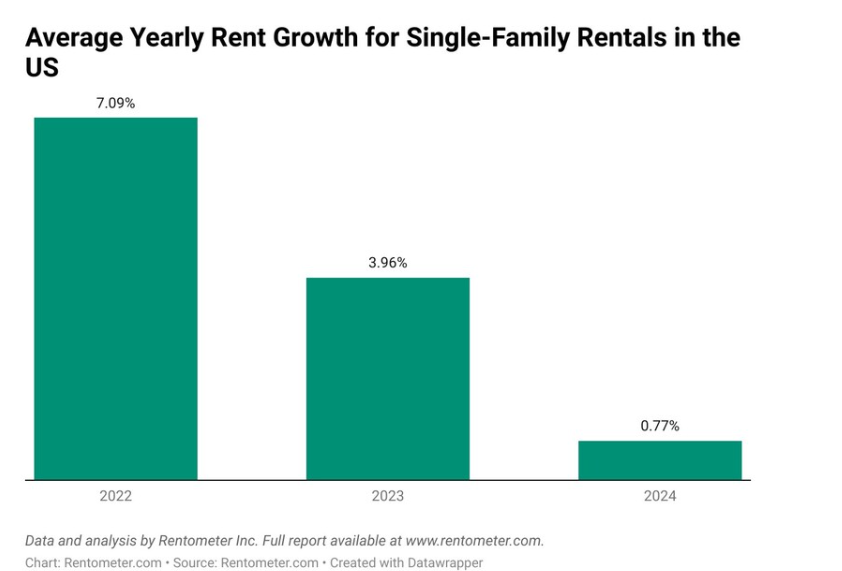

The single-family rental (SFR) market, which has outperformed the apartment rental sector in recent years, is showing clear signs of slowing. According to Rentometer’s 2024 National Single-Family Rentals Report, the average rent for a three-bedroom single-family home in the U.S. rose to $2,357—but annual growth slowed to just 0.8%, marking the smallest increase in years.

The report, which analyzed rental prices in 857 cities, highlights rising vacancies, shifting regional trends, and the impact of build-to-rent developments as key factors influencing rent prices. While some markets continue to see increases, others—particularly in the Sun Belt—are experiencing price declines as supply catches up with demand.

Regional Trends: Where Rents Are Rising and Falling

Single-family rent prices varied widely across U.S. regions in 2024, underscoring disparities in market conditions.

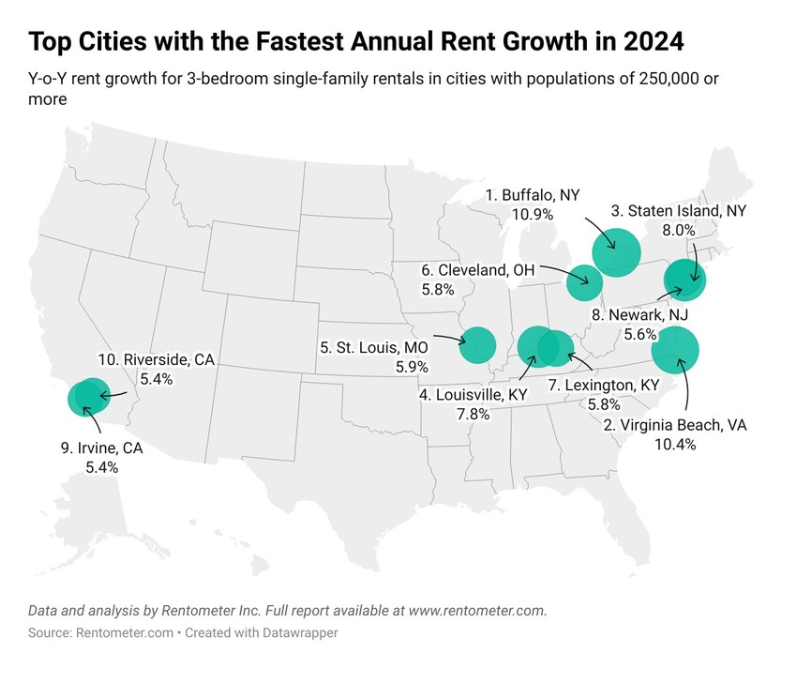

- Midwest rents grew the fastest, increasing 5.26% year-over-year, followed by the Northeast (+4.84%).

- Pacific (+2.12%) and Rocky Mountain (+1.75%) markets saw moderate increases, reflecting stabilization in higher-cost areas.

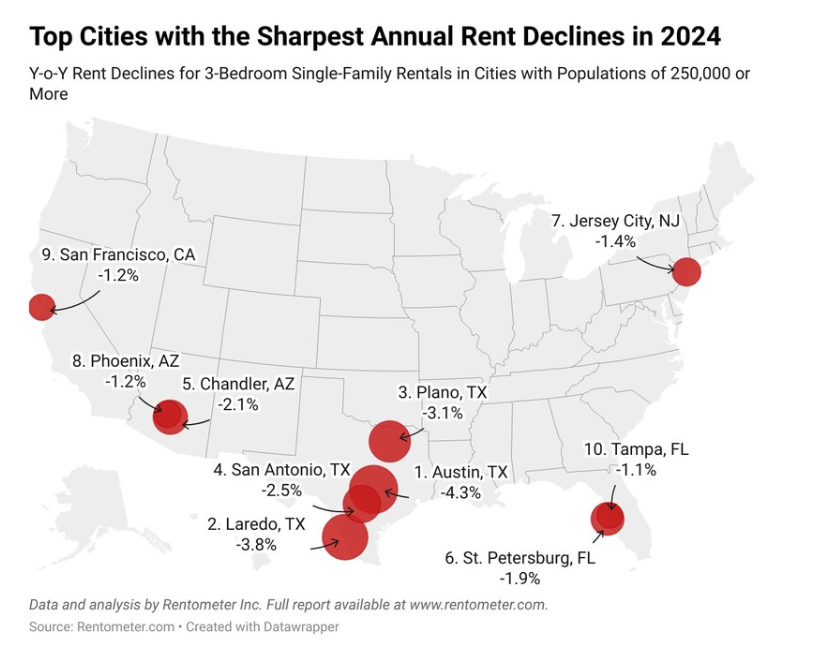

- The Southeast (+0.62%) experienced minimal growth, while the Southwest (-0.09%) recorded a slight decline—signaling cooling demand in previously high-growth states like Texas and Arizona.

- The Sun Belt, which has seen a surge in build-to-rent developments, accounted for many of the cities experiencing rent declines. Austin, Texas; Phoenix, Arizona; Tampa, Florida; St. Petersburg, Florida; and San Antonio, Texas all saw year-over-year rent drops in 2024.

Although lower rents may provide relief for tenants, some experts caution that this trend could be temporary. With fewer new build-to-rent homes expected in the coming years, rent prices may start climbing again.

Coastal Cities Remain the Most Expensive Rental Markets

Despite some price corrections, California cities continue to dominate the list of the nation’s most expensive single-family rental markets.

- San Francisco remains the priciest large city, with average rents of $5,265 for a three-bedroom home.

- Los Angeles ($5,082) and Irvine ($5,079) closely follow, while San Diego ($4,618) also ranks among the top high-cost markets.

- Outside of California, Boston ($4,161) and Miami ($3,996) were among the top 10 most expensive cities for SFRs.

Meanwhile, Washington, D.C. ($3,779) and Seattle, Washington ($3,692) ranked just outside the top 10, continuing to command high rental prices.

Where Renters Find the Most Affordable Homes

In contrast to high-cost coastal cities, the Midwest and South offer some of the most affordable single-family rental options in the U.S.

- Toledo, Ohio leads as the cheapest large city for single-family rentals, with an average rent of $1,217.

- Other affordable cities include Detroit, Michigan ($1,308), Wichita, Kansas ($1,342), and Fort Wayne, Indiana ($1,492).

While wages in high-cost areas like San Francisco are significantly higher, the gap in affordability remains stark. In Toledo, rent prices are nearly four times lower than in California’s most expensive markets, highlighting the growing divide in the U.S. rental landscape.

Luxury Rental Markets in Mid-Sized and Small Cities

Beyond large cities, affluent mid-sized and small markets are seeing record-high rents, particularly in education and tech-driven areas.

- Cambridge, Massachusetts ($5,687) tops the list of most expensive mid-sized cities, benefiting from strong demand fueled by proximity to Harvard and MIT.

- Newport Beach, California ($7,316) and Santa Monica, California ($7,139) lead small-city rental costs, reflecting continued demand for coastal properties.

- Miami Beach, Florida ($6,567) was the only non-California city to rank among the most expensive small rental markets.

These cities, driven by high-income professionals and limited housing supply, continue to command premium rents.

Looking Ahead: A Market in Transition

The single-family rental market is undergoing a shift, with rent growth slowing, vacancy rates rising, and regional trends diverging. While the Sun Belt experiences price corrections, demand remains strong in many Midwest and Northeast cities, fueling steady rent growth.

Looking forward, industry analysts predict that as new build-to-rent supply decreases, rent prices in some regions could rebound. However, with affordability concerns growing nationwide, renters and investors alike will be closely watching market trends in 2025.

Click here for more on Rentometer’s 2024 National Single-Family Rentals Report.