Intercontinental Exchange has released its March 2025 ICE Mortgage Monitor Report, based on the company’s mortgage, real estate and public records datasets, analyzing the latest trends shaping the housing market in early 2025, with a special emphasis on rising insurance costs and the ways borrowers are adapting to protect what, for many, may be their most valuable asset.

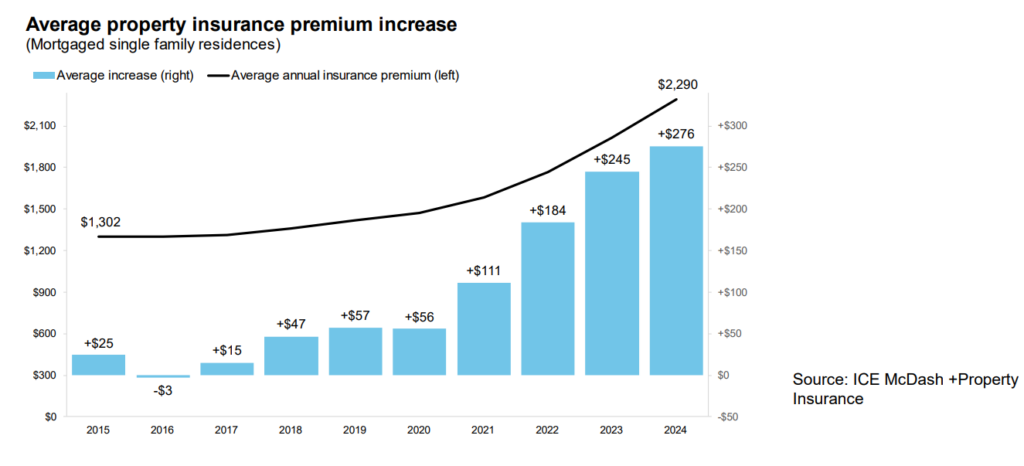

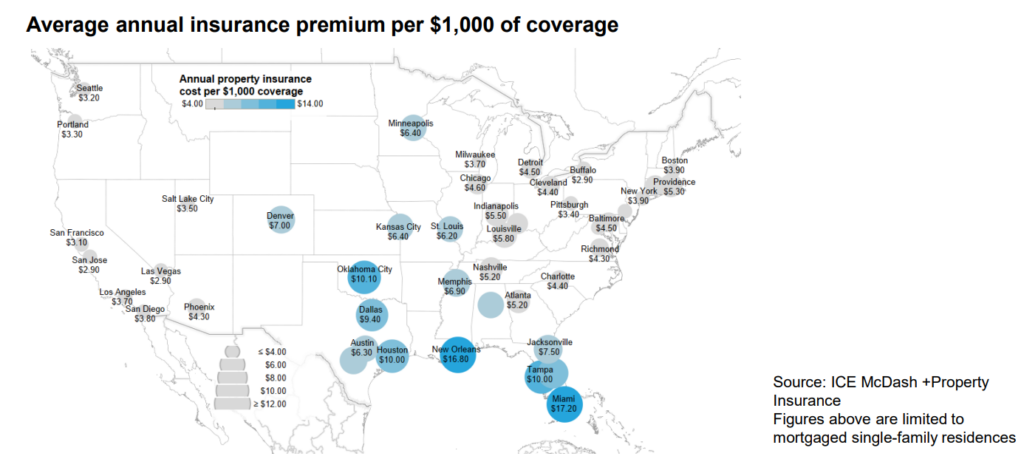

Property insurance costs for mortgaged single-family homes rose by a record $276 (+14%) to $2,290 in 2024 with average premiums now up 61% over the past five years. Seattle (+22%), Salt Lake City (+22%), and Los Angeles (+20%) saw the largest percentage increases in 2024, while the largest increases by dollar amount were in Dallas (+$606) and Houston ($515). Premiums in Florida increased by less than half the national average on a percentage basis, but rates there remain among the highest in the country.

“While it’s no surprise that insurance costs are rising, we’re beginning to see emerging trends in terms of how homeowners are responding to the higher cost environment,” said Andy Walden, Head of Mortgage and Housing Market Research for Intercontinental Exchange. “We’re seeing increases in both the share of borrowers switching policies and borrowers taking on higher deductibles as a way to combat rising premiums.”

Markets with the highest insurance costs, which have also been the focal point of non-renewal activity in recent years, unsurprisingly have the highest percentage of borrowers switching providers. Nearly a quarter of mortgage holders in Miami, for example, switched insurance providers in 2024, the highest share of any major market, followed by New Orleans and Orlando (both 23%).

“The average borrower switching policies in Miami paid slightly more, but in most markets with higher-than-average turnover, borrowers who switched are paying less than those that stayed put,” Walden said. “For example, in Jacksonville, Dallas, San Antonio and Denver, homeowners who switched paid at least 10% less, on average than borrowers who remained with their old carrier.”

Key Takeaways

- The average annual property insurance premium among mortgaged single-family homes rose by a record +$276 (+14%) to $2,290 in 2024, capping a five-year rise of +$872 (+61%)

- Seattle (+22%), Salt Lake City (+22%) and Los Angeles (+20%) saw the largest percentage increases in 2024, while the largest increases by dollar amount were in Dallas (+$606) and Houston ($515)

- Property insurance premiums in Florida increased by less than half the national average on a percentage basis, but rates there remain among the highest in the country

- A record 11.4% of borrowers switched carriers in 2024, up two percentage points from 2023, likely due to a combination of rising nonrenewal activity and borrowers shopping for lower premiums

- Homeowners are opting for higher deductibles in exchange for premium savings, with new borrowers having 19% ($390) higher deductibles and 12% ($284) lower premiums than the market at large

“ICE loan-level data shows that a record 11.4% of borrowers switched insurance providers in 2024, up from 9.4% in 2023 and less than 8% historically,” Walden added. “While this has undoubtedly been driven by rising non-renewal rates, it may also be a sign of borrowers switching providers in search of lower premiums.”

Measuring the Impact of LA’s Wildfires

A recent study by Realtor.com took a closer look at the immediate and long-term impact that the wildfires in the Palisades and Eaton regions of Los Angeles County will have on the area’s housing market.

Though the full damage of the fires has yet to be fully assessed, more than $40 billion worth of residential real estate is located within the boundaries of the impacted area. In measuring the impact on the housing space in the long- and near-term, Realtor.com matched up fire perimeters as reported by the National Interagency Fire Center on January 21, 2025 with its own database of residential properties and found the following:

- The 15,841 residential properties within the designated fire boundaries had a total value of $40.3 billion. This estimate includes single-family homes, town homes, condominiums, and cooperatives.

- The sizable total value of residences impacted by the fires stems from both the high number and the relatively high median value. The median home within the boundaries of the Eaton fire has an estimated $1.3 million value while the typical home in the Palisades fire boundary has an estimated value of $3 million.

- For comparison, the total value of residential real estate in Los Angeles County is $2 trillion, and the median value of the 1.7 million properties in Los Angeles County is somewhat lower ($870,500).

- The residences within the fire boundaries comprise 0.9% of Los Angeles County residential properties by number and account for 2.0% of the total value of properties in Los Angeles County.

- So far in 2025, about 100 homes have been listed for sale within the Eaton and Palisades fire boundaries. LA county as a whole has seen 8,426 active listings year-to-date, meaning these at-risk properties made up about 1.3% of active for-sale home listings so far this year.

- Rents have been stable to modestly down in the Los Angeles metro area in recent years as the rental vacancy rate has risen to a 10-year high. This will likely help the market better accommodate displaced households, but rental price increases are still expected.

The typical property in the boundaries of the Palisades fire was worth $3 million, and the median value of a home in the Eaton region was $1.3 million. The Los Angeles County median home value currently stands at approximately $870,500.

“California, where insurers have been reducing their footprint due to strict regulations and rising wildfire risk, stands out as a notable exception,” Walden said. “Borrowers who switched providers in San Diego, Sacramento, San Francisco, Los Angeles and San Jose all paid at least 15% more, on average, than those who stayed put.”

What Lies Ahead

Separate research from the ICE Climate team suggests borrowers taking out mortgages in recent years may also be taking on higher deductibles to help offset rising premiums. Homeowners who took out mortgages in 2024, for example, had a 19% ($390) higher deductible than the average single-family mortgage holder. That same group had 12% ($284) lower annual insurance premiums than the market at large.

“As borrowers become more interested in shopping for the best insurance rates, there is an emerging opportunity for lenders and servicers to meet this need with embedded insurance comparison tools both at the front end of the pipeline and for people with existing mortgages,” Walden said. “ICE’s integrations with insurance providers in both our origination and servicing platforms have been aimed at exactly this opportunity as part of our continuing goal of making home finance as simple and transparent as possible.”

Click here for more on ICE’s Mortgage Monitor Report.