The rising cost of homeownership has made it difficult for younger buyers to enter the housing market, but Gen Z is beginning to carve out its place. According to the CoreLogic Loan Application Database, Gen Z homebuyers accounted for 13% of total home purchase applications in 2024, marking a three-percentage point increase from 2023. While affordability remains a significant hurdle, lower-cost Midwestern and Southern markets are providing opportunities for young buyers to take their first steps into homeownership.

Where Is Gen Z Buying Homes?

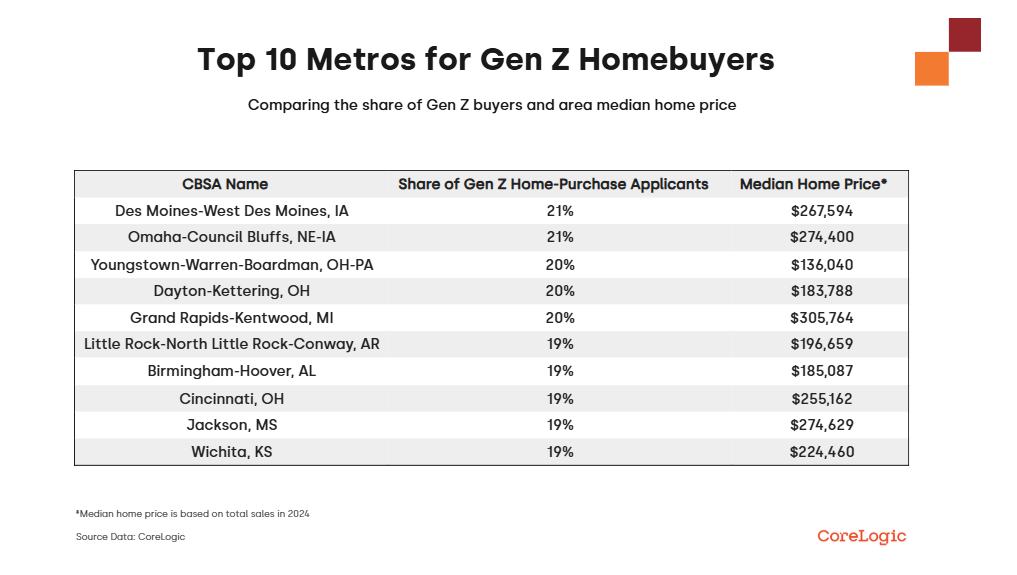

Gen Z homebuyers are more prevalent in affordable Midwestern metros, where housing costs are significantly lower than in high-cost coastal cities. The metro areas with the highest share of Gen Z homebuyers in 2024 included:

In contrast, Gen Z buyers were far less active in more expensive coastal metros, where affordability challenges remain steep. The lowest shares of Gen Z homebuyers were found in:

- San Jose, California: 4%

- San Francisco, California: 4%

- Oxnard, California: 5%

- Los Angeles, California: 6%

- Urban Honolulu, Hawaii: 6%

- Bridgeport, Connecticut: 6%

Metropolitan areas with a high concentration of retirees also tended to have lower shares of Gen Z homebuyers, indicating that affordability and local demographics play a key role in determining where younger buyers enter the market.

Affordability Drives Gen Z’s Market Choices

Data shows a clear correlation between home affordability and Gen Z’s presence in the housing market. In states with lower median home prices, Gen Z accounted for a larger share of home purchases:

- The national median home price was approximately $332,000 in 2024.

- By comparison, the median home price in North Dakota was below $250,000, highlighting why younger buyers are more active in these regions.

The Midwest’s affordability is particularly appealing to first-time buyers, who often face higher mortgage rates and down payment challenges compared to older generations.

Co-Buying Trends: Nearly Half of Gen Z Buyers Have Co-Applicants

Another trend emerging among Gen Z homebuyers is co-buying. In 2024, 45% of Gen Z applicants had co-applicants, reflecting the growing trend of:

- Friends purchasing homes together as part of co-living arrangements.

- Parents co-signing mortgages to help their children buy homes.

As affordability remains a challenge, shared homeownership may become a more common strategy for younger buyers looking to enter the market sooner.

Looking Ahead: Gen Z’s Growing Presence in Homeownership

While home prices and mortgage rates continue to pose challenges, Gen Z’s share of home purchases is expected to grow in the coming years. With more young buyers seeking opportunities in affordable markets, the Midwest and South are likely to remain key destinations for first-time homeowners from this generation.

As housing affordability shifts, so too will Gen Z’s buying patterns—signaling an evolving real estate landscape where younger generations are finding new ways to achieve homeownership.

Click here for more on CoreLogic’s report on Gen Z homeownership.