Despite consumers’ growing concerns about affordability, overall housing sentiment is slightly higher. This is according to a recent Fannie Mae report.

Following a modest decline last month for the first time since July, the Fannie Mae (FNMA/OTCQB) Home Purchase Sentiment Index (HPSI) rose 0.3 points in January to 73.4. The increase was driven by improvements in consumer optimism over the state of the house-buying and home-selling markets, as well as even higher predictions that home values will climb over the next 12 months.

However, the net share of consumers who think mortgage rates would drop in the upcoming year fell by 13 percentage points in January, following a spike in mortgage rate optimism in the second part of last year. Additionally, compared to last month, the number of customers who anticipate an increase in rental prices rose by 8 percentage points to 65%. Year-over-year, the HPSI is up 2.7 points.

Home Purchase Sentiment Index—Component Highlights

Fannie Mae’s Home Purchase Sentiment Index (HPSI) increased 0.3 points in January to 73.4. The HPSI is up 2.7 points compared to the same time last year. Read the full research report for additional information.

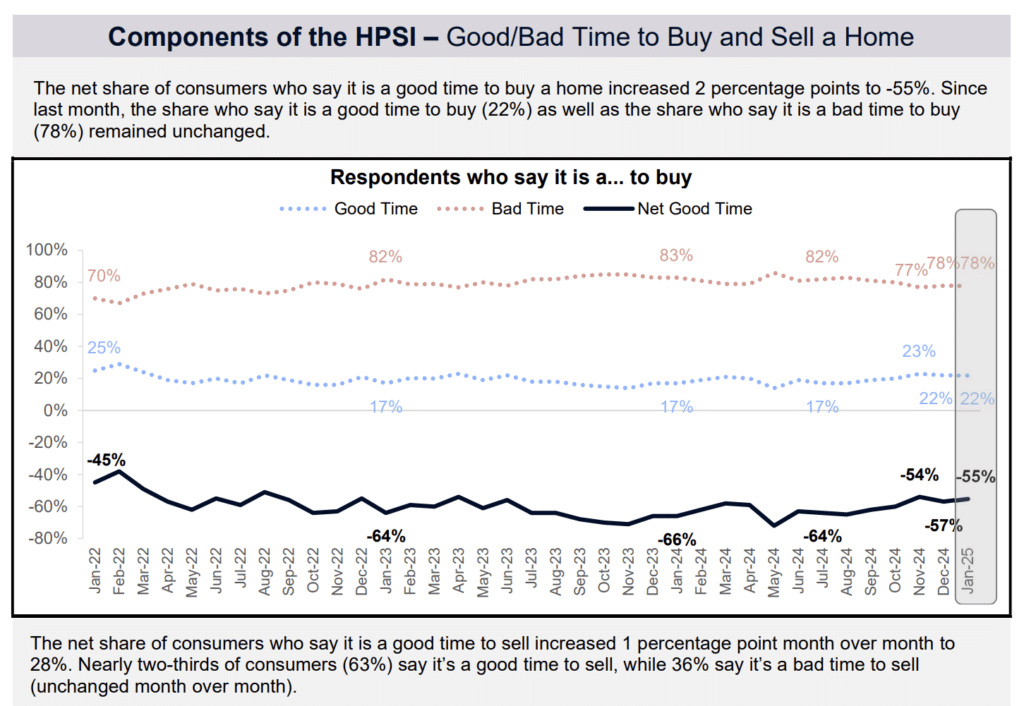

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home (22%) and the percentage who say it is a bad time to buy (78%) both stayed the same from last month. The net share of those who say it is a good time to buy increased 2 percentage points month over month to -55%.

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home (63%) and the percentage who say it’s a bad time to sell (36%) both remained unchanged month over month. The net share of those who say it is a good time to sell increased 1 percentage point month over month to 28%.

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months increased from 38% to 43%, while the percentage who say home prices will go down decreased from 27% to 22%. The share who think home prices will stay the same decreased from 35% to 34%. As a result, the net share of those who say home prices will go up in the next 12 months increased 9 percentage points month over month to 20%.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 42% to 35%, while the percentage who expect mortgage rates to go up increased from 25% to 32%. The share who think mortgage rates will stay the same increased from 32% to 33%. As a result, the net share of those who say mortgage rates will go down over the next 12 months decreased 13 percentage points month over month to 3%.

- Job Loss Concern: The percentage of employed respondents who say they are not concerned about losing their job in the next 12 months increased from 77% to 78%, while the percentage who say they are concerned stayed at 22%. As a result, the net share of those who say they are not concerned about losing their job increased 2 percentage points month over month to 56%.

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago remained at 17%, while the percentage who say their household income is significantly lower decreased from 11% to 9%. The percentage who say their household income is about the same increased from 70% to 73%, a new survey high. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago increased 2 percentage points month over month to 8%.

“Consumers seem increasingly pessimistic that housing affordability conditions will improve across the board, as a growing share expects home prices, rent prices, and mortgage rates will all go up,” said Kim Betancourt, VP of Multifamily Economics and Strategic Research. “The lower optimism toward the mortgage rate outlook was largely expected, as rates have continued to stay elevated and even crossed the 7% threshold in mid-January. As noted in our latest forecast, we currently expect mortgage rates to end 2025 around 6.5%, relatively little changed from where we are today, which will likely continue to hinder relief for housing affordability and home sales activity.”

In addition, Betancourt stated: “Over the last two months, customers have shown a markedly increased expectation that rent prices will rise. This is consistent with our forecast that multifamily rents will increase by 2.0% to 2.5% this year, up from an expected 1.0% the previous year. In almost every U.S. metro area, renting is still more affordable than buying, but we anticipate that cost concerns will continue to be a significant obstacle for both homeowners and renters for some time to come.

To read the full report, click here.