According to study data published by RentRedi, most American real estate investors intend to increase their portfolios and make large investments in renovating their existing properties in 2025, exhibiting a strong growth mindset.

The poll, which was performed from November 7–22, 2024, found that 59% of U.S. RentRedi landlords intend to purchase real estate in 2025. The likelihood of acquiring new properties is highest among landlords in the Midwest and South (69% each), followed by those in the Northeast (68%).

The only group in the Western U.S. that falls short of the national average is landlords in the Western U.S. (52%). When the data is broken down by landlord size, 73% of large landlords (20+ rental units) and 69% of medium landlords (5-19 rental units) and 63% of small landlords (1-4 rental units) are expected to purchase new real estate in 2025.

“Removing operational barriers and time constraints are where RentRedi can be most impactful in helping landlords reach their growth goals in 2025,” said RentRedi Co-Founder and CEO Ryan Barone. “Using our platform to streamline processes from listings and tenant screening to rent collection and maintenance coordination allows landlords to work efficiently and scale quickly by managing everything in one place on a phone, mobile device, or desktop computer from any location.”

With roughly 52% of investors intending to spend at least $5,000 or more per unit on home improvement projects, U.S. landlords are giving priority to property upgrades in addition to purchases. Some 27% of landlords nationwide intend to make renovations totaling at least $20k per property.

With an estimated 37% of large landlords allocating more than $20,000 per unit, compared to 20% of small landlords, large landlords are driving this trend. With 60% of budgeting more than $5,000 per property, the Northeast demonstrates the largest regional commitment to major renovations, while the South adopts the most frugal spending strategy, with 52% allocating less than $5,000 per home.

No category differs substantially from the 47% national average, indicating that landlords’ primary focus in 2025 will be on generating income, regardless of location or portfolio size. In addition, a sizable portion of landlords state that their main objectives for managing rental properties in 2025 are financial independence (19%) and long-term investment (33%). The belief that real estate is still a long-term wealth-building strategy for the majority of Americans is supported by the fact that short-term value gains seem to be the least important (1%).

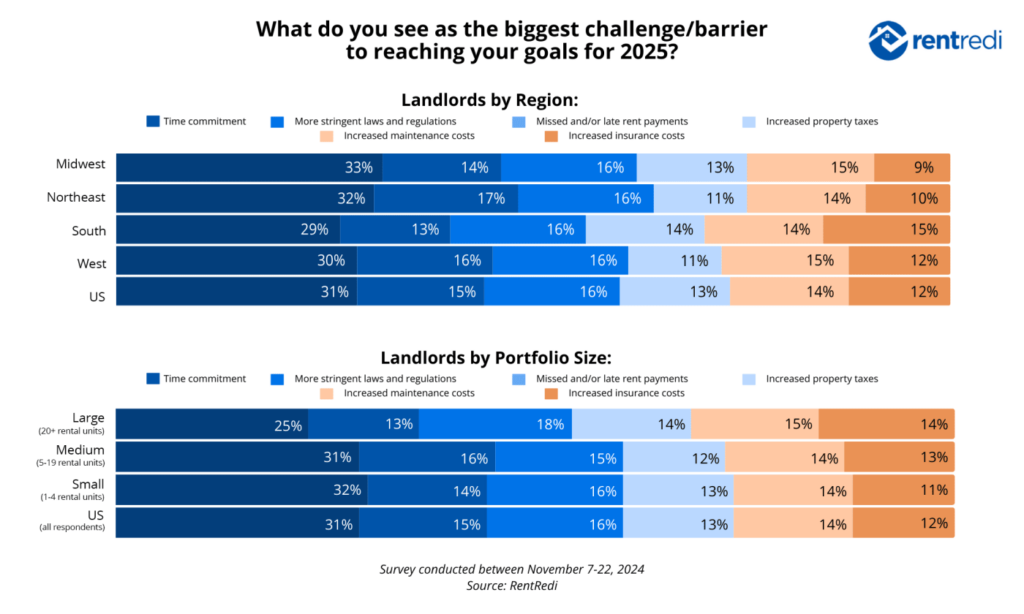

This year, revenue growth is the top priority for most landlords (43%) while time commitment is seen by 31% of landlords as the primary obstacle to achieving their objectives. Across all areas and portfolio sizes, landlords continue to face additional operational challenges, such as higher maintenance, property tax, and insurance expenses, as well as stricter laws and regulations.

In addition to taking advantage of same-day settlements and faster 2-day funding, landlords can add an infinite number of properties, units, tenants, and users to their account without having to pay more for their membership.

The RentRedi survey analyzes responses by region and landlord size, highlights notable trends in investment strategies, renovation spending, and business priorities.

To read the full report, including more data, charts, and methodology, click here.