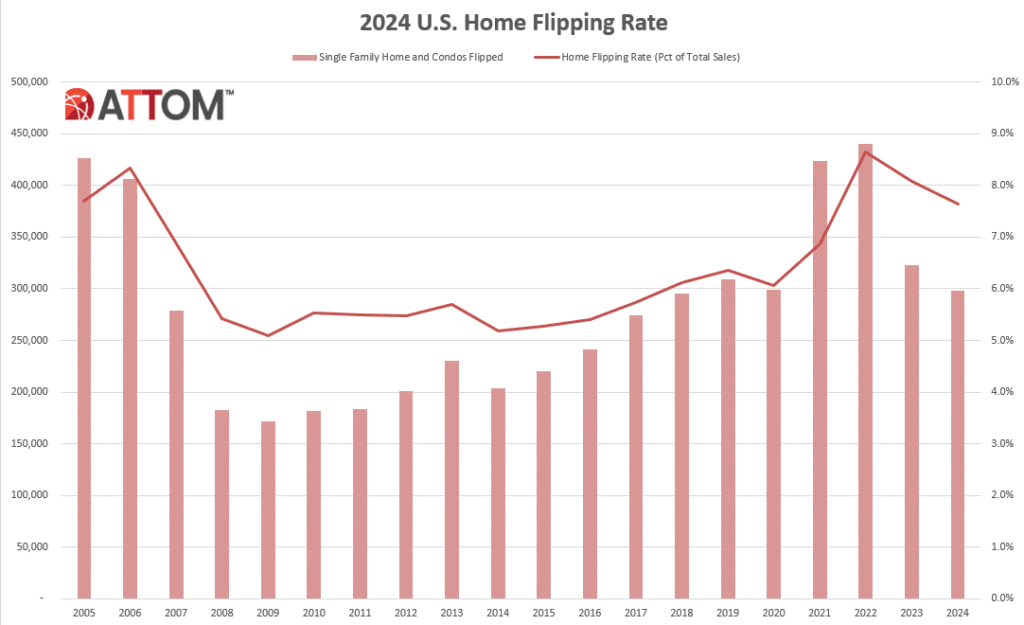

ATTOM has released its year-end 2024 U.S. Home Flipping Report, which finds that 297,885 single-family homes and condos in the U.S. were flipped in 2024—down 7.7% from the 322,782 homes and condos flipped in 2023 and 32.4% from a recent peak of nearly 441,000 reached in 2022. The report further reveals that as the number of homes flipped by investors declined, so did flips as a portion of all home sales, from 8.1% in 2023 to 7.6% last year.

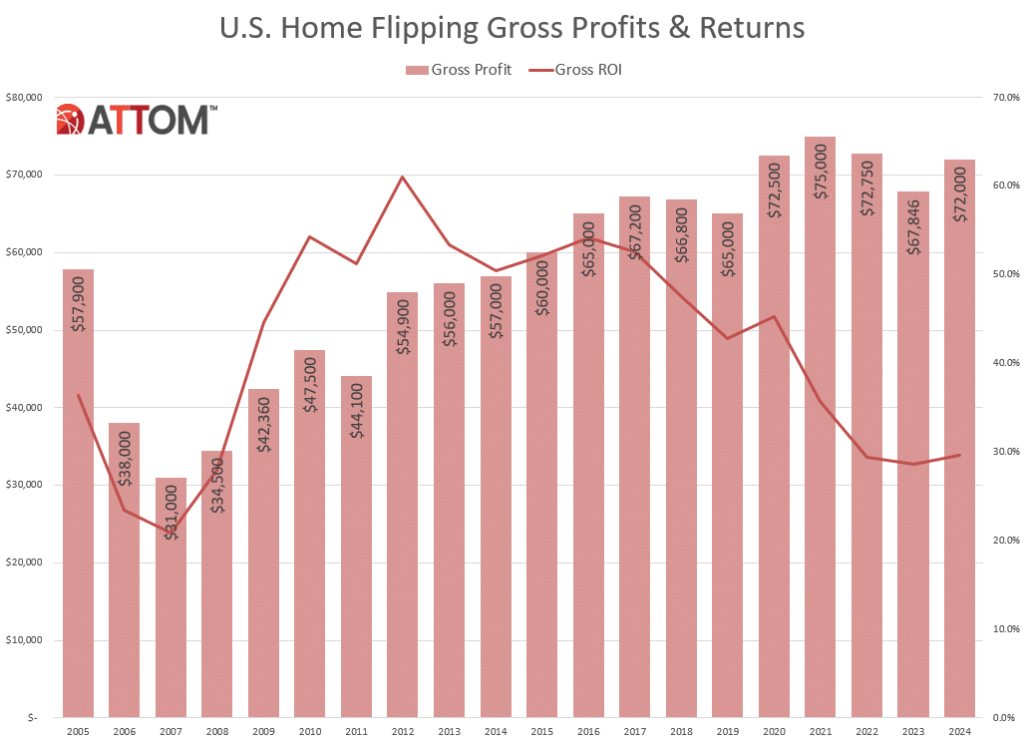

Profits and profit margins rose slightly in 2024 on typical buy-renovate-and-resell projects, but margins remained at one of their low points over the past decades, as investors continued struggling to take advantage of the nation’s housing market boom.

Gross profits on typical home flips in 2024 increased to $72,000 nationwide (the difference between the median sales price and the median amount originally paid by investors). That was up from $67,846 in 2023, and translated into a 29.6% return-on-investment (ROI) compared to the original acquisition price.

The latest nationwide ROI—before accounting for mortgage interest, property taxes, renovation expenses, and other holding costs—was up from 28.6% in 2023, and from 29.4% in 2022. However, ROI remained barely more than half of the 54.2% peak over the past decade in 2016.

“The home-flipping industry saw investors shy away even more in 2024 amid the extended period of languishing profits. But even as activity waned, there was at least a glimmer of hope that returns were starting to turn around,” said Rob Barber, CEO at ATTOM. “While home flippers still seemed to be having difficulty timing the market for big profits, their margins at least stopped going in the wrong direction.”

Flipping Rates Drop in Two-Thirds of the U.S.

Home flips as a portion of all home sales decreased from 2023 to 2024 in 145 of the 213 metropolitan statistical areas analyzed in the report (68%).

The largest year-over-year declines in flipping rates in metro areas with a population of one million or more were reported in:

- Charlotte, North Carolina (down 18.5% from last year)

- Jacksonville, Florida (down 16.9%)

- New Orleans, Louisiana (down 16.4%)

- Denver, Colorado (down 15%)

- Miami, Florida (down 13.6%)

Metro areas with a population of 200,000 or more and at least 100 home flips in 2024, where home flipping rates increased from 2023 to 2024, were led by:

- Cedar Rapids, Iowa (up 49.6% from last year)

- Bellingham, Washington (up 28.2%)

- Warner Robins, Georgia (up 26.8%)

- Merced, California (up 24.5%)

- Norwich-New London, Connecticut (up 23.4%)

Home Flips Purchased With Financing Dip Downward

The percentage of flipped homes originally purchased by investors with financing decreased in 2024 to 36.8%, down from 37.8% in 2023, although still up from 35.6% in 2022. Meanwhile, 63.2% of homes flipped in 2024 were originally bought with cash only, up from 62.2% in 2023, but down from 64.4% reported two years earlier.

Among metropolitan areas with a population of one million or more and sufficient data to analyze, those with the highest percentage of flipped homes in 2024 that had been purchased by investors with financing included:

- San Diego, California (59%)

- Seattle, Washington (58.1%)

- Fresno, California (50.6%)

- Providence, Rhode Island (49.9%)

- San Francisco, California (49.9%)

In that same group, the metro areas with the highest percentage of flips purchased with all cash included:

- Buffalo, New York (81%)

- Cleveland, Ohio (77.4%)

- Detroit, Michigan (76.5%)

- Birmingham, Alabama (75.7%)

- Pittsburgh, Pennsylvania (73.8%)

Gross Profits on Home Flips Grow

Homes flipped in 2024 were sold for a median price nationwide of $315,000, generating a gross flipping profit of $72,000 above the median original purchase price paid by investors of $243,000. That national gross-profit figure was up from $67,846 in 2023 but still down slightly from $72,750 in 2022, which was the second-highest level this century. Gross profits grew in 141, or 66%, of the 213 metro areas across the U.S. with sufficient data to analyze.

Among the 56 metro areas in the U.S. with a population of one million or more, those with the largest gross flipping profits on median-priced transactions in 2024 were reported in:

- San Jose, California ($283,000 profit)

- San Francisco, California ($218,000)

- New York, New York ($175,000)

- San Diego, California ($175,000)

- Washington, D.C. ($170,000)

The weakest gross flipping profits among metro areas with a population of at least one million in 2024 were found in:

- Austin, Texas ($8,844 profit)

- San Antonio, Texas ($17,832)

- Houston, Texas ($20,846)

- Dallas, Texas ($24,233)

- Kansas City, Missouri ($39,709)

Where Are Home Flipping Returns Up?

The profit margin on the typical home flips around the U.S. last year rose to 29.6%, but still stood at the third-lowest level since 2008. The ROI on median-priced home flips nationwide has dropped 16 percentage points since 2020 and is off by 25 points since the highwater mark over the past decade hit in 2016.

Margins increased last year, as the median nationwide resale price on flipped homes went up 3.3%, from $305,000 in 2023 to $315,000 in 2024. That represented a slightly larger increase than the 2.5% rise in the price investors had originally paid for properties they flipped ($237,154 for homes flipped in 2023 versus $243,000 in 2024). The typical home-flipping investment return improved from 2023 to 2024 in 116, or 54%, of the metro areas analyzed.

Among metro areas with a population of one million or more, the biggest percentage-point increases in profit margins on median-priced flips during 2024 were found in:

- Cleveland, Ohio (ROI up from 39.2% in 2023 to 72% in 2024)

- Buffalo, New York (up from 83.9% to 109.1%)

- Rochester, New York (up from 60.2% to 71.5%)

- Louis, Missouri (up from 34% to 45.1%)

- Memphis, Tennessee (up from 58.2% to 66.7%)

In that same group of markets with populations of at least one million, the largest decreases in returns on investment for typical home flips were found in:

- Philadelphia, Pennsylvania (ROI down from 82.4% in 2023 to 68.4% in 2024)

- Hartford, Connecticut (down from 59% to 45.7%)

- Pittsburgh, Pennsylvania (down from 123.7% to 110.9%)

- Richmond, Virginia (down from 81.7% to 69.7%)

- Detroit, Michigan (down from 66.7% to 59.2%)

Among metro areas with a population of at least one million, the biggest gross profit margins in 2024 were reported in:

- Pittsburgh, Pennsylvania (110.9% profit)

- Buffalo, New York (109.1% profit)

- Baltimore, Maryland (76.3% profit)

- Cleveland, Ohio (72% profit)

- Rochester, New York (71.5% profit)

“This year poses significant uncertainty for investors, what with a short supply of homes for sale, declining numbers of low-priced foreclosure properties, mixed economic forecasts, and elevated mortgage rates,” said Barber. “So, they will have to do some very smart buying and quick renovating to keep the profit rebound going.”

Click here for more on ATTOM’s analysis of 2024’s home flipping market.