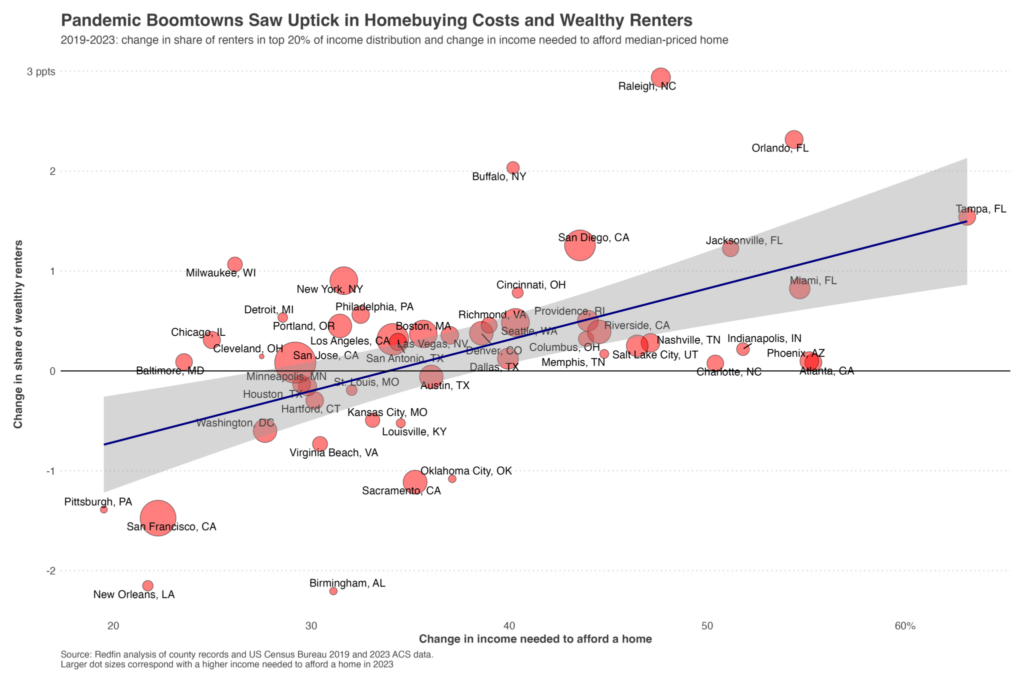

With all the revolving housing market trends going around, what’s the new symbol of status? A lease. More affluent Americans are choosing to rent rather than buy a home, particularly in Sun Belt cities that saw a sharp rise in population during the pandemic. A new Redfin report showed that in recent years, wealthy renters have increased their share of the rental market in over three-quarters of the most populated U.S. metropolitan areas (35 out of 50), with Raleigh, NC, and Orlando, FL, leading the way.

The highest increase among the top 50 metro areas was seen in Raleigh, NC, where 7.7% of renters are wealthy, up from 4.8% in 2019. Following it are San Diego (9.3%, up from 8%), Tampa, FL (9.4%, up from 7.9%), Buffalo, NY (6.6%, up from 4.6%), and Orlando, FL (10.8%, up from 8.5%).

“Many affluent Americans are choosing leases over mortgages because the cost of buying a home has jumped significantly more than the cost of renting one in recent years,” said Redfin Senior Economist Elijah de la Campa. “With mortgage rates near 7%, renting frees up cash for other investments that may be more lucrative than real estate.”

The average wealthy renter in each of the aforementioned metro areas makes more money than they would need to buy the median-priced house on the market. However, since 2019, renting has become more appealing, even for the wealthy, as the cost of purchasing a property in major metro areas has increased more than the cost of renting. The Sun Belt, where property values skyrocketed during the pandemic, is home to four of these metro areas.

Sun Belt Metros See Significant Housing Market Activity

For instance, Tampa’s median home sale price has increased by 67.4% from 2019—the largest increase among the metro areas Redfin examined. The average income required to purchase a home in Tampa has increased by 63.1%, making it the metro area with the largest growth in this analysis. In contrast, Tampa’s rentals have increased by 51.6%. Although it is less than the increase in homebuying expenses, that is also the biggest growth among the metro areas Redfin examined.

Rents have increased 28.1% nationwide, while the income required to buy the median-priced home has increased 36.9% from 2019. Redfin discovered that for every 10% decrease in homebuying affordability, the proportion of a metro’s wealthy renters increased by an average of 0.5 percentage points; this association is statistically significant at the 1% level. Please be aware that a home is deemed affordable if the monthly housing payment for a buyer who takes out a mortgage does not exceed thirty percent of their income.

However, according to Juan Castro, an Orlando Redfin Premier real estate agent, there are other reasons why many wealthy Americans chose to rent rather than buy a property.

“For a lot of folks, renting is all about opportunity,” Castro said. “The U.S. economy and job market are in flux, and people want to be able to move and flow as things change. I have friends who sold their home in favor of renting because they want the flexibility to move fast if their dream job surfaces in another state. They believe many employers won’t offer remote work moving forward, and don’t want to be stuck with a home that may be difficult to sell quickly.”

While it may come as no surprise to some, the pandemic caused Florida’s homebuying costs to soar, but in many areas of the state, prices have dropped over the past year due to escalating natural disasters, rising HOA dues, and rising insurance premiums.

It’s also important to take into account that, although wealthy renters increased their proportion in most metro areas between 2019 and 2023, renting as a whole declined. The rate of rentership decreased in almost all major metropolitan areas. The main reason for this is that during this time, mortgage rates fell to an all-time low, which encouraged many individuals to purchase homes. Many persons who moved from renting to owning during the pandemic were not in the highest income group, as seen by the fact that wealthy renters increased in number at the same time that renting decreased.

Rich Renters Find Luxury in Popular U.S. Metros

Of the 50 most populated metro areas, San Jose, CA has the largest percentage of wealthy renters (11%). San Francisco (10.4%), New York (10.3%), Orlando, FL (10.8%), and Seattle, WA (9.9%) follow.

With the exception of Orlando, where home prices surged during the pandemic, these metro areas have historically been among the priciest places to purchase a property. This is one of the factors contributing to the comparatively large proportion of wealthy renters in certain areas. For instance, San Jose has the highest median house sale price in the nation at $1.4 million.

However, because renting is much more affordable than buying, these metro areas also have a comparatively high proportion of wealthy renters. For example, in San Jose, CA, the average affluent person would only need to spend 10.5% of their income on rent to afford the median-priced apartment, compared to 21% for the median-priced home for sale—the biggest difference among the top 50 metro areas.

The great concentration of wealth in these metro areas contributes to their high cost. In the early 2000s, West Coast tech hotspots like Seattle and the Bay Area became more well-known, which caused property values to soar and attracted affluent workers. The percentage of affluent renters in these places increased dramatically over that time. The largest increase in the country occurred in Seattle, where the percentage of wealthy renters increased from 6.7% to 9.5% between 2000 and 2019. The second-largest rise was observed in San Francisco, with San Jose, CA, following closely behind.

“Many wealthy Americans can easily afford the median-priced home, but are renting to save up for the high-end home of their dreams,” de la Campa said. “When housing costs rise rapidly—be it in tech hubs during the early 2000s or Sun Belt boomtowns during the pandemic—that dream home takes longer to save up for, keeping folks renting for longer.”

Which Metros Are Seeing the Highest & Lowest Share of Affluent Renters?

As of 2023, just 4.7% of renters in Oklahoma City made in the top 20% of local salaries, making it the city with the lowest percentage of affluent renters. Cincinnati (4.8%), Hartford, CT (5%), Cleveland (5.1%), and Providence, RI (5.2%) come next. Because these metro areas have some of the lowest homebuying expenses in the nation, wealthy residents are probably less inclined to rent.

However, Southeast metros are seeing exceptional drops in the overall share of wealthy renters. The percentage of wealthy renters in Birmingham, AL, has decreased from 7.6% in 2019 to 5.4%, which is the biggest drop among the top 50 metro areas. New Orleans experienced a similar decline, going from 7.5% to 5.4%. Next were Oklahoma City (4.7%, down from 5.8%), San Francisco (10.4%, down from 11.9%), and Pittsburgh (5.8%, down from 7.2%), followed by Sacramento, CA (5.9%, down from 7%).

The median price of homes sold in Birmingham, AL, New Orleans, Pittsburgh, and Oklahoma City is lower than the national average. Additionally, the income required to buy a home has increased less than the national average in each of the metro areas noted above, which could help explain why some wealthy Americans chose to convert their lease into a mortgage.

For instance, Pittsburgh has seen the smallest growth in the U.S. in the income required to buy a home, rising 19.5% from 2019. Pittsburgh has the highest surplus among the top 50 metro areas, with the average rich Pittsburgher earning at least $145,295 annually, almost four times what they would need to buy the median-priced home.

San Francisco is the most costly city on the above list, making it the biggest outlier. However, a large number of individuals left during the pandemic, which caused housing values to plummet. As a result, many affluent tenants who remained were able to obtain affordable properties for sale.

To read more, click here.