The overall number of loans now under forbearance fell by 7 basis points from 0.47% of servicers’ portfolio volume in the previous month to 0.40% as of January 31, 2025, according to the Mortgage Bankers Association‘s (MBA) monthly Loan Monitoring Survey. MBA estimates that 200,000 homeowners are enrolled in forbearance agreements.

In January 2025, the percentage of Freddie Mac and Fannie Mae loans in forbearance dropped by 2 basis points to 0.17%. The forbearance share for portfolio loans and private-label securities (PLS) was unchanged from the previous month at 0.40%, while Ginnie Mae loans in forbearance fell 19 basis points to 0.88%.

“While the number of forbearance requests grew in January, the number of forbearance exits outweighed that pick-up, reaching the highest level since June 2022,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “This outcome was somewhat surprising given the recent events in California, but it speaks to recovery in other parts of the country affected by natural disasters and the movement of aged government loans out of forbearance.”

Key Findings of MBA’s Loan Monitoring Survey – January 1 to January 31, 2025

- Total loans in forbearance decreased by 7 basis points in January 2025 relative to December 2024: from 0.47% to 0.40%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased relative to the prior month from 1.07% to 0.88%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior month from 0.19% to 0.17%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance stayed the same relative to the prior month at 0.40%.

- Loans in forbearance as a share of servicing portfolio volume (#) as of January 31, 2025:

- Total: 0.40% (previous month: 0.47%)

- Independent Mortgage Banks (IMBs): 0.43% (previous month: 0.54%)

- Depositories: 0.38% (previous month: 0.38%)

- By reason, 64.1% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability. Another 32.9% are in forbearance because of a natural disaster. The remaining 3.0% of borrowers are still in forbearance because of COVID-19.

- By stage, 65.1% of total loans in forbearance are in the initial forbearance plan stage, while 18.1% are in a forbearance extension. The remaining 16.8% are forbearance re-entries, including re-entries with extensions.

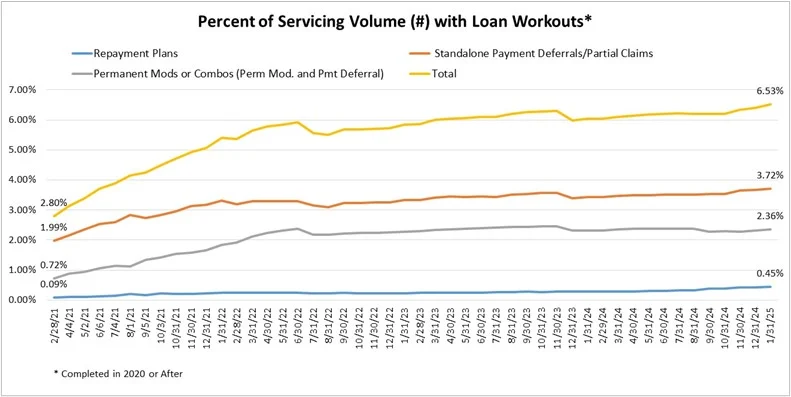

- The percentage of servicing volume with loan workouts (completed in 2020 or after) grew to 6.53% in January 2025 from 6.41% the previous month and 6.04% one year ago.

- Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) was 95.35% in January 2025, up 30 basis points from 95.05% the prior month (on a non-seasonally adjusted basis), and down 32 basis points from one year ago.

- The five states with the highest share of loans that were current as a percent of servicing portfolio: Idaho, Washington, Idaho, Oregon, Alaska, and Colorado.

- The five states with the lowest share of loans that were current as a percent of servicing portfolio: Louisiana, Mississippi, Indiana, West Virginia, and Alabama.

- Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts increased to 65.63% in January 2025, up 24 basis points from 65.39% the prior month, and down 925 basis points from one year ago.

Added Walsh, “As the number of borrowers in forbearance dropped this past month, the number of borrowers with permanent loan workouts grew. Today, approximately 6.5 percent of all borrowers – or 3.3 million homeowners – are in a loan workout completed in 2020 or after.”

To read the full report, click here.