Housing affordability challenges are worsening for millions of American homeowners, with a growing number struggling to keep up with rising costs. A new research brief analyzing the latest American Community Survey data highlights that cost burdens—defined as paying more than 30% of household income on housing—have surged across income levels and demographics. The hardest-hit groups include low-income households, older adults, and homeowners of color, many of whom have limited options for financial relief.

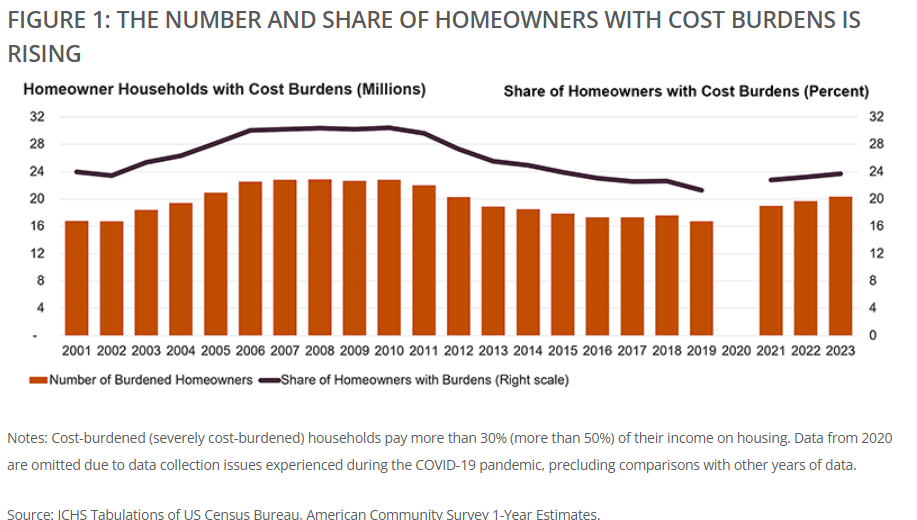

In 2023, the total number of cost-burdened homeowners increased by 650,000 households, bringing the total to 20.3 million—or 23.7% of all homeowner households. This marks a sharp rise in financial strain, with affordability worsening in both expensive metro areas and regions historically considered more affordable.

Cost Burdens Rise in Unexpected Markets

While high-cost regions continue to challenge homeowners, some of the most dramatic increases in cost burdens have occurred in traditionally affordable metros. Cities such as Milwaukee, Scranton, and Oklahoma City—where cost-burden rates were below 20% in 2019—have seen rates more than double the national average increase since then.

The findings suggest that rising costs of property taxes, insurance, utilities, and home maintenance—rather than just mortgage payments—are driving increased financial pressure, even for those who secured historically low mortgage rates in recent years.

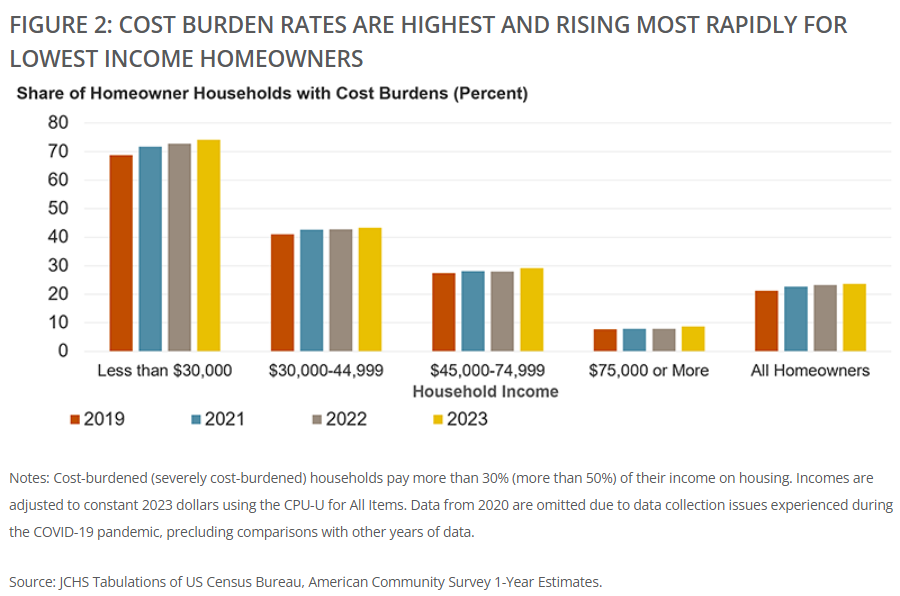

Lower-Income Homeowners Facing Record High Burdens

Homeowners earning less than $30,000 per year have been hit hardest. In 2023, the cost-burden rate for this group reached 74.2%, marking an increase of 5.4 percentage points over the last four years. This is the highest level recorded in over 20 years, surpassing the previous peak of 71.4% in 2010 following the Great Recession.

For those in this income bracket, severe burdens—defined as spending more than 50% of income on housing—also reached a record high. In 2023, 6 million lower-income homeowners found themselves in this category, underscoring the growing difficulty of maintaining homeownership under current economic conditions.

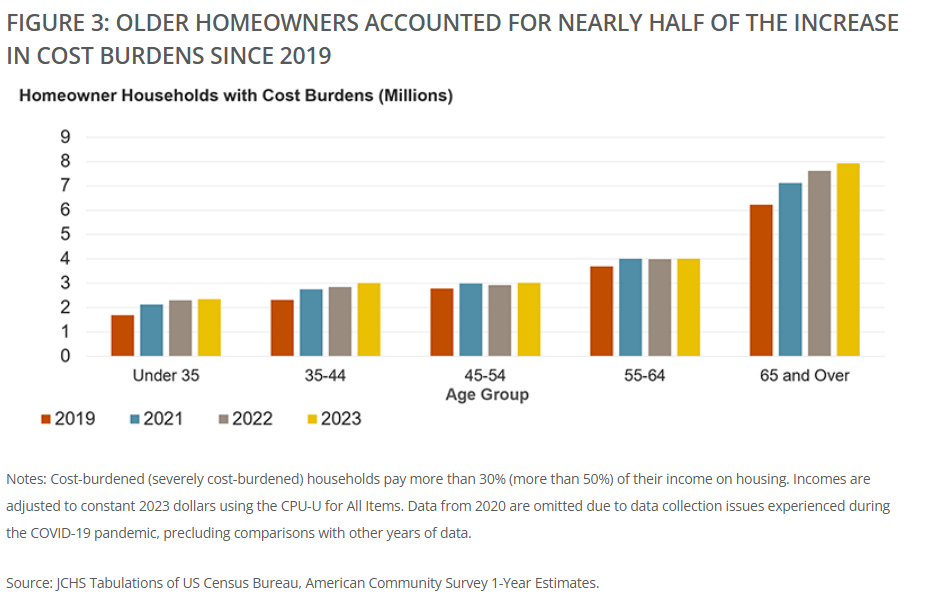

Older Homeowners Now Represent Nearly Half of the Increase in Cost Burdens

A disproportionate share of the increase in cost burdens is falling on older homeowners. Between 2019 and 2023, 1.7 million homeowners aged 65 and over became cost-burdened, accounting for 47% of the total increase. This brings the number of burdened senior homeowners to 7.9 million, or 27.6% of all homeowners in this age group.

The data suggest that rising homeownership costs are affecting not just new buyers, but long-term homeowners who are now struggling with increasing expenses. While mortgage payments remain the largest single housing cost for most, non-mortgage expenses—including home insurance, property taxes, utilities, and maintenance—have risen significantly, adding financial strain even for those who secured low mortgage rates during the pandemic.

Financial Pressure Disproportionately Impacts Homeowners of Color and Single-Income Households

The study highlights that Black and Hispanic homeowners face significantly higher cost burdens compared to white homeowners. Additionally, financial strain is rising most rapidly among single-person and single-parent households, where one income must cover all housing expenses.

As more homeowners struggle with affordability, the report emphasizes the urgent need for policy interventions to ease financial pressures. Solutions could include reducing monthly housing costs, expanding access to financial assistance, and providing targeted relief programs for distressed homeowners facing mounting bills.

With homeownership costs continuing to rise, financial burdens are no longer just a challenge for new buyers—they are a growing crisis for millions of existing homeowners nationwide.

Click here for more on the Harvard Joint Center for Housing Studies report on U.S. housing affordability.