Following their last meeting July 30-31, 2024, the Federal Open Market Committee (FOMC) has once again, ruled to U.S. interest rates steady. Industry experts offered their insight as Americans continue to adjust to evolving market conditions.

Key Commentary — Experts Weigh In

Sam Williamson, Senior Economist at First American:

FOMC Will ‘Wait and See’ in March

- “The Federal Reserve Open Market Committee (FOMC) is widely expected to hold interest rates steady at 4.25 to 4.5% at its second meeting of the year on Wednesday. Although there has been a slight moderation in economic growth and labor market conditions since the Committee’s last meeting in January, the FOMC is likely to maintain its ‘wait-and-see’ mode amid ongoing policy uncertainty, while emphasizing that the risks to its employment and inflation goals remain ‘roughly in balance.’”

- The central bank is also set to release its quarterly update to the Summary of Economic Projections (SEP), last updated in mid-December. The interest rate forecast, or dot plot, will likely show the median participant still anticipates 50 basis points of easing by year-end, consistent with December’s outlook. With markets currently pricing in the possibility of three cuts this year, the Committee is unlikely to signal a more hawkish stance, which could lead to a tightening of financial conditions. The FOMC will also aim to avoid appearing overly dovish, given that inflation remains approximately 50 bps above the central bank’s target, coupled with increased uncertainty about inflation expectations.”

- “Treasury yields should remain stable if the Fed’s actions align with market expectations, as the March pause is already priced in, though hawkish comments could push yields higher, while dovish signals may lower them.”

Mortgage Rates Potentially Set for Gradual Decline Later in the Year

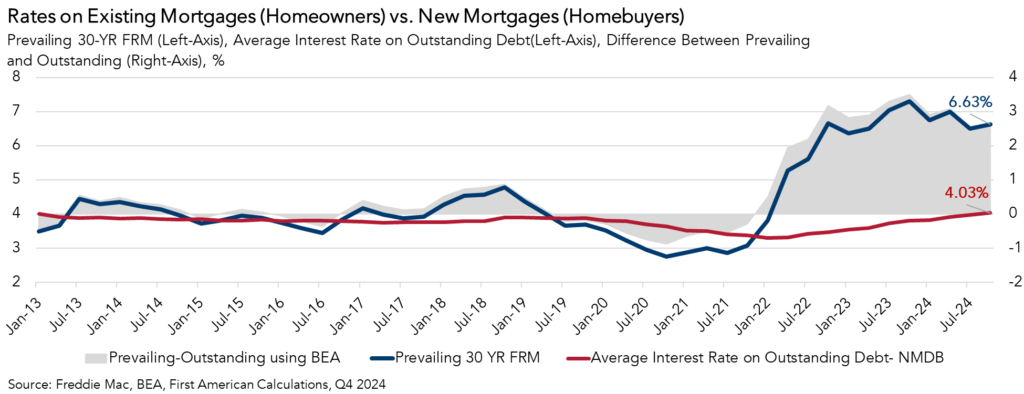

- “Although mortgage rates have dropped by approximately 40 basis points in the past month, affordability challenges are expected to persist during the busy spring season. Additionally, weakening consumer sentiment may further dampen the potential for a strong spring housing rebound this year.”

- “In the latter half of the year, increased policy clarity may help lower 10-year Treasury yields, which mortgage rates loosely follow. By year end, mortgage rates are projected to settle in the mid-6 percent range, offering some relief to prospective buyers. Nonetheless, some nascent signs suggest the 2025 spring home-buying season may still see improvement over last spring, alongside rising inventory levels and home buyers’ increasing acceptance of the ‘higher-for-longer’ rate environment.”

Danielle Hale, Chief Economist at Realtor.com:

“The Federal Reserve’s Open Market Committee (FOMC), the rate-setting body that meets roughly eight times per year, is expected to leave the Federal Funds rate unchanged at a range of 4.25 to 4.5 percent at its meeting later this week. Since the January Fed meeting and ‘no cut’ decision, we’ve seen continuing resilience in the labor market despite a slightly higher unemployment reading in February. While inflation rose in January in both overall and core measures, we saw a reversal of this trend in February. While some indicators—consumer confidence and retail sales—suggest concerns from consumers that could weigh on economic growth moving forward, most data suggest that the economy remains largely on track even if the risks have risen.”

“The Fed’s policy rate remains a whole percentage point lower since its big, initial cut in September. Yet in that time, economic and policy changes have caused views about what’s ahead for the economy to fluctuate widely, and interest rates reflect this uncertainty. The 10-year yield has ranged from roughly 3.8% to 4.8% while mortgage rates have traversed a nearly similar span from 6.1% to 7.0%. Fortunately both the 10-year and mortgage rates seem to have settled at the middle of this range, a welcome break for home shoppers as the Best Time to Sell approaches next month.”

“In this March meeting, the Fed will update its summary of economic projections, which may begin to shed light on any changes in the Fed’s outlook. At its December meeting, the Fed’s projections suggested that members anticipated that an additional 50 basis points of easing would likely be appropriate this year and next given anticipated declines in inflation and stability in the unemployment rate.”

Samir Dedhia, CEO of One Real Mortgage:

“The Federal Reserve is expected to hold the federal funds rate steady this week at 4.25%-4.50%, as policymakers navigate a complex economic landscape. Although inflation has moderated in recent months, lingering uncertainties—particularly the potential impact of new tariffs on trade—have made the Fed cautious about shifting its stance too soon. Tariff discussions, especially regarding imports from China, could drive up the cost of goods, adding inflationary pressure at a time when the central bank is striving to maintain stability. Given these concerns, alongside mixed economic signals, the Fed is likely to maintain its current policy, prioritizing a steady approach rather than risk premature rate cuts.

Beyond inflation, the Fed must weigh factors such as labor market trends, consumer spending, and global economic conditions. At a time when the labor markets seem to be cooling, trade uncertainties and supply chain disruptions could introduce new challenges, making future inflation trends less predictable. By keeping rates unchanged, the Fed is allowing itself time to assess how these dynamics evolve before making any decisive policy moves.

For consumers, the decision to hold rates steady comes as mortgage rates have declined over the past two months, providing some relief in home affordability. This trend has encouraged more buyers to enter the market., while other borrowing costs, such as credit card and auto loan rates, may remain elevated in the near-term, the overall direction of interest rates signals a more favorable environment for homebuyers and businesses looking to plan long-term financial decisions.”

Tim Lawlor, CFO of Kiavi:

“We expect the Fed to keep interest rates unchanged today rather than continuing on the path of deceleration we saw at the end of last year — largely due to economic uncertainty and the impact of potential policies. In terms of the housing market more specifically, we expect some short-term volatility over the next six to nine months but anticipate the market will stabilize over the next 18 months as the Fed provides more clarity around its interest rate policy for the remainder of 2025.

The housing market faces short-term headwinds, including potential tariffs which are expected to increase incremental costs of construction projects. This, combined with a construction labor shortage, is affecting real estate development costs and strategies. Some housing markets, like Texas and Florida, are starting to soften, while Midwest and Northeast markets are performing better. Real estate investors should also be cautious of the markets showcasing increasing days on the market for home sales. Real estate investing is based on a margin of safety: buy at the right price, have exit options, and stay in tune with local trends. As a nationwide lender, we are continuing to monitor market risk at a zip-code level to inform our strategies.

While today’s housing market faces short-term volatility due to broader economic uncertainty, rising materials costs, and the construction labor shortage, the long-term case for investment in real estate remains compelling. The U.S. faces a massive housing shortage as new housing production has slowed since the Great Financial Crisis and the population continues to rise and household size shrinks. The public conversation and attention about the housing availability and affordability crisis has intensified over the last few months, which only reinforces our belief in housing as a solid asset class longer-term.”

To read more, click here.