According to the National Association of Realtors (NAR) , pending home sales dropped 5.5% in December, following four consecutive months of increases. All four U.S. regions experienced month-over-month losses in transactions, with the most significant drop reported in the Western U.S. Year-over-year, contract signings reduced in all four U.S. regions, with the Midwest seeing the largest decrease.

, pending home sales dropped 5.5% in December, following four consecutive months of increases. All four U.S. regions experienced month-over-month losses in transactions, with the most significant drop reported in the Western U.S. Year-over-year, contract signings reduced in all four U.S. regions, with the Midwest seeing the largest decrease.

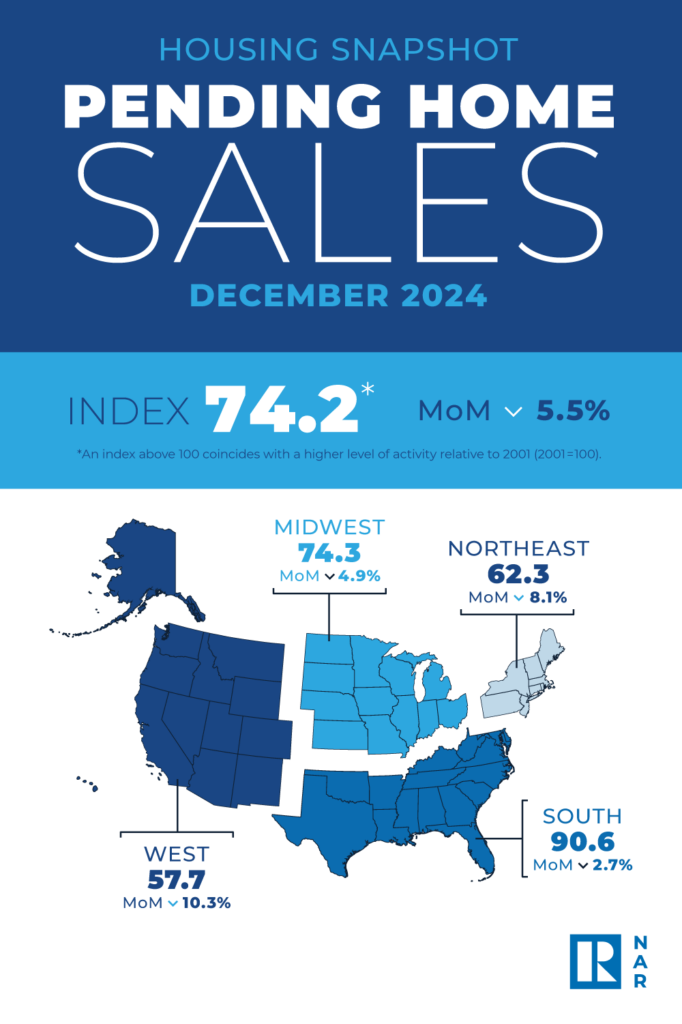

NAR’s Pending Home Sales Index (PHSI)–a forward-looking indicator of home sales based on contract signings–slid 5.5% to 74.2 in December. Year-over-year, pending transactions declined 5%. Last year’s cyclical low point occurred in July 2024 at 70.2. A PHSI reading of 100 is equal to the level of contract activity in 2001.

“After four straight months of gains in contract signings, one step back is not welcome news, but it is not entirely surprising,” said NAR Chief Economist Lawrence Yun. “Economic data never moves in a straight line. High mortgage rates have not significantly dented housing demand due to greater numbers of cash transactions.”

First American Deputy Chief Economist Odeta Kushi added, “Affordability challenges remain, with national home prices reaching another record high in December alongside elevated mortgage rates. Despite the difficult conditions, there are some signs of resilient demand and pockets of activity may emerge as rising inventory in some areas could ease price pressures and offer more options for buyers and sellers.”

According to Zillow, the average U.S. home value is currently $356,585, up 2.6% over the past year.

Regional Trends Set the Tone

NAR’s Northeast PHSI fell 8.1% from the previous month to 62.3, down 1.3% from December 2023. The Midwest Index shrunk 4.9% to 74.3 in December, down 6.9% from the previous year. The South PHSI slipped 2.7% to 90.6 in December, down 5.1% from a year ago. The West index tumbled by 10.3% from the prior month to 57.7, down 5.1% from December 2023.

“Contract activity fell more sharply in the high-priced regions of the Northeast and West, where elevated mortgage rates have appreciably cut affordability,” added Yun. “Job gains tend to have greater impact in more affordable regions. It is unclear if heavier-than-usual winter precipitation impacted the timing of purchases.”

“The South saw the biggest pick up in for-sale housing inventory in December, and boasts a high share of affordable inventory, helping prevent bigger declines in pending home sales,” said Realtor.com Senior Economic Research Analyst Hannah Jones. “The Northeast and Midwest have seen slower inventory growth as demand remains relatively sustained in the region, as captured in the December Hottest Markets report.”

Affordability remained a factor for potential buyers as 2024 closed out, as Freddie Mac reported the 30-year fixed-rate mortgage (FRM) at 6.85% to close out the year.

“The most obvious factor that would draw buyers into the market is a drop in mortgage rates. While rates are not expected to drop significantly, short-term dips could cause buyers to get into the market opportunistically,” said Bright MLS Chief Economist Lisa Sturtevant. “Beyond mortgage rates, however, an increase in inventory could attract buyers who have been waiting on the sidelines. As people have become more accustomed to mortgage rates in the mid-to-high 6% range, an increase in fresh listings could be the deciding factor for buyers in the first part of 2025.”

New White House Actions

As the calendar year turned, the nation welcomed its 47 President as Donald J. Trump was inaugurated President of the United States, and wasted no time in ushering in his “Golden Age of America” by signing a series of executive actions. Just hours after returning to the White House, Trump revoked 78 policies signed under President Joe Biden’s term through executive orders, a number of which directly impact the housing industry.

Among Trump’s executive orders taking aim at immigration policies, withdrawal from the Paris Climate Agreement and World Health Organization (WHO), and actions pardoning approximately 1,500 charged in the January 6, 2021 attack on the U.S. Capitol, the 47th U.S. President turned his focus toward regulatory requirements that account for 25% of the cost of constructing a new home.

According to an analysis by Associated Builders and Contractors, construction input prices ticked up 0.3% in October, driven primarily by increased costs across all energy subcategories. As prices of raw materials have risen based on short supply and ties to tariffs, industry trade groups have thrown their expertise into the ring in an attempt to solve the affordability crisis faced by potential home buyers.

“The new administration has introduced some uncertainty to the housing market as buyers and sellers evaluate the possible impacts of President Trump’s housing policies on mortgage rates and home prices, ‘said Jones. “However, the seasonal easing of home prices, high inventory and relatively stable, though high, mortgage rates has contributed to steady market activity.”