A new study by Redfin has found that the typical U.S. homeowner stays in their house for 11.8 years, but homeowners in California—where Proposition 13 can lock owners into low property-tax rates—are staying put much longer.

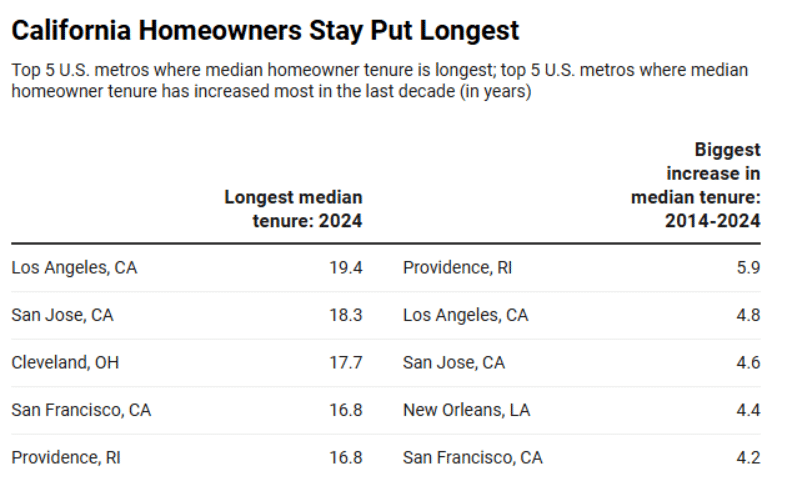

In Los Angeles, where homeowners hold onto their houses longer than any other U.S. metro, the median tenure was 19.4 years in 2024—the longest span on record for the area. It’s followed closely by San Jose, with a median tenure of 18.3 years. Homeowners in San Francisco, San Diego, and Riverside also stay put longer than the average American.

California is also home to three of the five U.S. metros with the biggest increases in homeowner tenure over the last decade. Providence, Rhode Island had the biggest uptick, hitting a median tenure of 16.8 years in 2024, up from 10.9 years in 2014. It’s followed by Los Angeles, San Jose, New Orleans, and San Francisco.

Lower Taxes Found Appealing in the Golden State

California homeowners tend to hold onto their houses for a long time because a state tax law incentivizes them to do so. Proposition 13, adopted in 1978, mandates that homeowners pay property taxes of 1% of their home’s assessed value, and strictly limits tax increases.

For many Californian homeowners, especially in expensive coastal areas like Los Angeles and San Francisco, it doesn’t make financial sense to more than double their property-tax rate to buy a similar home in the same area.

Prop 13 is also a factor in homeowner tenure increasing significantly over the last decade. But it’s exacerbated by the rapid rise in mortgage rates over the last three years.

Many California homeowners are locked in not just by low property taxes, but by low mortgage rates. Mortgage rates hovered between 3% and 5% from 2010 to the start of 2022, dropping to a record low of under 3% at the height of the pandemic moving frenzy. Since early 2022, mortgage rates have been sitting in the 6%-8% range. Selling a home where you pay a 3% mortgage rate to move and take on a 7% rate would significantly increase a homeowner’s monthly payment—and in California, your property tax bill would also jump.

“Long-term homeowners tend to have low monthly payments. If they were to move—even using their equity as a down payment—they would have a much higher monthly payment because home prices and interest rates have soared over the last several years,” said Gregory Eubanks, a Redfin Premier Agent in Los Angeles. “Many older homeowners are adding on and creating a multigenerational home, with their kids and grandkids moving onto the property. And even many people who do move hang onto their house and rent it out because low property taxes and low monthly payments make them view it as a financial asset.”

California’s Proposition 19, which was designed to allow older homeowners to keep relatively low tax rates when they move, went into effect in 2020. It’s unclear how effective Prop 19 has been at freeing up housing inventory.

“But it’s a problem for young people trying to break into the state’s notoriously expensive housing market,” Redfin Senior Economist Sheharyar Bokhari. “Tight inventory only pushes home prices up more, and adds to the generational homeownership divide.”

The only major metro with a bigger increase in homeowner tenure than Los Angeles is Providence, Rhode Island where one of the main factors is an aging population. The average Providence homeowner is 54, older than nearly every other major U.S. metro. Older people have typically owned their home longer than younger people, and they’re less likely to move.

Tenure was reported the shortest in Louisville, Kentucky where the typical homeowner remains in place for eight years, followed by Las Vegas (8.4 years) and Charlotte, North Carolina (8.7 years). One reason for short tenure in those places is that the relative affordability of buying a house encourages moving. The typical home in each of those three metros sells for under $440,000, compared to roughly $900,000 in Los Angeles and $1.5 million in San Jose.

Trends in Tenure

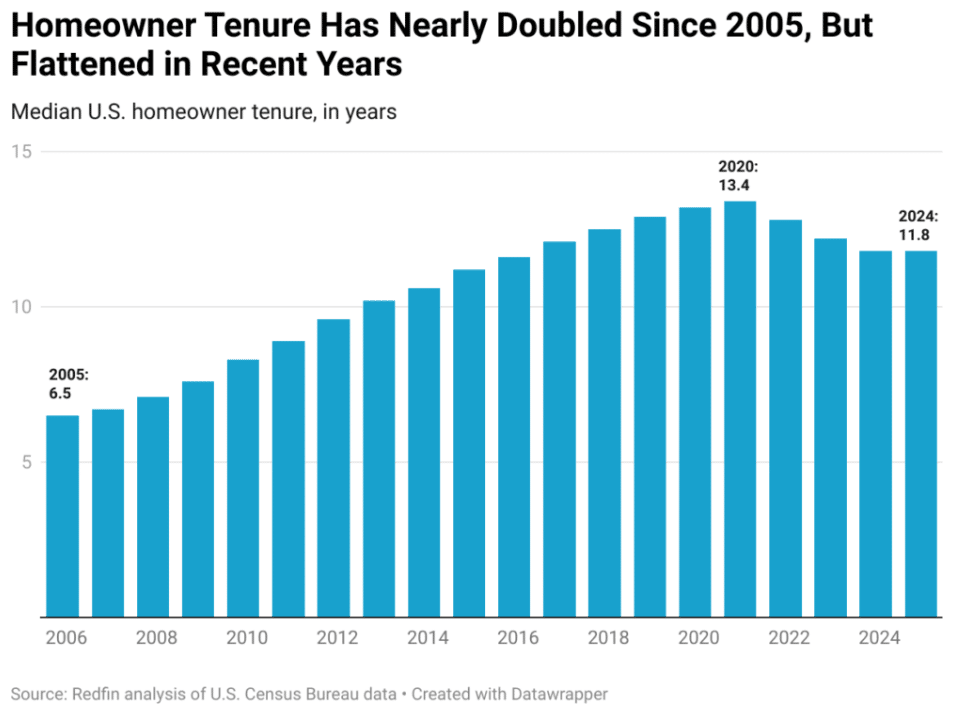

Around the U.S., homeowner tenure has flattened out over the last few years. After peaking at 13.4 years in 2020, the average tenure declined to 11.8 years nationwide in 2023, and stayed the same in 2024.

Homeowner tenure declined slightly each year from 2020-2023 mainly because of the pandemic-driven moving frenzy. At the start of the pandemic, record-low mortgage rates and the increasing prevalence of remote work motivated many Americans to move. Tenure remained the same from 2023-2024 because home sales were slow due to high mortgage rates and sale prices.

Still, homeowners are holding onto their houses for nearly twice as long as they were in the early aughts. The typical homeowner stayed put for 6.5 years in 2005, then tenure gradually increased over the next 15 years.

There are several reasons for the increase. The American population has grown older, and older people are less likely than younger people to move. Gen Zer’s and millennials typically stay in homes for shorter periods because they’re switching jobs and starting families. But baby boomers and older Gen Xers—who are more likely to be homeowners—tend to be settled in with less reason to relocate, and they’re increasingly choosing to age in place. Additionally, they’re financially incentivized to stay put; many older Americans own their homes free and clear, and those who do have a mortgage very likely have a lower rate than they would have today.

Long homeowner tenure is an obstacle for first-time buyers all over the country, not just in California, because it contributes to the country’s housing shortage and pushes sale prices higher. Housing costs are unlikely to drop significantly unless many people start letting go of their houses.

Click here for more on Redfin’s examination of homeowner tenure trends nationwide.