According to a new IPX 1031 survey, an estimated 67% of Americans are worried about the real estate market in 2025. Homebuyers have numerous obstacles they face in the U.S. housing market, such as the need to carefully negotiate high borrowing rates and agent commissions.

IPX 1031 conducted a poll of thousands of Americans to find out how they intend to handle these hurdles—diving into their homeownership goals, budgets, and fears for 2025.

Housing Affordability Woes: Some 49% Think Purchasing a Home in 2025 is “Impractical”

Despite the fact that many Americans hope to own a home by 2025, 49% believe that this goal is unattainable. Actually, one in three Americans no longer believe that owning a home is the American Dream.

In 2025, over half (47%) will not be able to afford to purchase a home. 18% of Gen Zers, 51% of millennials, 24% of Gen Zers, and 7% of baby boomers are unable to purchase.

Millions of Americans aspire to own a home, but 12% think it’s a poor investment, and 65% are worried about the real estate market in 2025. Since taxes, interest rates, and prices are increasing more quickly than personal income, their worries are mostly related to affordability.

The three main issues are as follows:

- Rising home prices (34%)

- Interest rates (22%)

- Tax rates (7%)

Homeowners deal with a unique mix of real estate issues, and many of them feel ensnared by interest rates. Some 35% of homeowners, according to the survey, wish to sell in 2025 but do not want to lose their existing rate. Additionally, because of mortgage rates, 34% of people now view their current residence as their “forever home.”

Americans Still Shopping Despite Economic Uncertainty

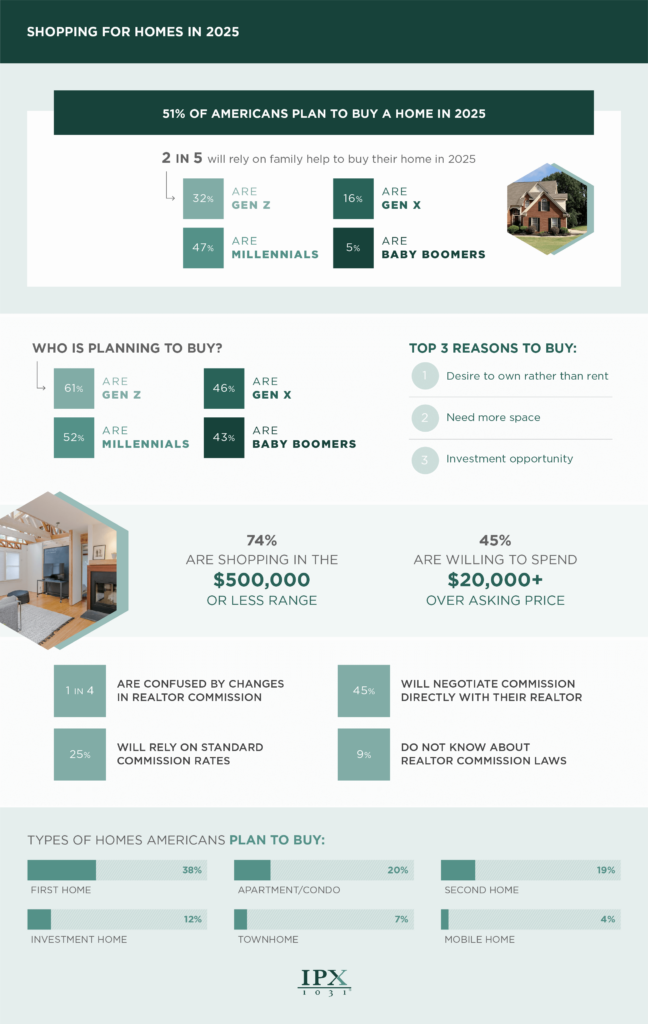

Sixty-one percent of Gen Z, 52% of millennials, 46% of Gen X, and 43% of baby boomers intend to own a home in 2025. Some 38% of respondents intend to purchase their first home, while 19% and 12%, respectively, wish to purchase second homes or investment properties.

Two out of five people who intend to purchase will receive assistance from their families. Millennials make up 47% of them, with Gen Z coming in second (32%).

The following are the top three reasons individuals purchase homes:

- The desire to own rather than rent

- Need for more space

- Investment opportunity

Many purchasers anticipate having to pay out of pocket, even though 74% of them are shopping in the price range under $500,000. Nearly half (45%) are prepared to pay more than $20,000.

Home sellers are no longer liable for paying the realtor costs for both the buyer and the seller as a result of a federal case. Homebuyers might now negotiate the normal 5-7% charge with their agent starting in August 2024. One in four homebuyers, according to our survey, are perplexed by these shifts. 25% will rely on conventional rates, while 45% will directly negotiate commission with their realtor. Nine percent, or almost one in 10, were completely unaware of the commission laws.

The majority of respondents select suburban (49%), urban (28%), and rural (23%), respectively, as their ideal house location. However, two out of three would forgo their preferred location for the right house, so it’s not a deal breaker for everyone. In a similar vein, 38% would forgo novelty in favor of the ideal house.

One in four Americans today experience social pressure to purchase a home. Some respondents liked the convenience of renting, but nine out of ten said they would rather own. Their justifications include the availability of more contemporary solutions, ease of upkeep, and less permanence (possibility of easy mobility).

To read the full report, including more charts, data, and methodology, click here.