Whiles homes across the U.S. are primarily a households’ biggest investment, a new study by LendingTree has found that many lack the proper insurance to protect this investment. According to their findings, 11.3 million U.S. owner-occupied homes are currently uninsured, leaving these homeowners vulnerable to disasters.

LendingTree researchers analyzed the U.S. Census Bureau 2023 American Community Survey (ACS), and found that nearly one in seven homes across the U.S. are uninsured, 11.3 million of 82.9 million owner-occupied homes, or 13.6%, that are uninsured.

LendingTree analysts classified uninsured homes as owner-occupied homes with annual home insurance costs of less than $100. The number of owner-occupied homes that paid less than $100 in annual home insurance costs in 2023 was divided by the total number of owner-occupied homes to calculate the percentage of uninsured homes. LendingTree also utilized Federal Emergency Management Agency (FEMA) data to calculate uninsured rates among the 25 most at-risk counties (counties with the highest risk from 18 FEMA-identified hazards: avalanches, coastal flooding, cold waves, droughts, earthquakes, hail, heat waves, hurricanes, ice storms, landslides, lightning, riverine flooding, strong winds, tornadoes, tsunamis, volcanic activity, wildfires and winter weather).

“For most people, your home is your most important investment,” said LendingTree Content Writer and licensed insurance agent Rob Bhatt. “It’s important to protect that investment with insurance. Insurance has become more expensive and harder to get in recent years. This is putting people just one disaster away from losing the physical and financial security their home provides.”

Key Findings

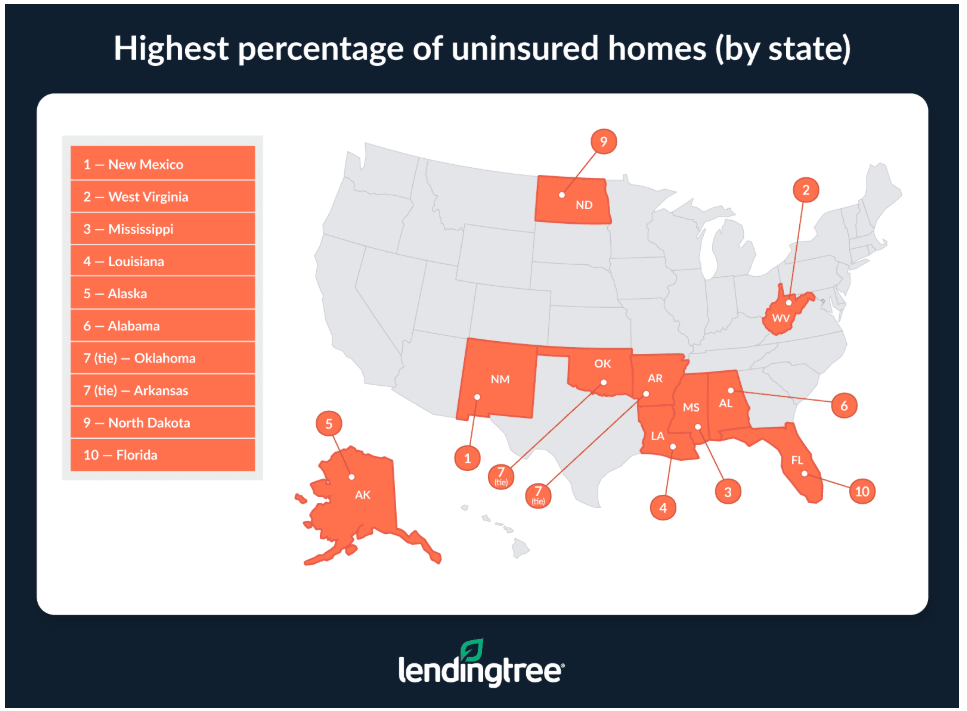

- New Mexico had the highest rate of uninsured homes with 23.3% of homes in the state lacking insurance coverage, ahead of West Virginia (23%), and Mississippi (22.9%).

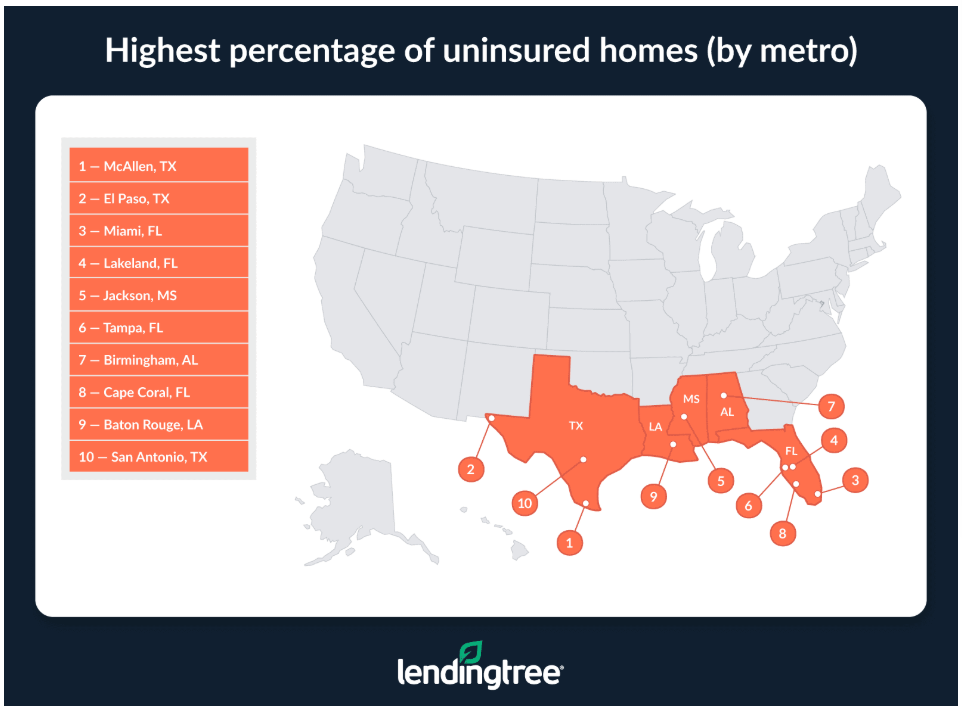

- Among the largest U.S. metros, McAllen, Texas, has the highest uninsured rate—by a massive margin, with 43.3% of homes in the Texas metro don’t have home insurance, more than 20 percentage points higher than fellow Texas metro El Paso at 23%, while Miami at 21%, rounds out the top three.

- Florida’s Miami-Dade County has the highest rate of uninsured homes among the country’s most at-risk counties. Considering the 25 counties with the highest National Risk Index (NRI) scores, Miami-Dade County tops the list at 23.5%. Fellow Florida counties—Broward County (22.7%) and Lee County (17.9%)—follow.

“Wind and hail damage is the most common homeowners insurance claim,” added Bhatt. “Of the top three states, this is especially true in Mississippi. Wind and hail damage is covered by standard homeowners insurance in most parts of the country. However, you have to buy windstorm coverage separately in some of Mississippi’s coastal areas.”

Click here for more on LendingTree’s analysis of the nation’s uninsured homes.