The most damaging wildfires in California history are expected to occur due to the recent climate disasters in Los Angeles. Since the emergency is still ongoing, it is too soon to determine the entire extent of the damage. However, it is evident that one outcome is a “shock” to the housing supply, or a sharp decline in housing production. It is challenging to estimate the magnitude of the housing supply stock at this time.

The majority of reports that are now accessible only include “structures” that have been demolished, which makes it difficult to convert them into “housing units,” which are the standard indicator of supply in the residential market.

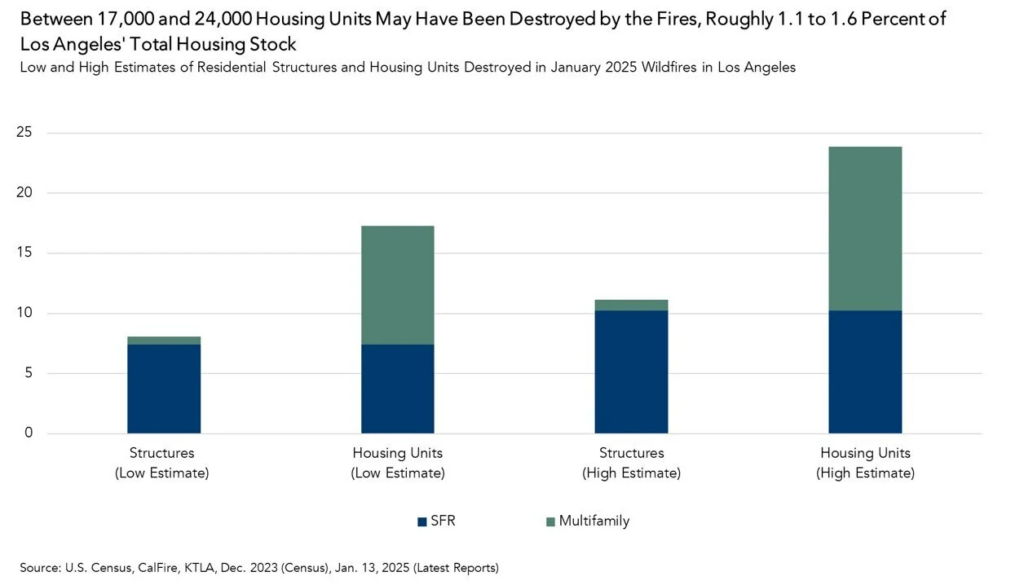

An initial estimate of the home stock lost by the recent fires was generated by First American for the study. According to our analysis, during the first week of the flames, between 1.1 and 1.6% of Los Angeles’ entire housing stock might have been destroyed.

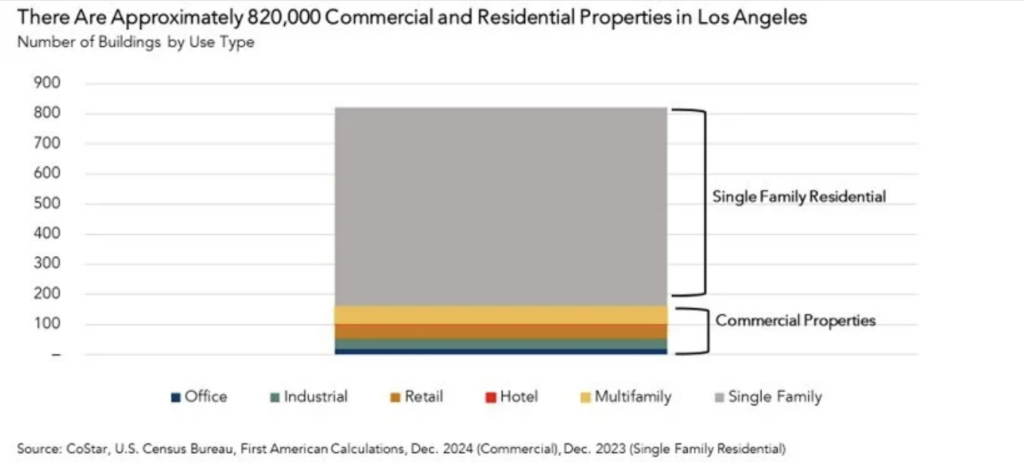

Examining Commercial/Residential Property Stock in LA

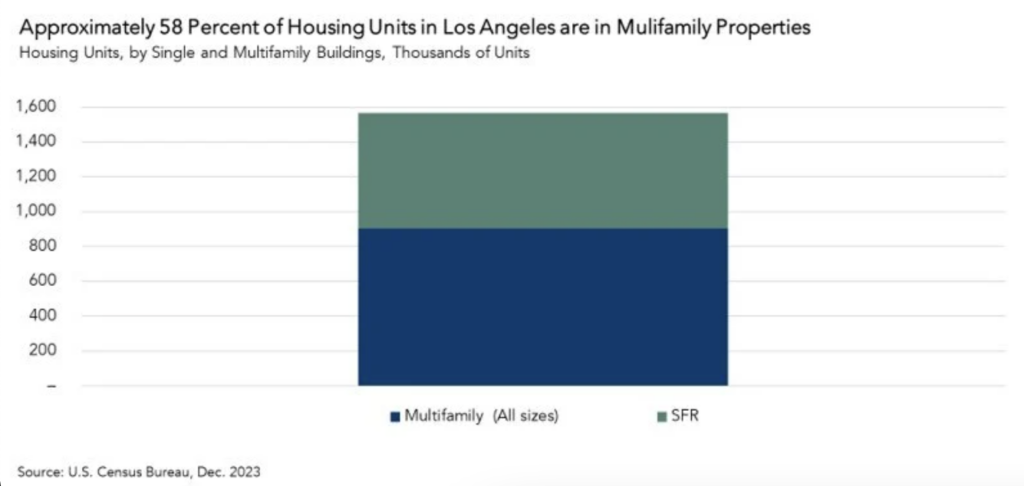

First American calculated the overall size of that inventory in order to translate “structures” into a more recognizable metric of real estate inventory, such as housing units. Single-family homes (SFRs) make up about 80% of all properties in Los Angeles. Office, industrial, retail, hotel, and multifamily facilities of all kinds and types make up the remaining 20%. Multifamily properties are made up of several apartments and are much larger. About 905,000 (58%) of the 1.5 million total housing units are in multifamily buildings, with the remaining 660,000 (42%) being single-family homes.

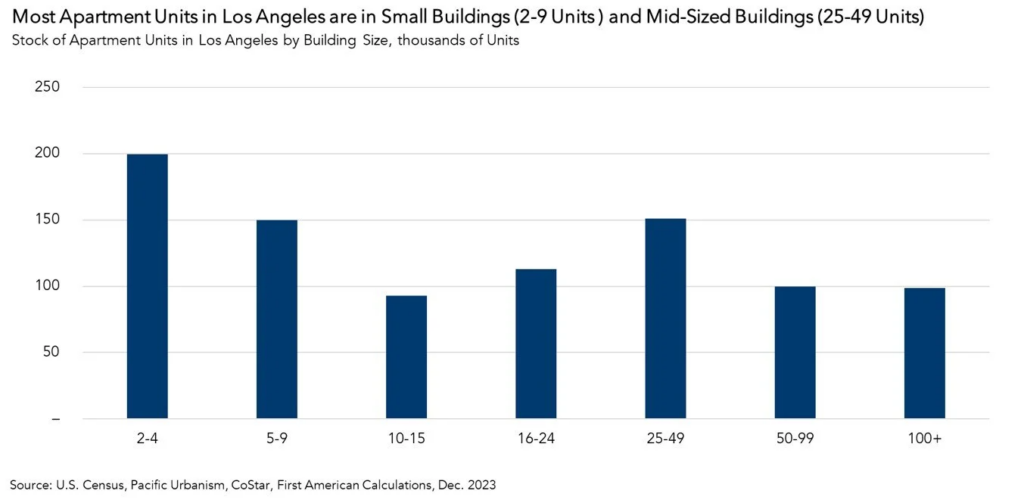

Since one SFR unit often equates to one detached independent structure, counting the number of SFR units destroyed is a little easier. On the other hand, the size of multifamily properties varies significantly. Approximately 200,000 of Los Angeles’s 905,000 apartment units are spread throughout smaller multifamily buildings with two to four units, referred to as duplexes, triplexes, or quads. Approximately 150,000 units are found in buildings with five to nine units. About 150,000 units are also found in mid-sized buildings with 25–49 units.

Estimating the average number of units in Los Angeles apartment buildings is one premise required to calculate the overall number of housing units destroyed. That’s about 18 units per building, according to CoStar. To take into consideration the prevalence of single-family homes in both Altadena and the Palisades, particularly in northern Altadena along the foothills where the Eaton fire has found plenty of fuel to spread, we reduced the average number of units by 20% to 14 units per building in the analysis.

Nevertheless, any update to the estimate of the number of units per building affected by the fires should take into account the fact that the fire has partially spread into the southern Lake Avenue and Fair Oaks Avenue corridors into areas of Altadena that contain higher density apartment units.

Residential Structures, Housing Units Destroyed Across LA

Converting “structures” to units is the main obstacle in calculating the number of housing units destroyed. A structure can be a building, but it can also be a shed, a pool house, a chicken coup, or even a car, according to Los Angeles County Fire Chief Anthony Marrone. This is because it’s not always clear what a burned form in an image is, and the first estimates of destroyed “structures” are based on infrared aerial photographs.

To obtain a more accurate count of building structures, officials do, however, review these photos and make every effort to omit cars. This implies that the structure count should gradually decline in the direction of the actual building count.

According to current estimates, the Palisades, Eaton, and other minor flames across Los Angeles have destroyed between 12,300 and 17,000 buildings. In terms of the number of buildings burned, these wildfires are probably the most catastrophic in California’s history.

By assuming that about 25% of all recognized structures are either vehicles or auxiliary buildings, such as sheds and poultry coups, First American modified the estimate of structures destroyed to account for non-property structures, such as automobiles. The percentage of commercial and residential buildings in burned regions is approximately the same as that of the rest of Los Angeles, and that, on average, the multifamily structures that were destroyed had 14 units per building.

Based on reports of demolished structures, these assumptions resulted in an estimated loss of 17,000 to 24,000 dwelling units. This suggests that between 1.1 and 1.6% of Los Angeles’s housing stock—which consists of about 1.5 million units—has already been destroyed.

Will LA Housing Growth Recover After the Fires?

Using percentages to illustrate the scope of a supply shock can be challenging, particularly in a vast and dispersed region like Los Angeles. The amount of dwelling units constructed in Los Angeles throughout the last three years provides a more concrete understanding of the devastation. Between 10,000 and 15,000 additional housing units were added year between 2021 and 2023, for a total of about 32,000 units. Additionally, the additional supply supplied in 2022 and 2023 combined is roughly equal to the number of dwelling units lost by the flames in Los Angeles. This analysis indicates that the amount of new home supply in Los Angeles has decreased by about two years.

It will be difficult to rebuild in Los Angeles. The city is renowned for its challenging construction environment. Despite efforts to loosen various restrictions in order to facilitate reconstruction, it is unclear if these measures will have the desired impact. A considerable amount of time will pass during which all displaced households will be looking for accommodation, with fewer homes being available all at once due to lengthy redevelopment times and high redevelopment expenses. Furthermore, single-family development occupies around 72% of all residential acreage in Los Angeles, which may make it challenging to swiftly construct a housing supply dense enough to meet demand.

All around the city, this will raise housing costs, including rentals and prices. However, the supply shock would be less severe and the impact on rentals and property prices would be more constrained if a large number of those who have lost their homes decide to move to other cities.

Note: I wish my sincerest consolations to everyone affected and hope for timely and sufficient relief.

To read the full report, including more data, charts, and methodology, click here.