A new report released today from ServiceLink revealed that Gen Z remains eager and ready to buy a home this year. But high interest rates and home prices could deter them from crossing the finish line as their tolerance is waning. The annual survey analyzes generational trends among recent and prospective homebuyers, revealing their sentiment about the current housing market and their intentions to purchase, refinance or leverage home equity this year.

“These findings show that there is still a strong appetite for homeownership, particularly among the youngest generation, despite the ups and downs of today’s market,” said Dave Steinmetz, President of Origination Services. “Today’s buyers need to be armed with information, while demonstrating patience and flexibility, in order to achieve their dream of homeownership. For lenders, this provides an opportunity to tap into technology and increase offerings that buyers indicate they want to see. Lenders also should focus on education and increasing transparency to meet the current needs of today’s buyers.”

While Gen Z Remains Prepared to Purchase, They’re Also Ready to Back Out

Compared to 51% of millennials, 49% of Gen X, and 22% of baby boomers, around 67% of Gen Z respondents stated they intended to buy a home this year.

In all, an estimated 47% of respondents stated that they would think about buying a house in 2025. Elevated mortgage loan rates and housing prices may deter purchasers from making a purchase. For those reasons, 43% of respondents stated they thought about purchasing a home in 2024 but ultimately decided against it.

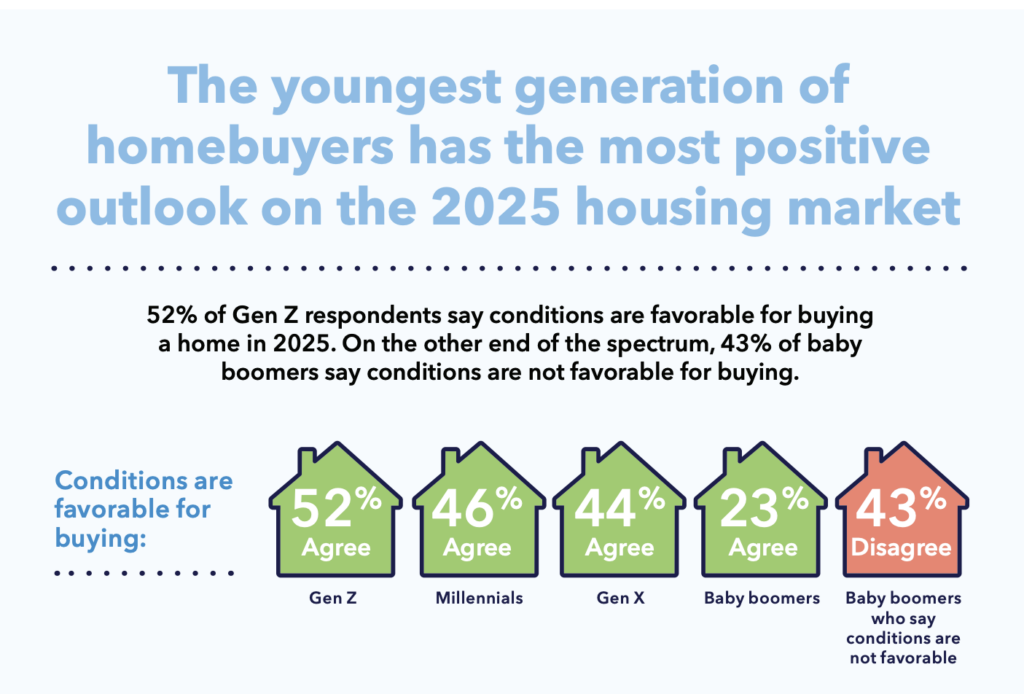

Of all respondents, Gen Z was the most likely to give up on the homebuying process, with 58% reporting that they did so in 2024 and 38% stating that they had failed to make a purchase during the previous four years. According to 41% of all respondents, the current market is favorable for home purchases this year. Among Gen Z, 52% had a positive outlook on the market, compared to only 23% of baby boomers.

An estimated 69% of those surveyed expressed satisfaction with their existing mortgage rate. People who want to buy this year are becoming less tolerant of high prices. According to Gen Z respondents, their average mortgage rate is 5.1%, but they would think about raising it to 5.8%.

Compared to a year ago, when Gen Z respondents were willing to go as high as 6.3%, that number is lower. This year, millennials are also lowering their tolerance, as the study shows the greatest rate they would tolerate is 5.5%, down from 6.2% in 2024.

Generational Homebuying Trends & Buyer Preferences

Two years ago, millennials were the most eager generation to buy a home, but they are gradually reversing their desire. Millennials still want to purchase in 2025 at a rate of 51%, down from 61% two years ago and 59% last year.

Compared to 60% in 2023, just 46% of millennials stated that the market will be favorable for purchases in 2025. In contrast, Gen Xers are expressing a revived desire to own a home in 2025. Compared to 45% in 2024, 25% in 2023, and 12% in 2022, 49% of Gen X respondents stated they intended to purchase this year.

With 82% stating that they would be more inclined to cooperate with a lender that offers appraisal or closing appointment scheduling from a phone or tablet that allows them to choose the precise date and time they prefer, Gen X is also the group most impacted by technology. Furthermore, 77% of Gen Xers who responded stated that they would choose a lender that provided virtual closings.

Some 39% of respondents stated they would like to see more space between homes, and 60% of respondents who intend to buy a home within the next year stated they are searching for a home with greater space—a 17% increase from a year ago.

The largest deterrent to purchasing a home, according to 51% of respondents, is that the house is too tiny. Higher taxes (48%), a lack of privacy or too close-together residences (43%), and a lack of outdoor space (33%), are other major deal-breakers. At 66%, Gen Z is the generation that most wants a bigger, more spacious home, followed by millennials at 64%.

Compared to 34% in 2023, 39% of all respondents reported having at least $100,000 in home equity. Compared to 28% in 2024, only one in four respondents stated they intended to take out a home equity loan this year. Ten percent of those surveyed stated that they are not knowledgeable enough about home equity loans to give them any thought.

Many respondents believe that this year would see a decline in mortgage rates, which would enable purchasers to get a better deal. In an effort to obtain a better rate, 60% of respondents stated that they are “likely” or “somewhat likely” to refinance this year. Compared to 57% in 2024, that is a tiny increase.

To read the full report, click here.