In this industry, some specific housing market terms bring about more worry to American consumers than others. For instance: WIRE FRAUD.

While the term may sound scary—and is most definitely illegal—a new survey from CertifID showed how many first-time homeowners are at-risk or more likely to be victims of real estate wire fraud. The third annual State of Wire Fraud study was released by CertifID today, revealing information and data about the potential risks to American consumers during real estate transactions.

In less than 10 years, the annual losses from real estate wire fraud have increased fiftyfold, from $9 million to $446 million, according to the FBI Internet Crime Complaint Center (IC3). Due to the frequently complicated closing process that involves numerous parties, the public availability of property and listing data, and the enormous sums of money involved—the median home sale price in the U.S. is $427k—with cybercrime increasing in the housing sector.

“Delivering safe and secure transactions is not just good for the real estate industry; it’s our duty to consumers as they enter into the largest transaction of their lives,” said Thomas Cronkright II, Co-Founder and Executive Chairman of CertifID. “This data provides meaningful insight into the true impact of these crimes targeting American homebuyers and sellers, who are already under stress in what is the most challenging housing market in recent history. We hope this report sparks new and continued action for all real estate and title professionals to lead their communities in the change needed to protect consumers; it is within reach.”

Note: N = 1,485 total responses across all states.

2025: Examining the Impact of Wire Fraud on Consumers

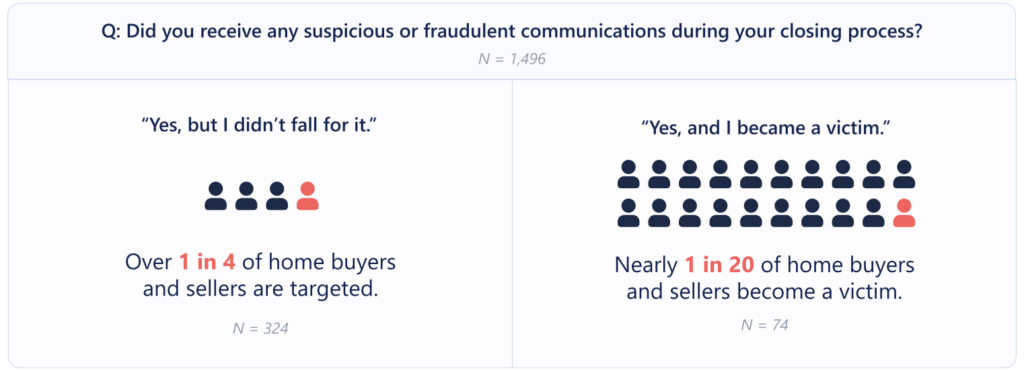

According to the survey, almost 1 in 20 consumers fall victim to fraud in a real estate transaction, and more than 1 in 4 consumers are the targets of fraud. The study also finds that the U.S. homeowner population has unequal vulnerabilities, with higher risk variables according to age, region, and experience.

Key findings from the State of Wire Fraud report:

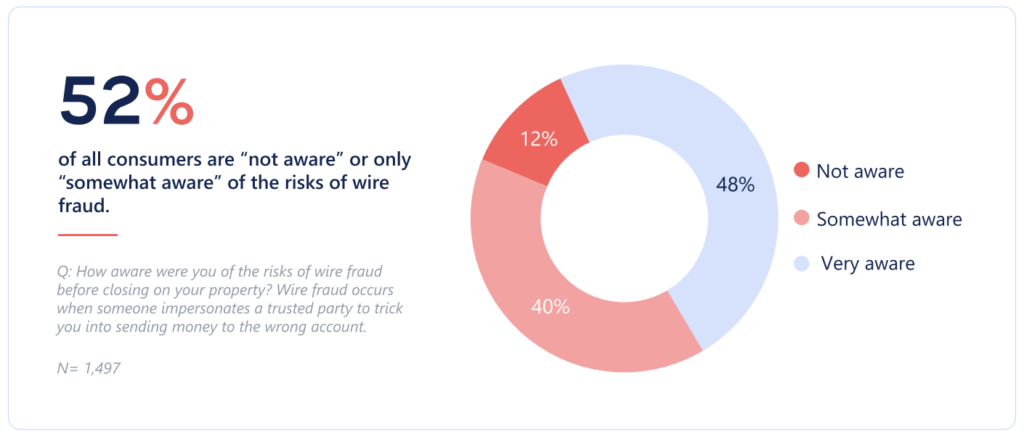

- Some 52% of consumers are “not aware” or only “somewhat aware” of the risks of wire fraud at the start of a real estate transaction.

- Only 47% of consumers were informed about the risks by their real estate professionals at the start of the process.

- Consumers aged 55 and older are 2x more likely to be unaware of wire fraud risks compared to those who are 44 and younger.

- First-time consumers look most often (35%) to their real estate agent to protect them from wire fraud, while experienced consumers look most often to their title company or attorney.

- Consumer awareness, wire fraud education, and victim rates vary significantly state to state.

- Overall, 79% of consumers are willing to pay more to work with real estate providers who prioritize their security from wire fraud.

“The entire CertifID organization is rooted in our mission to be a trusted resource for real estate and title professionals and the customers they serve, to help keep their money out of the hands of criminals,” said Tyler Adams, Co-Founder and CEO of CertifID. “This report identifies areas of vulnerability that require greater focus and investment. We believe that consistently adopting strong security strategies, tools, and practices as a business community can make us a safer industry to serve American homeowners.”

Unfortunately, fraud is now a common occurrence in the U.S. According to Consumer Reports, about half of all Americans have personally experienced a cyberattack or attempted digital swindle. In addition to being more frequent, these cyberattacks are also getting bigger. Last year, the FBI IC3 received reports of cybercrime damages over $12.5 billion, a 22% increase in yearly losses. Fraud and scams account for the majority of the losses reported to the IC3. With damages from business email compromise (BEC) reaching around $500 million yearly, real estate has been recognized as an especially vulnerable target.

Many Consumers Lack Awareness Surrounding Wire Fraud

For a number of years, the U.S. housing market has been difficult to navigate for many. Both the housing supply and affordability are at all-time lows, while interest rates are still at all-time highs. In most markets, the median sale price of an existing home is almost double what it was before the pandemic. Now, wrap potential real estate wire fraud into the mix and it just further complicates the entire process.

One of the primary issues affecting Americans is that many lack the awareness or knowledge of what real estate wire fraud is, how easily it can happen, and the potential indicators for identifying it. Many homebuyers and sellers simply don’t know that wire fraud “is a thing.”

An estimated 52% of 1,500 homebuyers and sellers in the U.S. who participated in a recent CertifID poll said they were “not aware” or only “somewhat aware” of the hazards of wire fraud prior to the closing process. In contrast, according to the previous year’s research, some 51% of respondents were “not aware” or “somewhat aware.” This implies that within the past 12 months, there hasn’t been any discernible increase in general consumer knowledge of the issue.

Per the report, consumers aren’t being educated about the risks early or often enough. Consumers cannot rely on a homebuyer or seller coming across a news story or report regarding real estate fraud. It’s important to provide consumers with education more regularly so they can avoid the potential risks altogether. Just 49% of homebuyers and sellers said their real estate agents first informed them about wire fraud. For 47% of purchasers and sellers, education begins at the first meeting, but for most customers, it occurs too late in the process.

Too Many Consumers Are Falling Victim

There are far too many fraud victims among American consumers who spend their hard-earned money before, during, and after the homebuying process. During the closing process, more than 1 in 4 (26%) of buyers and sellers said they received shady or deceptive messages. Almost 1 out of every 20 (4.7%) homebuyers and sellers said they had been a victim.

But hold on, wait a minute. Who’s attempting these fraudulent transactions? Unfortunately, real estate agents were the most frequently impersonated professionals during a fraud attempt; according to 58% of victims, their agent appeared to be the source of suspicious communications. The next most common impersonation, according to 41% of respondents, was their settlement agent or title agent.

Remarkably, 34% of respondents said that loan officials were routinely impersonated in these frauds, despite the fact that they have no part in directing the money transfer during a closing. This demonstrates how little customers know about the roles played by each party in a real estate transaction and what to anticipate from it.

If a consumer suffers a loss to real estate wire fraud, the methods used to recover funds and the experiences of victims differ greatly. Victims who are unsure of who to turn to ask for assistance from anyone in their immediate vicinity, including their bank, title firm, lawyer, or law enforcement. There is more stress and a worse chance of healing in the absence of a consistent procedure or assistance. Nevertheless, 22% of victims choose not to notify federal law enforcement of the crime. It is evident that buyers encounter considerable complexity in both “normal” real estate transactions and the most catastrophic situations.

Consumers Weigh in On Education, Past Experiences

Q: Did you receive any suspicious or fraudulent communications during

your closing process?

A: Yes, and I became a victim.

States with highest rate of consumers who fall victim:

- Massachusetts: 14%

- Florida: 10%

- New York: 10%

- Michigan: 8%

- South Carolina: 8%

Q: When did they [real estate professional] first tell you about wire fraud?

A: In our first meeting or consultation.

Top five states that most often educate from the start:

- Alabama: 70%

- Tennessee: 68%

- Oklahoma: 62%

- Mississippi: 57%

- Massachusetts: 55%

States that least often educate from the start:

- Iowa: 8%

- Nebraska: 25%

- Arizona: 31%

- Utah: 32%

- Minnesota: 35%

Consumer Education, Prevention, & Age Factors

While there is a lot more for consumers to learn and protect themselves from fraud, experience counts. Consumers who are making their first real estate purchase are particularly vulnerable. Compared to seasoned buyers and sellers, these “first-timers” are three times more likely to become victims of wire fraud during the closing process. Educating first-time buyers and sellers about the hazards should be a special priority for real estate agents.

Experience also influences who a consumer seeks out for recovery assistance after being defrauded. This variation in experience emphasizes the absence of a uniform procedure for victims to obtain compensation.

Age is a significant factor as well. Older Americans have a notable lack of cyber awareness. Older consumers are less aware of the risks when they enter the real estate market. Just 8–9% of buyers under the age of 44 had no prior knowledge of wire fraud before they started their real estate transaction. Among Americans 55 and older, it is double that, at 18% or higher. Compared to other age groups, older consumers have a considerably higher expectation that their title company or lawyer will safeguard them.

In conclusion, Americans will eventually demand change. The necessity for change becomes more evident the more consumers are hurt and affected by wire fraud. Regarding what consumers want from their business providers, the message is unambiguous. While further education is encouraged to protect oneself, many buyers and sellers still hold their banks, title companies, lawyers, and real estate brokers equally accountable for their safety.

To read the full report, including more data, charts, and methodology, click here.