While many office and retail buildings remain delinquent throughout the U.S., the fourth quarter experienced some significant activity. The most recent commercial real estate finance (CREF) Loan Performance Survey from the Mortgage Bankers Association (MBA) shows that delinquency rates for mortgages backed by commercial properties rose in Q4 of 2024.

“The delinquency rate for commercial mortgages increased during the final three months of 2024, with increases across most capital sources and property types,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “The challenges facing different sectors vary—with office properties perhaps facing the most challenging combination of weaker fundamentals and stubbornly high interest rates. However, despite the current conditions, other property types continue to benefit from a relatively strong economy.”

Q4 Snapshot: Delinquency Rates for Commercial Mortgages

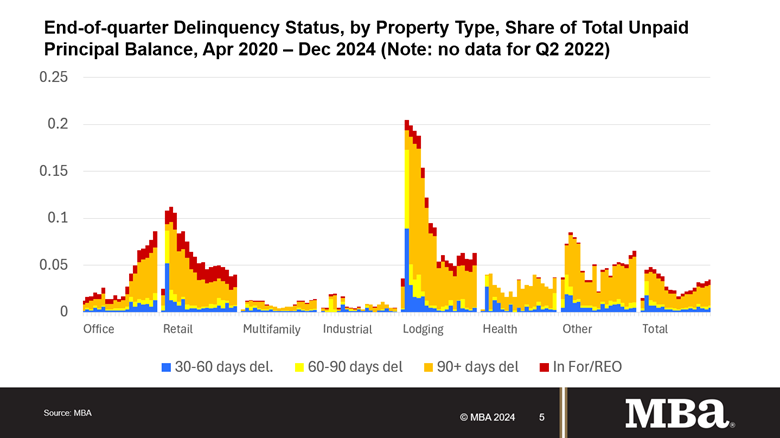

The balance of commercial mortgages that are not current increased slightly in Q4 of 2024. Additionally, for several property types—especially office, lodging, retail, and multifamily—the percentage of defaulted loans rose.

Industrial properties experienced a drop in delinquencies, and although they remained unchanged throughout the quarter, CMBS loan default rates saw the highest levels among capital sources.

Compared to 4.8% at the end of the previous quarter, 5.3% of CMBS loan balances were 30 days or more past due. Other capital sources continued to have relatively mild non-current rates. The percentage of FHA health care and multifamily loan amounts that were 30 days or more past due increased from 0.87% at the end of the previous quarter to 1.0%.

Further, the percentage of life business loan balances that were past due decreased from 0.94% to 0.86%. And, the percentage of GSE loan balances that were past due increased from 0.5% to 0.6% in the prior quarter.

Since April 2020, comparable polls have been undertaken, and this quarter’s results build on those findings. According to MBA’s third-quarter MDO report, participants reported on $2.5 trillion in loans in December 2024, which accounted for 52% of the $4.7 trillion in commercial and multifamily mortgage debt outstanding (MDO).

The Q3 MDO report showed that the third quarter of 2024 saw a rise in commercial mortgage delinquencies.

“The increases varied by capital source and were driven by the particularities of each individual loan and property,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “Stresses differ by property type and subtype, geographic market and submarket, loan type and vintage, borrower type and more.”

As of December 30, 2024, data on commercial and multifamily mortgage portfolios was gathered by MBA’s CREF Loan Performance survey.

To read the full report, including more data, charts, and methodology, click here.