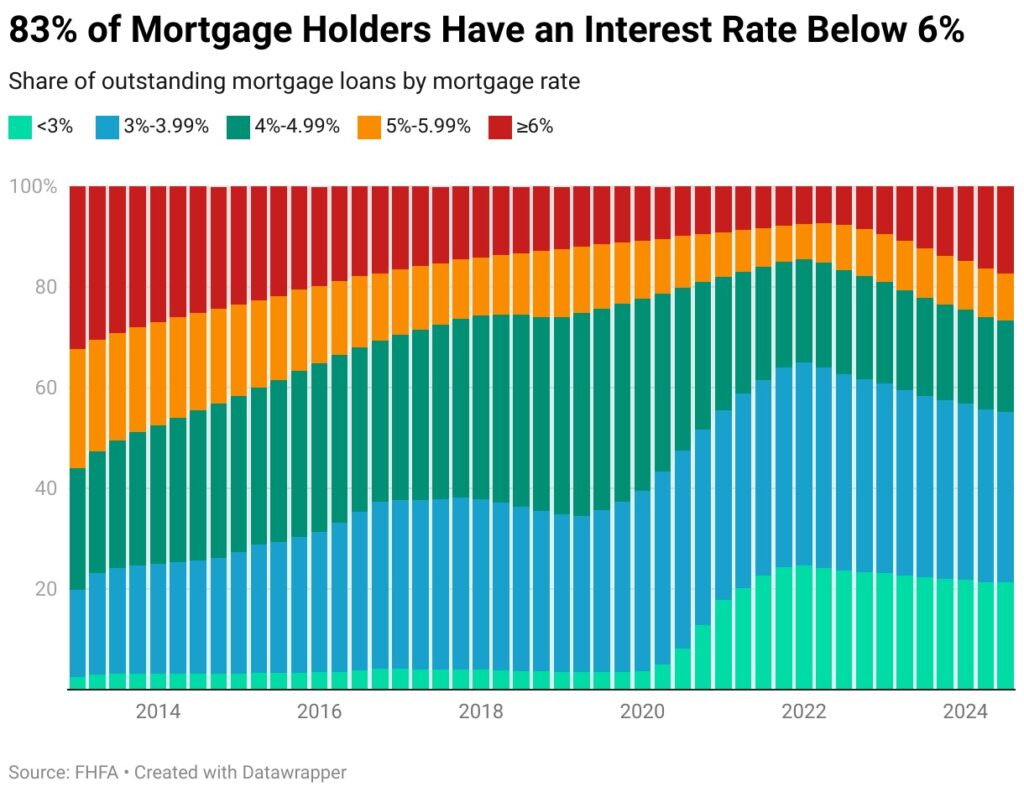

According to a recent Redfin analysis, some 17.2% of U.S. homeowners with mortgages nationwide have an interest rate higher than or equal to 6%, the highest percentage since 2016. Compared to 12.3% in Q3 of 2023, that is an increase of almost five percentage points. The percentage of homeowners with a rate of at least 6% would almost quadruple in the following three years if this growth rate persisted, which is possible.

In contrast, the interest rate for 82.8% of homeowners who hold mortgages is less than 6%. The “lock-in effect” refers to the fact that many people choose to remain in their present residence rather than selling and purchasing a new one at a higher rate because even more have rates lower than the current weekly average of 6.95% as of January 30.

However, this lock-in impact has been lessening; for instance, 87.7% of homeowners with mortgages had a rate below 6% in Q3 of 2023. Additionally, the share reached a record 92.7% in the middle of 2022.

U.S. “Lock-in Effect” Moderates as Buyers Adjust to Elevated Rates

The lock-in effect has discouraged homeowners from listing their homes for sale, which has contributed to America’s acute housing scarcity. The pandemic-era record low of 2.65% for mortgage rates has already been more than doubled. However, the lock-in effect is lessening because it is unrealistic for most individuals to remain in one place for all time. The housing shortage is gradually getting better as a result; both new and active listings are up from a year ago. However, it’s important to note that a large number of homes are lying on the market, which results in an accumulation of stale listings, which is one reason why supply is increasing.

“The rate-lock effect is letting up a bit here in Seattle,” said local Redfin Premier real estate agent David Palmer. “Homeowners hate to give up their 2-3% mortgage rate, but life happens and people have to move.”

Many people are moving because they have no other option after a significant life event, such as a divorce or job shift, according to Redfin agents. The lock-in impact is lessening for a few other reasons. First, a lot of Americans are coming to terms with the fact that rates are not likely to drop to pandemic levels in the near future. Second, many homeowners have enough equity to support selling and taking on a higher rate due to the pandemic’s spike in home values, particularly if they’re downsizing or relocating to a more affordable area. Lastly, a growing percentage of Americans do not have a mortgage, meaning they are not subject to any interest rate.

The percentage of homeowners with mortgage rates below 6% has decreased since everyone who purchased a property in the past two years done so when the average weekly rate was higher than 6%.

The current homeowners’ positions on the mortgage-rate spectrum are broken out as follows:

- Below 6%: 82.8% of mortgaged U.S. homeowners have a rate below 6%, down from a record 92.7% in Q2 2022 and the lowest share since the Q4 2016.

- Below 5%: 73.3% have a rate below 5%, down from a record 85.6% in Q1 2022 and the lowest share since Q3 2017.

- Below 4%: 55.2% have a rate below 4%, down from a record 65.1% in Q1 2022 and the lowest share since Q4 2020.

- Below 3%: 21.3% have a rate below 3%, down from a record 24.6% in Q1 2022 and the lowest share since Q2 2021.

- Greater than or equal to 6%: 17.2% of mortgaged homeowners have a rate greater than or equal to 6%, the highest share since Q4 2016.

- 5%-5.99%: 9.5% have a rate of 5%-5.99%, the lowest share since Q4 2022.

- 4%-4.99%: 18.1% have a rate of 4%-4.99%, the lowest share in records dating back to 2013.

- 3%-3.99%: 33.9% have a rate of 3%-3.99%, the lowest share since Q4 2019.

- Below 3%: 21.3% have a rate below 3%, the lowest share since Q2 2021.

Additionally, in January, the Fed announced it does not anticipate changing its intentions on tariffs, immigration, fiscal policy, or regulatory policy until there are more tangible developments to respond to. Chair Powell responded that tariffs and fiscal policy, not monetary policy, were to blame for the one percentage point increase in mortgage rates at the same time that the Fed cut by one percentage point.

Since there was no new information from this meeting, mortgage rates will mostly stay the same today. However, volatility may be introduced by new jobs data in February.

To read the full report, including more data, charts, and methodology, click here.