Warren, MI | 10.3% | $300,000 |

| Nassau County, NY | 10.0% | $715,000 |

| Baltimore | 10.0% | $385,000 |

| West Palm Beach, FL | 9.2% | $510,000 |

| New Brunswick, NJ | 9.1% | $540,000 |

“Cleveland may still have a reputation as an affordable-housing haven among out-of-staters, but not so much among locals,” Phillips said. “Many families have been priced out, and those who can still afford to buy have to move to neighborhoods they don’t really want to live in. Their dream of owning a beautiful farmhouse on 1.5 acres has shifted to a reality of a small home in an urban area.”

The Top 10 Metros with the Smallest YoY Change in Median Sale Price:

| U.S. metro area | Year-over-year change in median sale price | Median sale price |

|---|---|---|

| Tampa, FL | 0.5% | $377,000 |

| Jacksonville, FL | 1.3% | $380,000 |

| Orlando, FL | 1.3% | $405,000 |

| Austin, Texas | 1.5% | $450,000 |

| San Antonio | 1.6% | $319,990 |

| Portland, OR | 1.7% | $539,000 |

| Houston | 2.1% | $336,995 |

| Nashville, TN | 2.2% | $460,000 |

| Atlanta | 3.2% | $392,000 |

| Fort Worth, Texas | 3.3% | $361,425 |

The smallest gain among the top 50 metro areas was seen in Tampa, Florida, where property prices increased by just 0.5% year over year in December. San Antonio (1.6%), Austin, Texas (1.5%), Jacksonville (1.3%), and Orlando (1.3%) followed.

In Florida and Texas, it was typical to observe a decline in housing values until December. For instance, Tampa (-1.3%) and Dallas (-0.6%), two of the top 50 metro areas, saw price declines in November. Due to the large number of homes being built in Texas and Florida, price growth is being constrained. Because many people have been priced out of the two main homebuying hotspots, buyer demand is likewise weak. Additionally, a climate and insurance issue in Florida has many homebuyers on edge.

So, where are you looking to move?

To read the full report, including more data, charts, and methodology, click here.