An examination of U.S. home prices by Redfin has found that the Midwest is home to three of the five metro areas where home prices are rising fastest. In Milwaukee, the median home sale price rose a record 20% year-over-year in February to $330,000—the biggest jump among the 50 most populous metros. Milwaukee was followed by Detroit, Michigan (12.5%); Nassau County, New York (11.7%); San Jose, California (11.1%); and Cleveland, Ohio (10%).

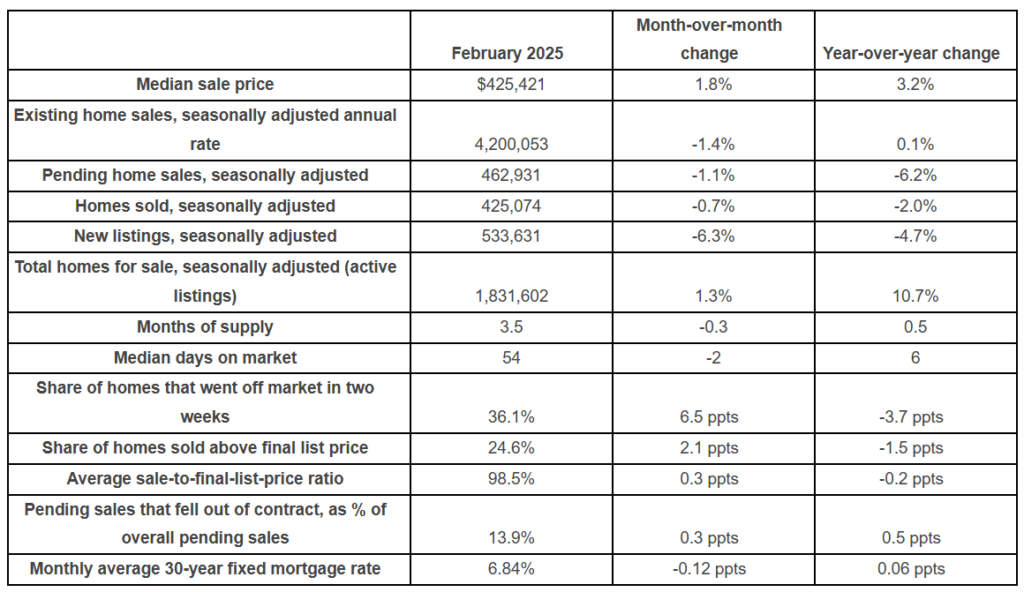

Nationwide, the median home sale price climbed 3.2% to $425,421—the slowest growth in six months. This crawl in price growth coincided with a slowdown in homebuyer demand, as U.S. pending home sales fell 6.2% year-over-year—the biggest decline since September 2023—and fell 1.1% month-over-month on a seasonally-adjusted basis.

In Detroit, active listings dropped 6.7% year-over-year in February—the largest decline among the top 50 metros, followed by Newark, New Jersey (-6.4%); Milwaukee (-3.7%); Cleveland (-3.6%); and Portland, Oregon (-3.1%).

Nationwide, active listings rose 10.7% year-over-year, and 1.3% month-over-month on a seasonally-adjusted basis, hitting the highest level since the early days of the pandemic (June 2020).

“Today’s housing market is weird. Some homes are attracting bidding wars like it’s 2020 again, while others are sitting on the market for weeks with no action,” said Desiree Bourgeois, a Redfin Premier Real Estate Agent in Detroit. “I recently saw one house get 10 offers and sell for $50,000 over the asking price, and the buyer waived their appraisal contingency. Oftentimes, it’s move-in ready homes in desirable areas that draw competition.”

Even though prices are rising in the Midwest, it remains the most affordable homebuying region in the country. Detroit has the lowest median sale price of any major metro at $180,000, with Cleveland ranking as the second most affordable, at $217,750.

February 2025 Housing Market Highlights: United States

Prices Plummeting in Texas and Florida

Prices fell in six major U.S. metros in February, and all but one of those metros are in Texas or Florida. In Austin, Texas, the median home sale price dropped 2.7% year over year to $430,000—the largest decline among the 50 most populous metros. Next came Tampa, Florida (-1.9%); San Antonio, Texas (-1.7%); Houston, Texas (-1.5%); Atlanta, Georgia (-1%); and Jacksonville, Florida (-0.8%).

The supply of homes for sale is surging in many parts of Texas and Florida, giving buyers an upper hand, and causing prices to fall. That’s partly because they’ve been building more homes than other states. And in Florida, unsold inventory is piling up amid skyrocketing insurance costs and HOA fees, along with intensifying natural disasters.

“There are about five times more home sellers than buyers, meaning it’s a buyer’s market,” said Connie Durnal, a Redfin Premier Agent in the northern suburbs of Dallas. “That’s why I’m telling all of my sellers that it’s crucial to price their homes competitively.”

Pace of Sales Hits Five-Year Low

The typical U.S. home that went under contract in February was on the market for 54 days—the longest period for any February since 2020, and up six days from a year earlier.

Homes took the longest to sell in Florida and Texas. In Miami, the typical home that went under contract last month sat on the market for 94 days—more than any other major metro. Next came West Palm Beach, Florida (92); Austin, Texas (91); Fort Lauderdale, Florida (91); and Pittsburgh, Pennsylvania (85).

Homes sold quickest in West Coast tech hubs. In San Jose, the typical home that went under contract in February was on the market for 10 days—fewer than any other major metro. It was followed by Seattle, Washington (12); Oakland, California (14); San Francisco, California (15); and Boston, Massachusetts (24). Historically, it has been common for homes in West Coast markets to sell the fastest.

Metro-Level Highlights: February 2025

- Prices: Median sale prices rose most from a year earlier in Milwaukee (20%), Detroit (12.5%) and Nassau County (11.7%). They fell most in Austin (-2.7%), Tampa (-1.9%) and San Antonio (-1.7%).

- Pending sales: Pending sales rose most in Los Angeles (6%); Anaheim, California (5.2%); and Columbus, Ohio (0.6%). They fell the most in Miami, Florida (-16.6%); Minneapolis, Minnesota (-16.1%); and Philadelphia, Pennsylvania (-16.1%).

- Closed home sales: Home sales rose most in Portland, Oregon (7.4%); Los Angeles, California (6.2%); and Anaheim, California (3.6%). They fell most in Miami, Florida (-20.7%); Austin, Texas (-18.2%); and Fort Lauderdale, Florida (-17.6%).

- New listings: New listings rose most in Oakland, California (24.8%); San Jose, California (22.9%); and Sacramento, California (17%). They fell most in Portland, Oregon (-24.9%); Detroit, Michigan (-23.3%); and Kansas City, Missouri (-20.2%).

- Active listings: Active listings rose most in Oakland, California (37.5%); Denver, Colorado (29.8%); and Anaheim, California (26.9%). They fell most in Detroit, Michigan (-6.7%); Newark, New Jersey (-6.4%); and Milwaukee, Wisconsin (-3.7%).

- Sold above list price: In San Jose, 67.6% of homes sold above their final list price, the highest share among the metros Redfin analyzed. Next came Oakland, California (59.6%) and San Francisco, California (58.4%). The lowest shares were in West Palm Beach, Florida (5.5%); Miami, Florida (7.4%); and Fort Lauderdale, Florida (9%).

Click here for more on Redfin’s report on where home prices are rising the quickest nationwide.