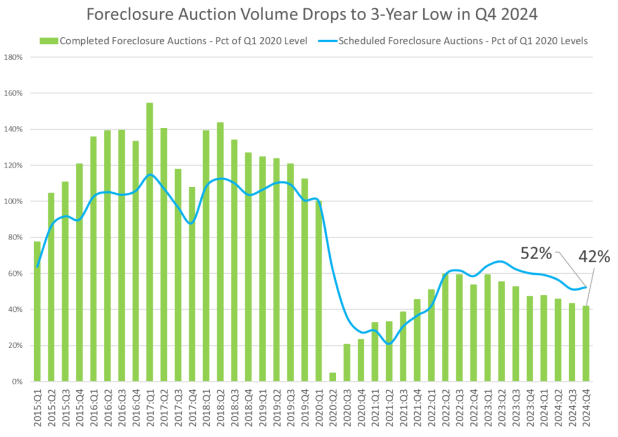

While scheduled foreclosure auctions slightly increased from a two-year low in the previous quarter, the supply of properties available to purchase at foreclosure auction fell to a three-year low in Q4 of 2024. This suggests that completed foreclosure auctions may also slightly increase in Q1 of 2025, according to new Auction.com data.

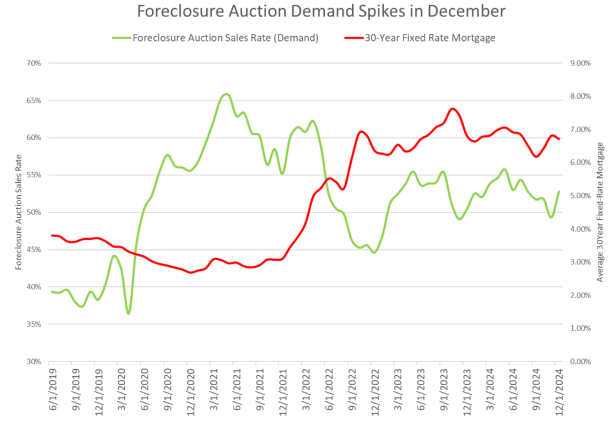

Although interest for properties up for foreclosure and bank-owned (REO) auctions declined overall in Q4, continuing a downward trend that began late in the second quarter, monthly data indicates that demand sharply increased in December after the election.

According to an early January 2025 survey of 145 individuals who have previously bought properties on Auction.com, roughly 43% of buyers said the results of the November 2024 election increased their willingness to buy properties at auction, while only 3% said the results decreased their willingness to buy. The remaining 54% of respondents stated that their inclination to purchase was unaffected by the election results.

“Election results should create a better market going forward,” wrote one survey respondent.

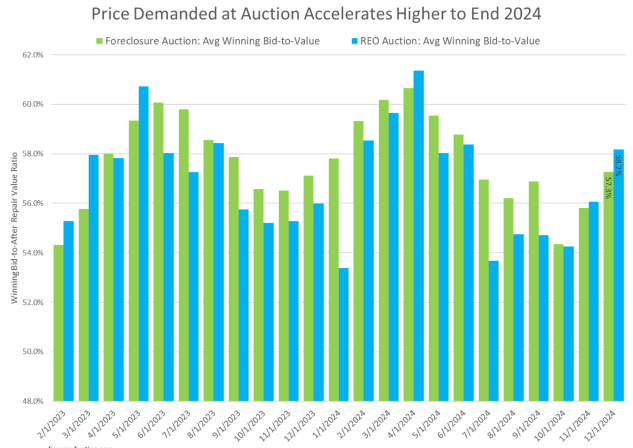

The final two months of Q4 saw an increase in price demand at auction, which measures the average price buyers are willing to pay as a percentage of the estimated after-repair value of the properties being bought. This suggests that local community developers who were purchasing distressed properties at auction gained more confidence in the 2025 real estate market after the election results.

How Much Are Distressed Properties Worth?

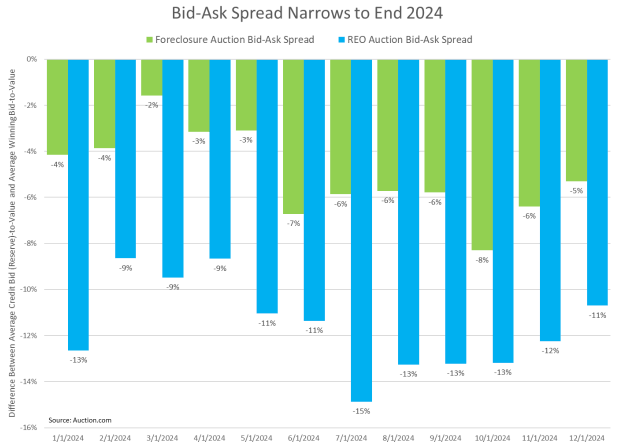

Since it usually takes six months to rehabilitate and bring distressed properties back to the retail market, local community developers must project housing market circumstances when purchasing distressed properties at auction. The bid-ask gap between what buyers were willing to pay and what sellers were willing to accept narrowed as a result of buyers’ increased price demand in the final two months of Q4. Even while sellers kept their prices the same for the quarter, that bid-ask spread shrank.

“The price of everything has increased, including foreclosures,” wrote one survey respondent who said the election results have made him more willing to buy. “However, as long as profit margins stay the same it doesn’t affect me much.”

Key auction demand measures also had a mixed fourth quarter following a widespread decline in demand in Q3. Despite persistently high mortgage rates, the majority of these variables showed a robust recovery in December after declining during the quarter. The percentage of properties available at auction that sold to third-party bidders, or the foreclosure auction sales rate, fell 3% from the previous quarter but remained 2% higher than it was a year ago. The foreclosure auction sales rate increased by 5% from a year earlier and by 7% between November and December, reaching a five-month high.

Demand indicators for REO auctions revealed a similar trend. At a five-month high, the average number of bids per REO auction grew 8% between November and December, although it dropped 7% from the previous quarter and 9% from a year ago, reaching a more than two-year low. Furthermore, from November to December, the percentage of REO auctions with a quality bid—a price that is within 30% of the seller’s reserve—rose by 2% to reach a six-month high.

According to a buyer study done in early January, the market is still working against Auction.com buyers more often than it is in favor of them, even with the increase in demand. In contrast to 24% who stated that market conditions are increasing their willingness to purchase, 35% of respondents stated that they are becoming less inclined to do so.

U.S. Foreclosure Auction Demand by Market

Of the 63 main metro regions examined in Q4, some 37 (59%) saw an increase in demand for foreclosure auctions compared to a year before.

Markets with increasing foreclosure auction sales rates included:

- New York (up 12% from a year ago)

- Chicago (+9%)

- Philadelphia (+19%)

- Houston (+14%)

- Cleveland (+29%)

Markets with decreasing foreclosure auction sales rates included:

- Dallas (down 20% from a year ago)

- Detroit (-3%)

- Atlanta (-10%)

- Minneapolis-St. Paul, MN (-11%)

- San Antonio (-19%)

What’s going on in Ohio? The demand is through the roof!

Markets with the highest levels of demand in the form of their foreclosure auction sales rates were:

- Providence, RI

- Dayton, Ohio

- Akron, Ohio

- Washington, D.C.

- Youngstown, Ohio

Markets with the lowest levels of demand were in:

- Minneapolis-St. Paul, MN

- Pittsburgh

- Wichita, KS

- San Francisco

- Jackson, MS

“(The) real estate market is stagnant,” wrote another survey respondent who said market conditions are making him less willing to buy distressed properties at auction. “With the high interest rates, (my) buyers pool is almost dry.”

Price Demand Jumped Higher to Close Out the Year

For both foreclosure and REO auctions, price demand—the amount that purchasers are ready to pay at auction in relation to the estimated after-repair value—rose during the fourth quarter and ended the year at a six-month high.

“The shortage of foreclosures going to auction is making us more likely to buy properties with tighter margins,” wrote one survey respondent who said he plans to buy more distressed properties at auction in Q1 2025 than he did in Q4 2024.

Following a two-year low in the preceding quarter, price demand at REO auctions increased in the fourth quarter. In Q4 2024, the average winning bid-to-value rate at REO auction was 56.2%, which was higher than 55.5% in Q4 of 2023 and 54.4% in the previous quarter. Throughout the quarter, price demand at REO auctions increased, reaching a six-month high in December.

The average winning bid-to-value ratios at the end of the year were still below early 2024 levels and well below peak pandemic levels in 2021, even with the price demand resurgence in November and December. Foreclosure auction bid-to-value ratios peaked in April 2021 at 67.6%, while REO auction bid-to-value ratios peaked in June 2021 at 67.1%.

Measuring Q4 Foreclosure Auction Pricing Trends

The average bid-to-value ratio for homes sold at foreclosure auction in the fourth quarter decreased year over year in 34 of the 53 markets examined (54%), indicating that price demand trends differed by market.

Markets with decreasing price demand in Q4 included:

- Chicago

- Dallas

- Detroit

- Philadelphia

- Houston

The 29 markets with increasing price demand in Q4 included:

- New York

- Cleveland

- Baltimore

- Washington, D.C.

- Phoenix

Markets with the highest winning bid-to-value ratios were in:

- Phoenix (68.5%)

- Lafayette, LA (67.1%)

- Providence, RI (66.5%)

- San Francisco (66.3%)

- Washington, D.C. (66.2%)

Those with the lowest winning bid-to-value ratios were in:

- Huntington, WV (26.6%)

- Minneapolis-St. Paul, MN (33.5%)

- Flint, MI (34.1%)

- Pittsburgh (34.5%)

- Peoria, IL (42.1%)

“Low inventory (is) pushing us to other markets,” wrote an additional survey respondent.

Due mostly to purchasers’ increased willingness to pay, the bid-ask gap between what bidders were willing to pay and what sellers were willing to accept for distressed properties at auction decreased dramatically during Q4 of 2024.

“I’m finding more foreclosure properties on which to bid,” wrote one survey respondent who said she plans to buy more distressed properties at auction in Q1 2025 than she did in Q4 2024.

In Q4 of 2024, the bid-ask spread for foreclosure auctions surged to a two-year high of seven points; however, as buyer demand for prices grew, the disparity significantly shrank in the second two months of the quarter. After reaching a five-year high of eight points in October, the bid-ask spread shrank in November and December. In December, the 5-point bid-ask spread was the lowest level in seven months.

The average seller reserve price as a percentage of predicted after-repair value was the main factor that caused the bid-ask spread to shrink, as buyers’ price demands increased rather than sellers’ prices decreasing. For both REO and foreclosure auctions, the price that sellers offered was essentially the same in Q4 as it was in the previous quarter.

To read more, including more data, trends, charts, and methodology, click here.