As the nation’s population grows more diverse, understanding the racial and ethnic composition of households is becoming increasingly important for analyzing housing trends. A new study, Recognizing Racial Diversity Within Households: Implications for Housing Research, examines 13.5 million multi-race households in the U.S., representing 10.4% of all households, using data from the 2022 American Community Survey.

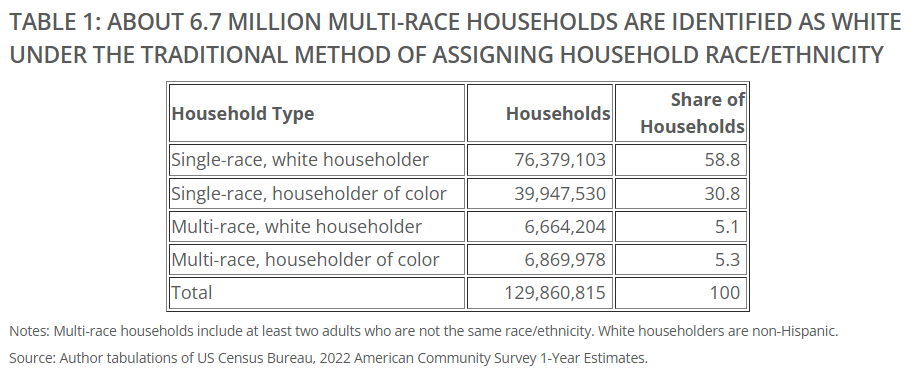

Traditional methods of categorizing households by the race or ethnicity of the householder often fail to capture the full diversity within multi-race households, which include at least two adults of different racial or ethnic backgrounds. Notably, 6.7 million multi-race households are categorized as white households under traditional methods, despite including a person of color.

Diversity in Multi-Race Households

Multi-race households display substantial diversity, with members representing 100 unique racial and ethnic combinations. Three combinations dominate: Hispanic-white, multiracial person-white, and Asian-white households. White individuals account for the largest share of people in multi-race households but are the least likely racial group to live in such households (8%). By contrast, 55% of multiracial individuals and about one-third of Native Hawaiian/Pacific Islander and American Indian/Alaska Native individuals reside in multi-race households.

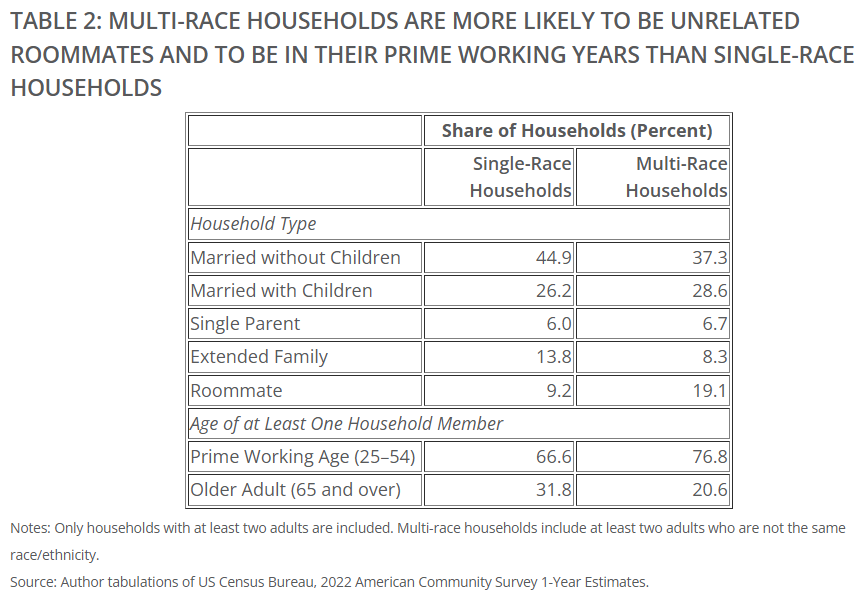

Multi-race households tend to be younger, with 77% including at least one member aged 25 to 54, compared to 67% of single-race households. Additionally, multi-race households are more likely to include unrelated roommates (19%) than single-race households (9%).

Housing Outcomes and Barriers

Multi-race households often experience different housing outcomes compared to single-race households. Households with a white adult generally exhibit higher homeownership rates and lower cost burdens, reflecting systemic advantages in education, employment, and housing. In contrast, multi-race households with both Black and Hispanic adults have the lowest homeownership rates and some of the highest cost burdens, paralleling the challenges faced by single-race Black and Hispanic households.

Median incomes for multi-race households are 12% higher than those of single-race households, likely due to a greater number of earners in their prime working years. However, cost burdens and affordability challenges persist for households with members of historically disadvantaged racial groups.

Implications for Housing Research

By incorporating the race and ethnicity of all adult household members, researchers can better understand disparities in housing access and outcomes. This expanded view reveals systemic inequities and underscores the importance of addressing housing discrimination and affordability barriers faced by diverse households.

With multi-race households comprising a growing share of the population, these findings provide critical insights for shaping equitable housing policies and improving access to homeownership for all racial and ethnic groups.

Click here for more on the Harvard Joint Center for Housing Studies’ findings.