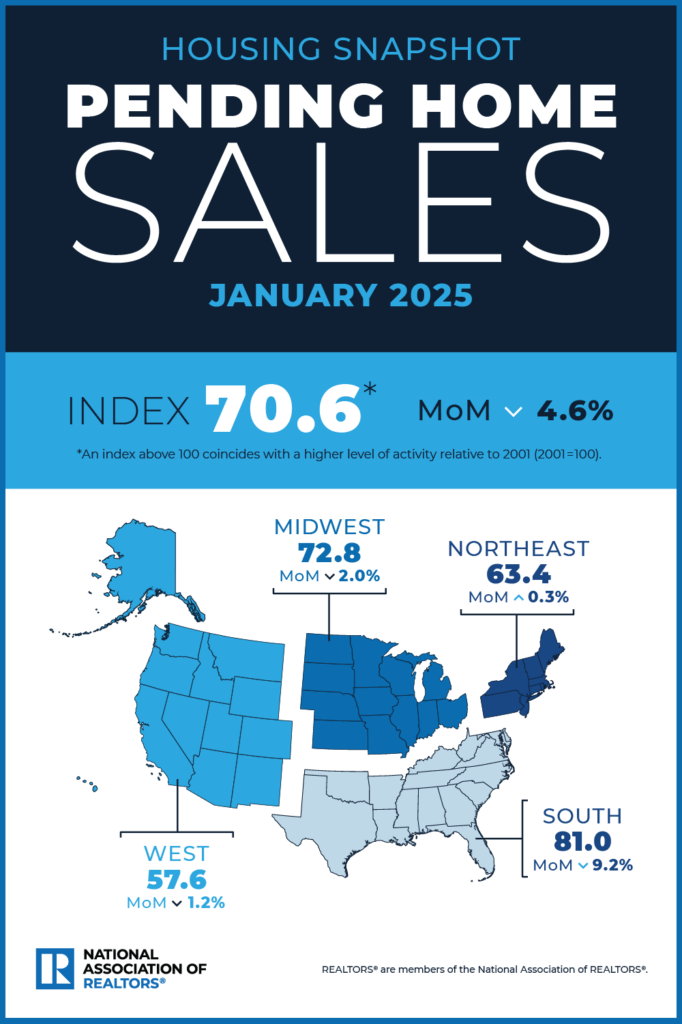

New data from the National Association of Realtors (NAR) has found that pending home sales pulled back 4.6% in January 2025, as the Midwest, South and West experienced month-over-month losses in transactions – with the most significant drop in the South. The Northeast saw a modest gain. Year-over-year, contract signings lowered in all four U.S. regions, with the South seeing the greatest falloff.

NAR’s Pending Home Sales Index (PHSI)–a forward-looking indicator of home sales based on contract signings–fell 4.6% to 70.6 in January, an all-time low. (Last year’s cyclical low point in July 2024 was revised from 70.2 to 71.2.) Year-over-year, pending transactions declined 5.2%. An index of 100 is equal to the level of contract activity in 2001.

According to NAR, pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

“It is unclear if the coldest January in 25 years contributed to fewer buyers in the market, and if so, expect greater sales activity in upcoming months,” said NAR Chief Economist Lawrence Yun. “However, it’s evident that elevated home prices and higher mortgage rates strained affordability.”

Housing affordability suffered in January as mortgage rates ranged from 6.91% to 7.04%. Compared to one year ago, the monthly mortgage payment on a $300,000 home increased by an extra $50 to $1,590.

“Pending home sales came in much lower than expected. As a forward-looking indicator based on contract signings, it looks like a slow start to the year, but a colder-than-normal January may have contributed to less buyer traffic,” said First American Deputy Chief Economist Odeta Kushi. “Heading into the spring season, we’re likely to see a modest, seasonal increase in home-buying demand. However, it will still be constrained by affordability issues and the persistence of the rate lock-in effect compared to pre-pandemic spring markets.”

A Regional Roundup

The Northeast PHSI rose 0.3% from last month to 63.4, down 0.5% from January 2024. The Midwest index contracted 2.0% to 72.8 in January, down 2.7% from the previous year. The South PHSI plunged 9.2% to 81.0 in January, down 8.8% from a year ago. The West index fell by 1.2% from the prior month to 57.6, down 4.5% from January 2024.

The Northeast PHSI rose 0.3% from last month to 63.4, down 0.5% from January 2024. The Midwest index contracted 2.0% to 72.8 in January, down 2.7% from the previous year. The South PHSI plunged 9.2% to 81.0 in January, down 8.8% from a year ago. The West index fell by 1.2% from the prior month to 57.6, down 4.5% from January 2024.

“Market activity continues to vary regionally, but all four regions saw a dip in contract signings annually, and all but the Northeast saw a monthly dip as well,” added Realtor.com Senior Economic Research Analyst Hannah Jones. “The South led the regions with a 9.2% monthly decline, followed by the Midwest (-2.0%), and the West (-1.2%), while the Northeast saw a 0.3% pick-up. On an annual basis, the South (-8.8%) saw the biggest dip, followed by the West (-4.5%), the Midwest (-2.7%) and the Northeast (-0.5%).”

Impacting the market in the West, specifically in California, were January’s wildfires that tore a path of destruction through the Los Angeles area. The Southern California Leadership Council and the LA County Economic Development Corporation have issued a report examining the destruction and economic loss caused by the fires and offers data-driven recommendations to guide recovery efforts. According to the study, the wildfires caused between $28 billion and $53.8 billion in property damages, with business disruptions projected to result in economic losses of up to $8.9 billion in Los Angeles County alone over the next five years (2025-2029). The report also estimates that the fires could lead to up to 49,110 job-years lost and reductions in labor income of up to $3.7 billion, while federal, state, and local governments could experience tax revenue losses ranging from $730 million to $1.4 billion.

Springing Ahead

Affordability constraints continue to hamper prospective buyers, but slight relief in mortgage rates may open the doors a bit to the spring home buyers market.

This week, Freddie Mac reports the 30-year fixed-rate mortgage (FRM) at 6.76%, falling to the lowest level in over two months.

Sam Khater, Freddie Mac’s Chief Economist, said, “The drop in mortgage rates, combined with modestly improving inventory, is an encouraging sign for consumers in the market to buy a home.”

Jones noted, “Housing affordability has not improved considerably in years as still-limited home supply keeps prices elevated and stubborn inflation applies upward pressure on interest rates. More for-sale inventory has the potential to generate more contract signings, but climbing home supply is not evenly distributed across the U.S. Moreover, many areas with high demand see relatively low for-sale inventory, which limits progress towards more home sales.”

According to the Federal Reserve Bank of St. Louis, the nation currently sits on a nine months’ supply of housing inventory, up from 8.3 months’ supply reported in January 2024.

“Even a slight reduction in mortgage rates will likely ignite buyer interest, given rising incomes, increased jobs and more inventory choices,” noted Yun.

Kushi added, “The affordability environment is challenging, but inventory is rising in parts of the country. In markets where homes are sitting on the market for longer, we may expect price cuts to make those homes more attractive to potential buyers.”

Click here for more on NAR’s report on the nation’s pending home sales.