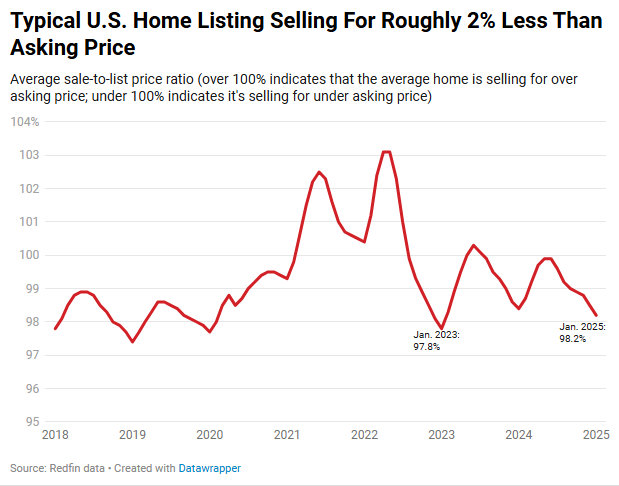

According to a recent Redfin research, the average property listing today is taking a long time to sell and selling for less than its asking price. It’s wonderful news for purchasers who have been struggling with high housing costs and a lack of availability, but it’s not ideal for sellers.

According to January Redfin data, buyers nationally might have greater negotiating leverage than they have in a number of years:

- The typical U.S. home is selling for 1.8% less than its asking price, the biggest discount in nearly two years.

- The typical home that sells is taking 56 days to go under contract, the longest span in nearly five years.

- More than half (56%) of listings are sitting on the market for at least 60 days without going under contract, roughly the same share during this time of year in 2023 and 2024. That’s down from the prior month, when 61% of listings were on the market for at least 60 days–the highest share in five years.

Today’s housing market is slow mostly because it’s so expensive to buy a home. The average 30-year mortgage rate was 6.96% in January. That’s down from the two-decade high of 7.62% hit in 2023, but remains well above the 3% to 5% rates that were common before and during the pandemic. The median U.S. home-sale price is up 4% year-over-year; together, high prices and rates have pushed the typical homebuyer’s monthly payment near record highs. Political and economic uncertainty is another reason some would-be buyers are pumping the brakes.

The upside of a slow market is that buyers have an opportunity to negotiate on price and terms for certain homes. Redfin agents in some parts of the country report that it feels like a buyer’s market, with sellers of homes that have been sitting on the market for a few weeks open to lowering the price.

Other Redfin agents note that while the pool of unsold inventory is growing and many homes are selling for under asking price, that doesn’t necessarily mean buyers have a big pool of desirable homes to choose from.

“More listings are hitting the market, but they’re not always the type of home buyers want and need,” said Charles Wheeler, a Redfin Premier agent in San Diego. “The listings lingering on the market tend to be in unpopular neighborhoods, or require renovation. Relatively affordable, move-in ready homes close to highly rated schools are selling quickly, often with multiple offers.”

MIA Market is on the Map — But Are Homes Selling?

There are five U.S. metros where 60%-plus of listings are sitting on the market for at least two months without going under contract. Three of them are in Florida. In both Miami and Pittsburgh, 63% of listings linger on the market for at least 60 days, followed by San Antonio (62%), Fort Lauderdale (61%) and West Palm Beach (60%).

On the other end of the spectrum is the Bay Area. Just over one-third of home listings in San Jose (34%), Oakland (36%) and San Francisco (38%) are sitting on the market for 60 days or more, followed by Boston (39%) and San Diego (42%).

To read the full report, including more data, charts, and methodology, click here.