Due in major part to customers’ growing pessimism about mortgage rates falling in the upcoming year, the Fannie Mae Home Purchase Sentiment Index (HPSI) fell 1.8 points to 71.6 in February. While the percentage of consumers who believe that now is a good time to sell a home fell to 62%, the percentage who believe that now is a good time to buy a home increased slightly to 24% last month.

American consumers’ optimism on their personal financial circumstances, such as household income and fear of job loss, also significantly decreased in February. The HPSI is down 1.2 points from the previous year.

“In February, the HPSI saw its first year-over-year decline in nearly two years, which was mostly due to a shrinking share of consumers expressing optimism about the direction of mortgage rates,” said Mark Palim, Fannie Mae SVP and Chief Economist. “This growing pessimism makes sense, as mortgage rates had remained near the 7% threshold for a few months, including when we fielded this survey. The decline in sentiment was further impacted by consumers’ growing concerns about their own personal financial situations. While some consumers may be slowly acclimating to the higher mortgage rate environment, the vast majority continue to believe it is a ‘bad time’ to buy a home—with high home prices cited as the primary sticking point. We continue to expect home sales activity to remain relatively light over our forecast horizon due to the ongoing lack of supply and overall unaffordability.”

In February, the Fannie Mae Home Purchase Sentiment Index (HPSI) dropped 1.8 points to 71.6. When compared to the same period last year, the HPSI is down 1.2 points.

Home Purchase Sentiment Index — Americans Weigh In

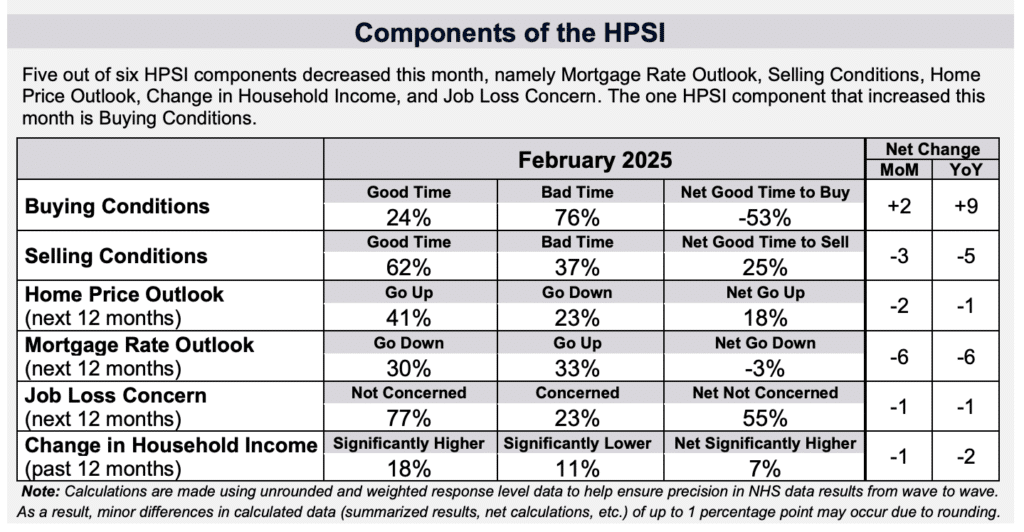

- Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home increased from 22% to 24%, and the percentage who say it is a bad time to buy decreased from 78% to 76%. The net share of those who say it is a good time to buy increased 2 percentage points month-over-month to negative 53%.

- Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home decreased from 63% to 62%, and the percentage who say it’s a bad time to sell increased from 36% to 37%. The net share of those who say it is a good time to sell decreased 3 percentage points month-over-month to 25%.

- Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months decreased from 43% to 41%, while the percentage who say home prices will go down increased from 22% to 23%. The share who think home prices will stay the same increased from 34% to 35%. As a result, the net share of those who say home prices will go up in the next 12 months decreased 2 percentage points month-over-month to 18%.

- Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months decreased from 35% to 30%, while the percentage who expect mortgage rates to go up increased from 32% to 33%. The share who think mortgage rates will stay the same increased from 33% to 36%. As a result, the net share of those who say mortgage rates will go down over the next 12 months decreased 6 percentage points month-over-month to negative 3%.

- Job Loss Concern: The percentage of employed respondents who say they are not concerned about losing their job in the next 12 months decreased from 78% to 77%, while the percentage who say they are concerned increased from 22% to 23%. As a result, the net share of those who say they are not concerned about losing their job decreased 1 percentage point month-over-month to 55%.

- Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago increased from 17% to 18%, while the percentage who say their household income is significantly lower increased from 9% to 11%. The percentage who say their household income is about the same decreased from 73% to 70%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago decreased 1 percentage point month-over-month to 7%.

To read the full report, click here.