A report on the financial results for borrowers of cash-out refinance mortgages has been released by the Consumer Financial Protection Bureau (CFPB). Credit scores for cash-out debtors first improved significantly before progressively declining.

However, overall scores continued to be higher than they were before to the refinance. According to CFPB research, debtors frequently use the proceeds from cash-out refinances to settle other debts, especially credit card and auto loan debt.

For homeowners, home equity is a major source of savings and the third most prevalent financial asset for families. With a cash-out refinance, homeowners can use their equity to finance necessary home repairs or pay off other debts. However, combining mortgage debt with non-mortgage debt can make foreclosure more likely.

The following are the main conclusions of the CFPB’s report:

- Borrowers gave “pay off other bills or debts” as the most common reason for cash-out refinancing: More than half of cash-out borrowers who participated in the National Survey of Mortgage Originations between 2014 and 2019 chose “paying off other bills or debts.” Over 40% of respondents chose that explanation for 2020 and 2021. The second most often stated explanation each year was “new construction or home repairs.”

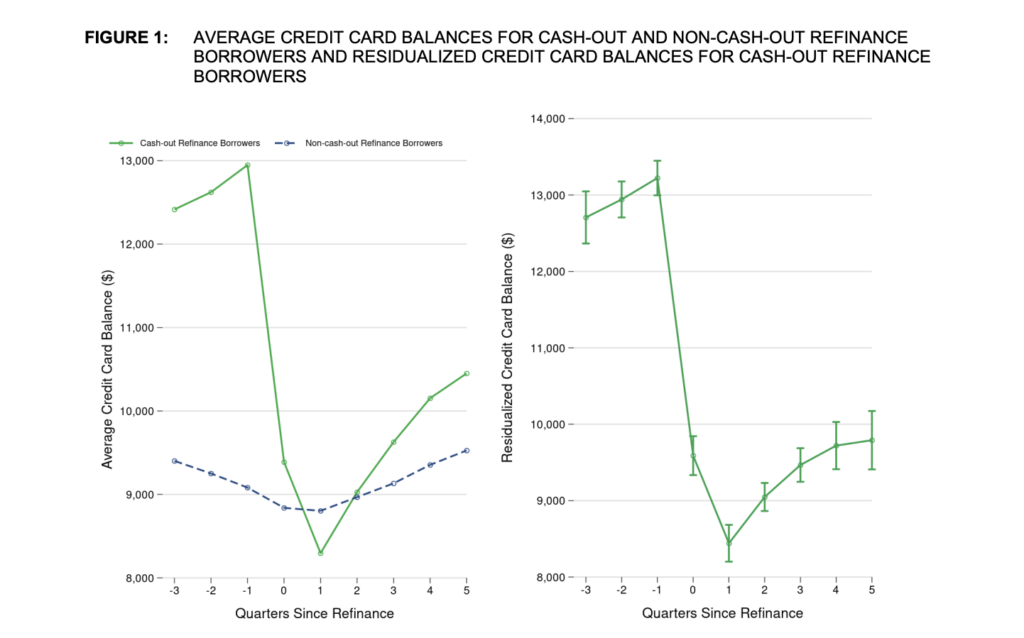

- Cash-out borrowers often have different debt profiles than other homeowners: Cash-out borrowers had mean credit card balances that were about $4,000 higher and mean student loan balances that were about $4,000 lower prior to the mortgage transaction. The average amount of auto loan balances for both borrower categories was comparable.

- Cash-out borrowers had sharp improvements in their debt load and credit scores at the time of refinancing: Cash-out borrowers had mean credit card balances that were about $4,000 higher and mean student loan balances that were about $4,000 lower prior to the mortgage transaction. The average amount of auto loan balances for both borrower categories was comparable.

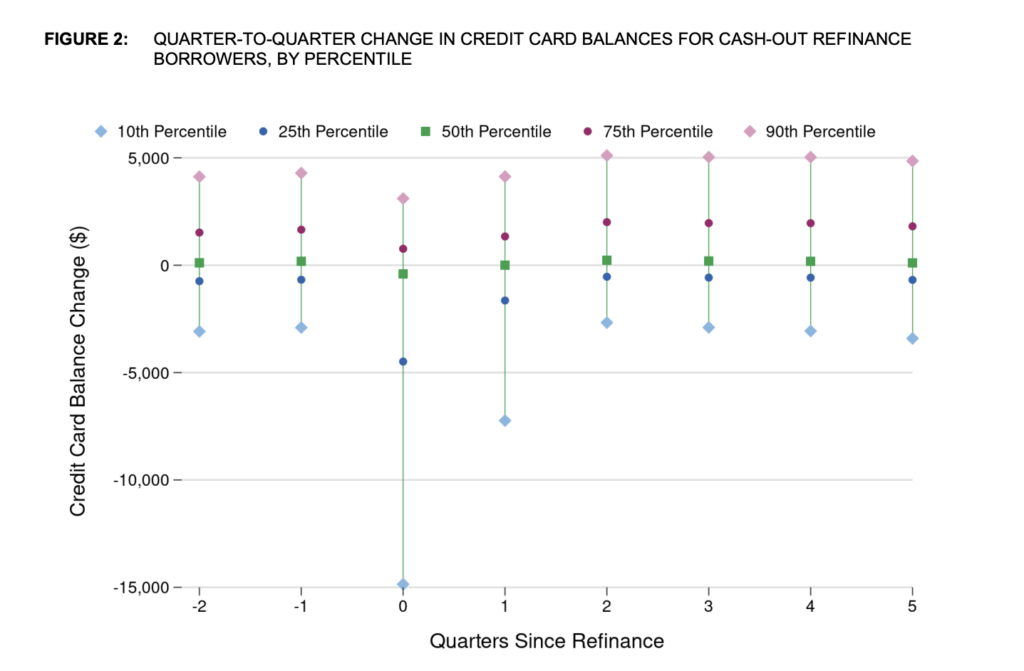

- Cash-out refinance borrowers’ average credit card balances and average credit card utilization rates increased in the year following the refinance. However, average balances and utilization rates stayed below their pre-refinance levels up to five quarters post-refinance.

- Cash-out refinance borrowers were also likely to have large auto loan balance decreases around the time of refinance and a sharp decrease in average auto loan balances during the quarter of the refinance and in the quarter following the refinance. Some 68.5% of cash-out refinance borrowers with auto loan balances had a balance decrease of 10% or more after the refinance.

- Cash-out borrowers’ average auto loan balances decreased by almost $3,000 from the quarter before the refinance to the quarter after the refinance. However, we also show that between 10 and 25 percent of cash-out borrowers with auto loans took on additional debt in the two quarters before refinance. Average auto loan balances continued to decline during the year following the refinance, suggesting resumption of regular paydown behavior.

- Cash-out refinance borrowers’ average credit scores sharply increased at the quarter of refinance, while non-cash-out borrowers’ average credit scores decreased slightly. Even though average credit scores moved back towards the pre-refinance average for both groups of borrowers, the average credit score for cash-out borrowers remained elevated in the year following the refinance.

Refis, Debts & Loans.. Oh My!

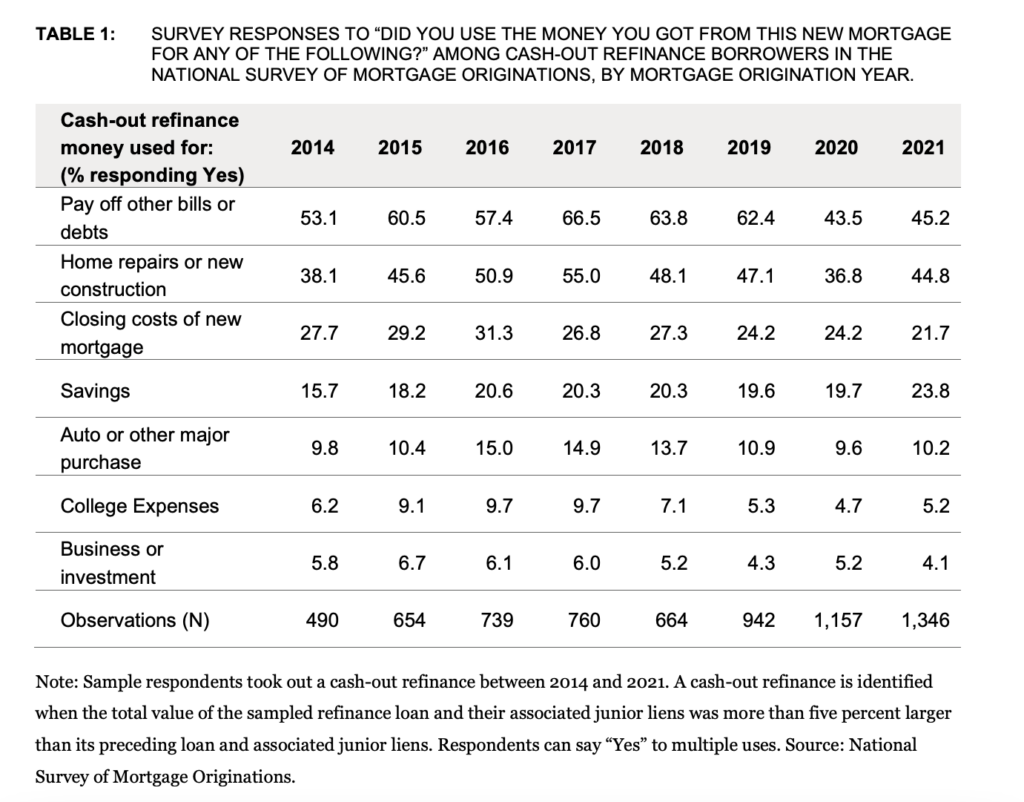

In order to determine why cash-out refinancing borrowers took out equity and whether these motivations had evolved between 2014 and 2021, the CFPB first examined their replies in the NSMO. The distribution of cash-out refinancing borrowers’ answers to the question, “Did you use the money you got from this new mortgage for any of the following?” with multiple “Yes” answers, is displayed in Table 1 below.

With between 44 and 67% of responses across all poll years, “Pay off other bills or debts” was the most often given response; in every year except 2020 and 2021, the majority of respondents chose this choice. With between 37 and 55% of responses, “Home repairs or new construction” was the second most often given solution.

Just five to 10% of respondents said they have used cash-out funds for college fees in any given year. The answers in Table 1 are consistent with findings from the Consumer Surveys conducted in 1999 and 2002, which inquired about the utilization of extracted home equity by refinance borrowers. Additionally, the CFPB discovered that, with a few notable exceptions, the relative ranking of replies in Table 1 remains consistent between survey years.

Conversely, with 92% of cash-out refinance borrowers and 93% of non-cash-out refinance borrowers having a positive credit card balance in the quarter before to their refinance, credit cards were the most common non-mortgage debt type among refinance borrowers. The mean credit card balances of cash-out borrowers were larger ($12,948) than those of non-cash-out refinancing borrowers ($9,082) among those with positive balances.

In the same way that student loans (22% and $41,733 for cash-out vs. 23% and $45,829 for non-cash-out) and auto loans (65% and $22,679 for cash-out vs. 61% and $23,553 for non-cash-out) were similar between the two groups. Although cash-out refinance borrowers were more likely to have HELOCs (17% compared to 10% for non-cash-out refinance borrowers), the mean balances of their HELOCs were lower ($61,365 vs. $80,595) if they did have one. In addition to having higher mean (total) balances across all of their non-mortgage obligations, cash-out refinance borrowers were more likely to have various kinds of open- and close-end loans.

The three products that we monitor have modest delinquency rates; auto loans had the lowest percentage of borrowers who were 60+ days past due (1% for both cash-out and non-cash-out borrowers). Cash-out borrowers had greater default rates in the quarter prior to refinance for all of these programs.

Credit card balances generally declined during the refinance quarter, then continued to decline through the second quarter before somewhat increasing. Nevertheless, the anticipated balance never materializes to the pre-refinance period level.

Note: The study examined debtors from 2014 to 2021.

To read the full report, including more data, charts, and methodology, click here.