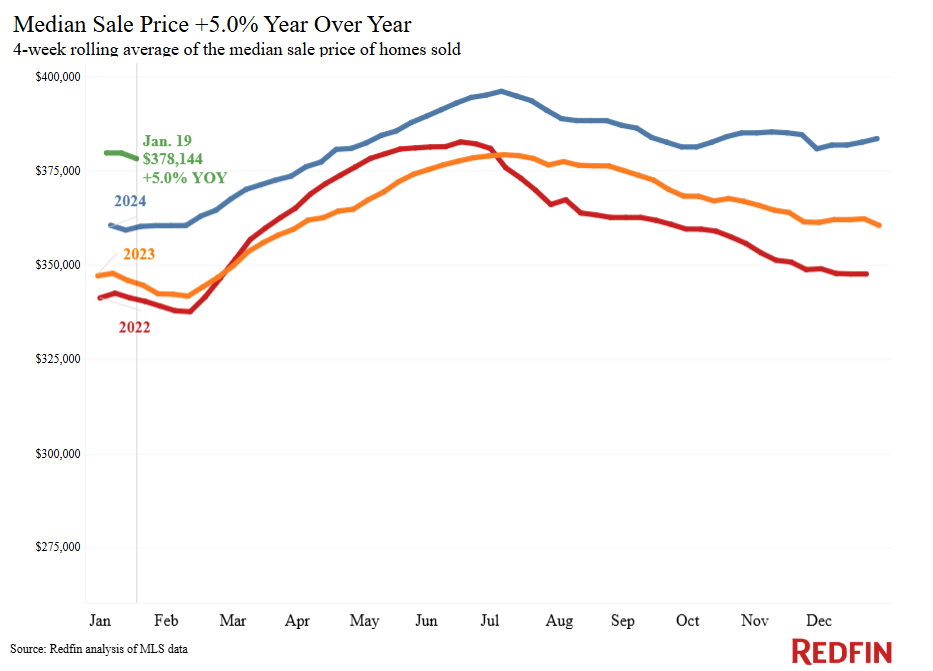

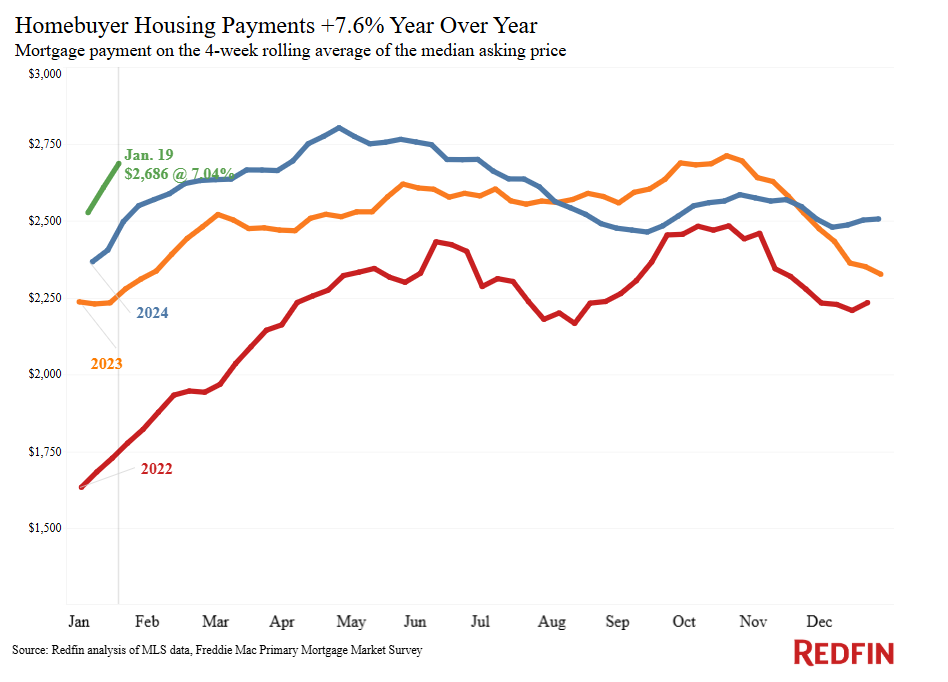

According to Redfin, the median U.S. monthly housing payment is $2,686, the highest level in nearly seven months, as of the four weeks ending January 19. Housing costs are high because of rising mortgage rates and home prices: The weekly average mortgage rate is currently 7.04% (according to Freddie Mac), the highest level since May, and the median U.S. home-sale price is up 5% year-over-year.

High housing costs are one factor keeping many would-be homebuyers on the sidelines. Pending home sales are down 10.1% annually, the biggest decline in more than a year, and Redfin’s Homebuyer Demand Index—a measure of tours and other buying services from Redfin agents—is near its lowest level since June. Homes are also selling relatively slowly. The average home is selling in 52 days, the longest span in two years.

Other factors pushing down pending sales are extreme cold and snow in some parts of the country, wildfires in Southern California, and limited new listings. Some prospective buyers also likely held off in the run-up to President Trump’s inauguration to wait and see if the new administration would take immediate action on housing.

Any Relief in Sight?

Daily average mortgage rates started coming down last week after a softer-than-expected CPI report, and Redfin economists expect rates to decline more if President Trump continues to signal he will be less aggressive on tariffs than expected. And sale-price increases may be losing momentum; the 5% year-over-year increase is the smallest since October.

With construction having ticked up slightly on new homes nationwide, a supply side issue remains which has hampered the housing market. Inadequate housing supply leads homeowners and renters to bid up sale prices and rental fees of available housing units, which continues to put a squeeze on affordability.

“President Trump’s executive order highlights continuity with his campaign pledge to address housing costs,” said Danielle Hale, Chief Economist for Realtor.com. “His executive order keeps housing affordability and other drivers of high costs for households front and center. Even though the order lacks concrete details, it rightly focuses on the need to expand housing supply. Realtor.com estimates suggest that the U.S. housing market is undersupplied on the order of 2.5 to 7.2 million homes over the last decade, a deficit that will take years to build out of.”

The Impact of L.A.’s Wildfires

The ongoing Los Angeles wildfires are pushing up rental searches and pushing down home sales. According to Redfin, roughly one of every six (17%) homes within the perimeters of the Palisades and Eaton fires in the Los Angeles area have been destroyed or damaged. Local Redfin agents report that the destruction has created a ripple effect of people searching for temporary or permanent housing.

“Tons of past clients are reaching out on behalf of friends, seeing if I know of any available rentals,” said Gregory Eubanks, a Redfin Premier Agent. “There’s competition for nearly every rental, and it’s not just on price; a lot of people are taking on long leases to secure a place to live. A rental listed for $16,000 per month got bids up to $30,000, and the winners took on a two-year lease. On the buying and selling side, people are pulling back, waiting for the dust to settle. Two buyers have canceled deals because they don’t feel comfortable making such a big purchase with the catastrophe going on. Three clients have canceled their listings, with the homeowners opting to rent their homes out to people impacted by the fires instead.”

Online views of rental listings in Los Angeles County nearly doubled from a year earlier to their highest levels in at least two years during the second week in January, also according to a Redfin analysis. But would-be buyers are backing off; pending home sales were down roughly 10% year-over-year during the four weeks ending January 19.

“I’m focused on helping families displaced by the fires find short-term housing, which is challenging because rentals are moving at an incredibly fast pace,” said Erik Miles, a Redfin Premier Agent in the Los Angeles Area. “I took one family from the Palisades to see a rental listing in West Hollywood last week, but it had already received 10 offers. The person who won it signed a three-year lease. Thankfully, that same agent had another rental in the area, so I took the family to see it immediately. It had received 35 offers sight-unseen, but my client is in position to get it because they had seen it in person.”

CoreLogic has announced its preliminary residential and commercial loss estimates for the Eaton and Palisades Fires, which found that ongoing losses from the Los Angeles wildfires are estimated to be between $35 to $45 billion, as both fires were less than 50% contained as January 16. CoreLogic’s analysis of both residential and commercial properties accounts for both fire and smoke damage as well as demand surge, debris removal, clean up and Additional Living Expenses (ALE). The majority of losses are to residential properties. Many of the potentially impacted properties are high value homes, so even moderate damage from the fires or smoke could result in costly claims. Of the 6,354 homes that have been destroyed or damaged, just over half of those (56%) were destroyed or damaged by the Eaton fire, and 44% by the Palisades fire. Single-family homes accounted for the vast majority (89%; 5,636) of the homes destroyed or damaged. Another 11% (707) were units in multi-family properties, and less than 1% (11) were mobile homes.