Auction.com has released its 2025 Distressed Market Outlook, which forecasts foreclosure auction volume decreasing 8% in 2025 as a baseline scenario. The forecast also incorporates two other less likely scenarios with differing macroeconomic and housing market assumptions. Those two scenarios have foreclosure auction volume increasing in 2025.

“The Auction.com marketplace provides rich, real-time data on supply, demand and pricing for distressed properties sold at auction nationwide,” said Jason Allnutt, CEO at Auction.com. “This data provides forward-looking insight into retail housing market trends.”

Auction.com’s 2025 Distressed Market Outlook shows foreclosure auction volume dropping to a three-year low in 2024, based on both proprietary Auction.com data and market-wide public record data.

Demand at distressed property auctions–for both foreclosure auctions and bank-owned (REO) auctions–has drifted lower to end 2024 as market headwinds such as rising retail inventory and higher-for-longer mortgage rates intensified for the local community developers buying at auction.

The prices that auction buyers were willing to pay relative to after-repair value also declined to end the year, although there were signs of price demand turning a corner higher in November and December.

Price supplied by sellers at foreclosure auction remained flat in Q4, further widening the bid-ask spread between what buyers were willing to pay and the reserve amount sellers were willing to take to sell these properties. The late-Q4 jump in price demand did narrow the bid-ask spread in December, providing an early sign that the local community developers buying at auction are becoming more confident in the retail housing market for 2025.

Foreclosure Auction Supply

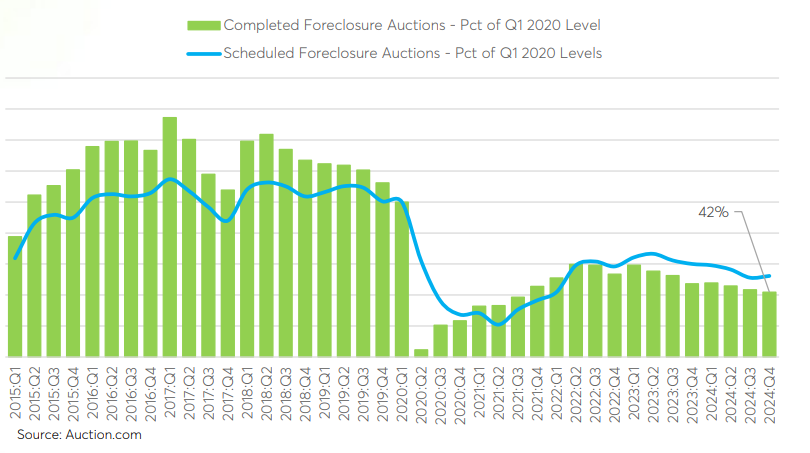

Completed foreclosure auction volume in Q4 of 2024 decreased 3% from Q3 of 2024, and was down 11% from a year ago to the lowest level since Q3 of 2021. Completed foreclosure auctions include properties sold to third-party buyers at auction and properties reverting to the foreclosing lender as real estate owned (REO).

According to proprietary data from Auction.com, which accounts for close to half of all completed foreclosure auctions nationwide, completed foreclosure auction volume in Q4 2024 was at 42% of the Q1 2020 level. While scheduled foreclosure auction volume in Q4 2024 was at 52% of the Q1 2020 level, indicating a possible uptick in completed foreclosure auction volume in Q1 of 2025.

REO Auction Supply

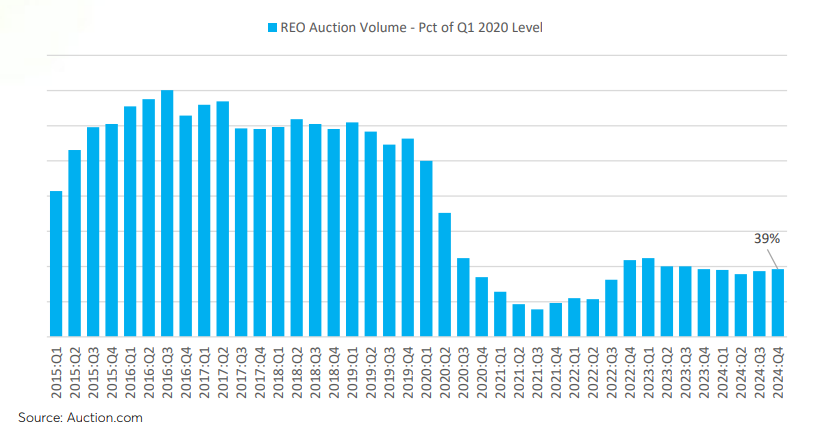

Auction.com found that bank-owned (REO) auction volume in Q4 of 2024 increased 3% from Q3 of 2024, and was virtually unchanged from a year ago. REO auction volume in Q4 2024 was at 39% of the Q1 2020 level, up slightly from 37% in the previous quarter, and unchanged from 39% in Q4 of 2023. REO auction volume bottomed out at just 16% of the Q1 2020 level in Q3 2021–in the midst of a nationwide foreclosure moratorium on government-backed mortgages.

REO auction volume increased steadily following the lifting of the moratorium in 2022, peaking at 44% of Q1 2020 levels before plateauing at around 40% in 2023 and 2024.

Distressed Market Waterfall

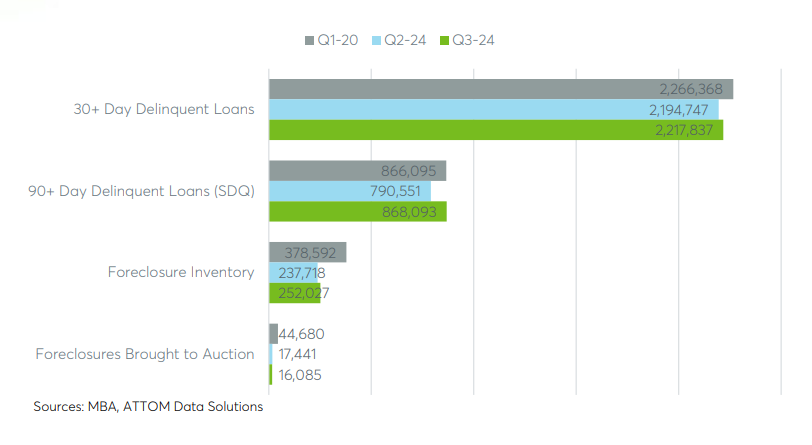

Distressed loan volume up-funnel from completed foreclosure auctions did show a shift in Q3 of 2024, with the estimated inventory of seriously delinquent (SDQ) mortgages increasing 10% from the previous quarter, and exceeding Q1 2020 levels for the first time since Q2 2023 (according to an analysis of data from the Mortgage Bankers Association).

The number of overall delinquent mortgages also increased in Q3 2024, up 1% from the previous quarter, although still 2% below the Q1 2020 level. But the upward shifts in delinquencies are not yet translating into substantive increases in foreclosure inventory or the volume of properties brought to foreclosure auction.

Foreclosure inventory in Q3 2024 was still 34% below the Q1 2020 level, and completed foreclosure auction volume nationwide was 64% below the Q1 2020 level.

“While the number of distressed homeowners has returned to pre-pandemic levels, many are avoiding foreclosure thanks to ample home equity that allows them to sell through a pre-foreclosure sale,” said Ali Haralson, Auction.com President. “These homeowners can now leverage the power of Auction.com’s transparent marketplace to sell, furthering our mission of protecting homeowner equity.”

2025 Foreclosure Outlook

“Some emerging risks in the economy and housing market are pushing delinquencies higher, but those higher delinquencies will not likely translate into higher foreclosure auction volume until at least early 2026,” added Daren Blomquist, Auction.com VP of Market Economics.

A regression-based model using home price appreciation and unemployment rates (imputed from seriously delinquent mortgage rates) as the primary inputs forecasts 2025 U.S. foreclosure auction volume decreasing 8% from 2024 to about 69,000, as a baseline scenario. That baseline scenario assumes home price appreciation continuing at its current pace of about 4% and the unemployment rate averaging 3.8% for the year, slightly below the average of 4.0% so far in 2024.

With the same home price appreciation of 4%, but a slightly higher unemployment rate of 3.9%, the model forecasts 2025 foreclosure auction volume increasing 10% to about 85,000 in 2025. With home price appreciation cut in half to 2% and an unemployment rate of 4%, the model forecasts overall foreclosure auction volume increasing 32% to approximately 99,000 for 2025.

Click here for more on Auction.com’s 2025 Distressed Market Outlook.