Homes.com has issued a new report detailing the home buying and selling trends in the Washington-area housing market after a number of changes amongst the federal workforce, including roughly 75,000 accepting buyouts offered by the Trump administration, and an additional number of employees being laid off, which continues to be in flux.

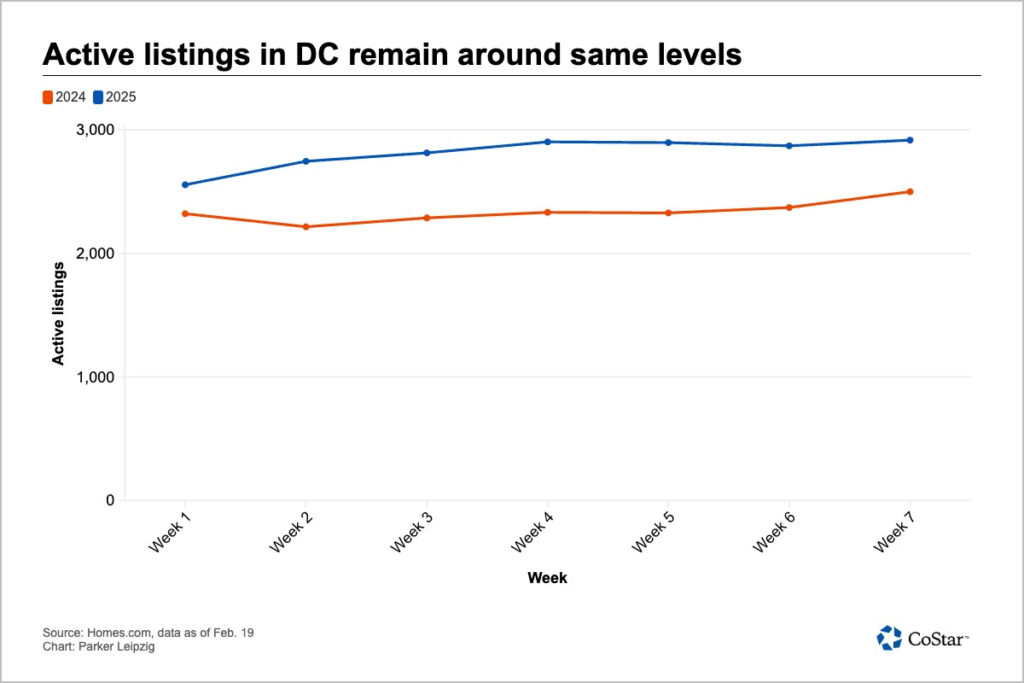

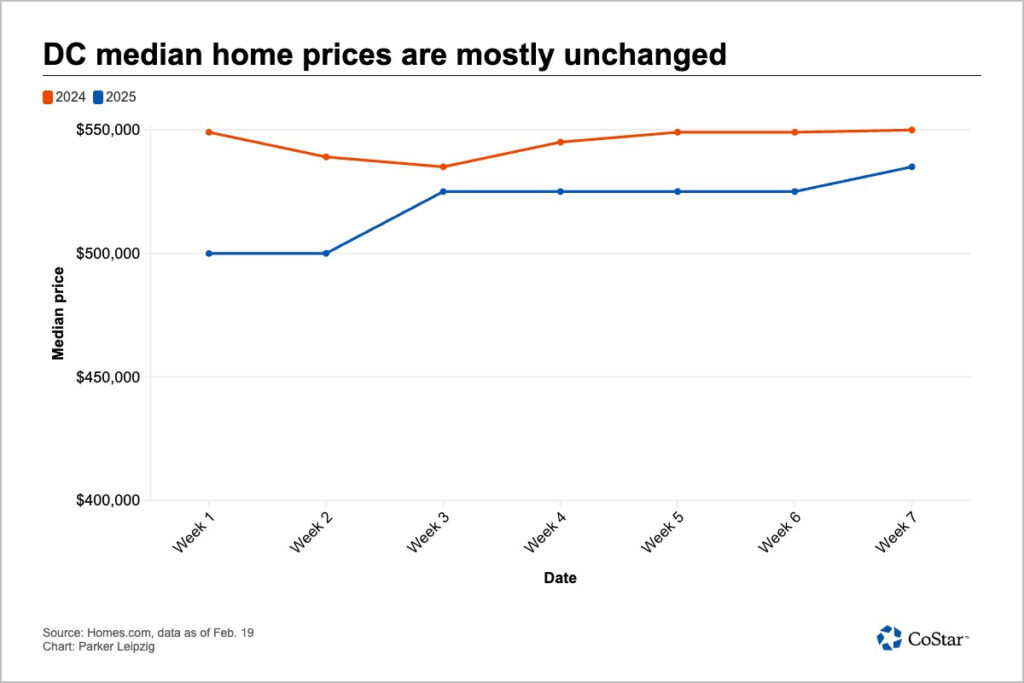

The analysis from Homes.com found that since the beginning of January, neither D.C. nor the surrounding suburbs in Maryland and Virginia have seen any drastic changes to the number of active listings, properties sold or median sales prices in the area. Moreover, when compared to the same time period a year earlier, the data shows no sharp changes. While there’s been a slight increase in the number of listings and asking prices, that trend started before the new administration took office.

On February 11, President Donald J. Trump signed an Executive Order implementing the President’s Department of Government Efficiency (DOGE) workforce optimization initiative designed to significantly reduce the size of government.

Despite the stagnant nature of the market at the current moment, insight from Homes.com noted any big changes in the size of the federal workforce is likely to drive countervailing trends, including sparking a desire for some to leave the area while others who once might have moved into the area are no longer interested. It’s difficult to know how supply and demand will take shape, especially with the peak moving season approaching in the spring, a time when more people tend to list their homes for sale.

One notable change taking hold in the Washington, D.C.; Maryland; and Virginia (DMV) housing market, though, is an increase in ultraluxury listings and ultraluxury buyers. Over the past month alone, there have been 13 houses in the city and its suburbs priced at $7 million or higher, according to Homes.com data, and this figure only accounts for houses that have been publicly listed on multiple listing services.

Local real estate insiders expect that trend will continue, with Daniel Heider, EVP and Agent at TTR Sotheby’s International Realty, saying, “I do anticipate this continuing just given, again, the shift in the way I think businesspeople are thinking about the policy that’s very quickly changing. These folks feel as though, economically, they’re going to do quite well.”

According to the White House, “there are too many federal employees” and excluding active-duty military and Postal Service employees, the federal workforce exceeds 2.4 million. No one knows exactly how many federal agencies exist, but the Federal Register lists over 400. In fiscal year 2022, the federal government spent nearly $300 billion on compensation for civilian employees, excluding pensions. According to a recent congressional report, only 6% of federal workers report to work in-person on a full-time basis.

According to USA Today, nearly 75,000 federal employees accepted President Donald Trump’s buyout offer in mid-February. That figure, confirmed by an Office of Personnel Management official, represents approximately 3.3% of the federal government’s 2.3 million workers.

Trump’s offer to federal employees promised eight months of pay and benefits to federal employees through September in exchange for their immediate resignation.