With the national median payment requested by purchase applicants falling to $2,127 from $2,133 in November, homebuyer affordability improved marginally in December. This is in line with the Mortgage Bankers Association‘s (MBA) Purchase Applications Payment Index (PAPI), which uses information from the MBA Weekly Applications Survey (WAS) to calculate how new monthly mortgage payments change over time in relation to income.

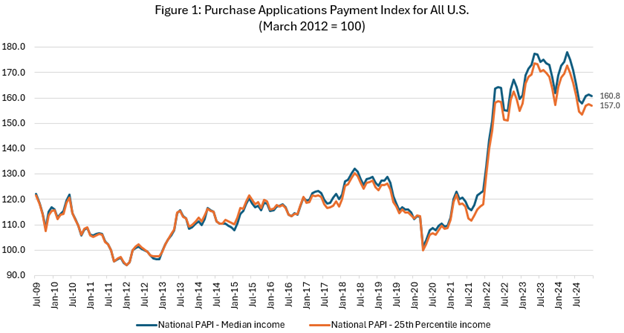

The mortgage payment to income ratio (PIR) is larger when the MBA’s PAPI rises, which is a sign of deteriorating borrower affordability conditions. This can be caused by rising mortgage rates, growing application loan amounts, or a decline in earnings. When loan application amounts, mortgage rates, or incomes decline, the PAPI declines, which is a sign of improving borrower affordability conditions.

“Homebuyer affordability conditions were essentially flat in December, the result of somewhat volatile mortgage rate movements and moderating home-price growth,” said Edward Seiler, MBA’s Associate VP of Housing Economics, and Executive Director for the Research Institute for Housing America. “2024 was a sluggish year for home sales because of weak affordability conditions throughout the country. MBA expects 2025 conditions will improve as housing supply increases, giving prospective buyers more options and putting less pressure on their budgets.”

Home Purchase Applications See Slight Decline in Q4

In December, the national PAPI (Figure 1) dropped from 161.3 in November by 0.3% to 160.8. The PAPI is down 0.6% annually as a result of the notable earnings rise, even if median wages were up 4.1% from a year ago and payments increased 3.5%. In December, the national mortgage payment rose from $1,436 in November to $1,446 for borrowers looking for lower-payment mortgages (the 25th percentile).

The median mortgage payment for purchase mortgages from MBA’s Builder Application Survey rose from $2,481 in November to $2,500 in December, according to the Builders’ Purchase Application Payment Index (BPAPI).

Results of the MBA’s December 2024 PAPI:

- The national median mortgage payment was $2,127 in December—down $6 from November. It is up by approximately $72 from one year ago, equal to a 3.5% increase.

- The national median mortgage payment for FHA loan applicants was $1,866 in December, down from $1,898 in November but up from $1,822 in December 2023.

- The national median mortgage payment for conventional loan applicants was $2,128, down from $2,133 in November but up from $2,053 in December 2023.

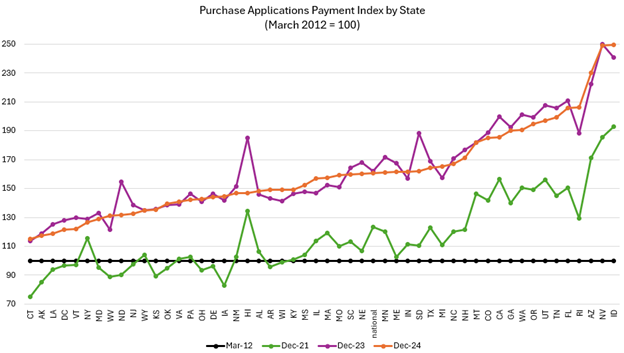

- The top five states with the highest PAPI were: Idaho (249.5), Nevada (249.0), Arizona (230.3), Rhode Island (206.3), and Florida (205.8).

- The top five states with the lowest PAPI were: Connecticut (115.2), Alaska (117.3), Louisiana (118.9), D.C (121.3), and Vermont (122.1).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 152.7 in November to 152.2 in December.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 154.1 in November to 153.6 in December.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 164.3 in November to 163.8 in December.

U.S. Home Sales Jump, Slowing Mortgage App Payment Activity

Stagnant mortgage application activity may be due in part to a rise in December home sales. The MBA recently reported that new single-family home sales reached a seasonally adjusted annual pace of 698,000 in December, according to data from the U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau.

This represents a 6.7% increase from the forecast of 654,000 in December 2023 and a 3.6% increase from the revised November rate of 674,000.

“New-home sales are now 16% higher than the pre-pandemic average, but we are currently still only building about 10 per 1,000 households, which is about the same as in 1991,” said Mark Fleming, Chief Economist at First American. “New construction has struggled to keep up with demand. Rising construction costs, zoning restrictions and a shortage of labor have all contributed to the inability to build enough homes.”

Key Findings:

- In 2024, an anticipated 683,000 new residences were sold, 2.5% more than the revised 666,000 in 2023.

- In December, the average sales price of a new home sold was $513,600, while the median sales price was $427,000.

- At the end of December, there were 494,000 new homes for sale, according to a seasonally adjusted estimate. At the current sales rate, this amounts to an 8.5-month supply.

“To put this pace in perspective, in the late 1930s and early 1940s, we were building between 500,000 and 700,000 units a year, which equated to 15-20 units per 1,000 households,”Fleming said. “Post-World War II that ramped up to over a million units, peaking at 1.9 million units per year in 1950, or 44 units per 1,000 households. We have never built at this rate since.”

To read the full report, including more data, charts, and methodology, click here.