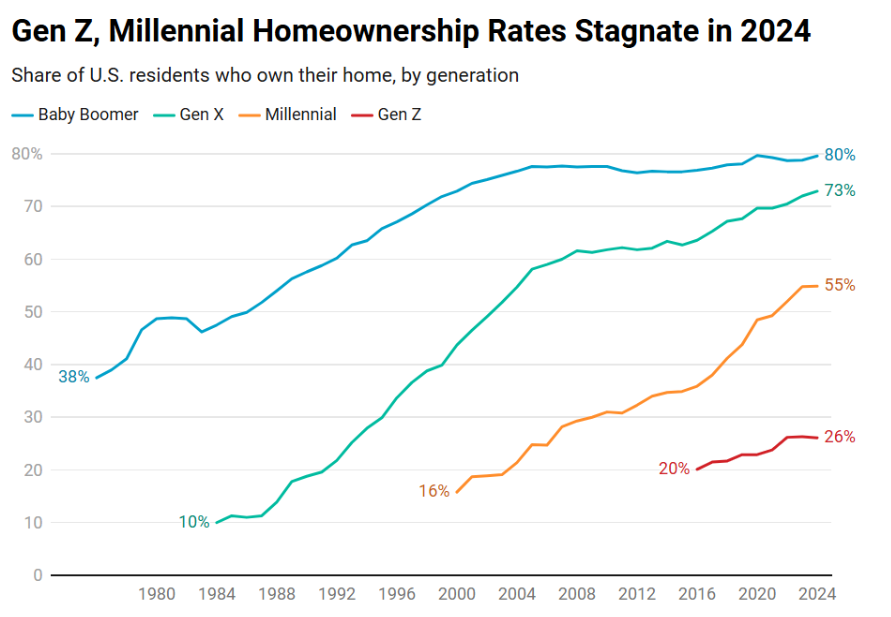

New findings from Redfin conclude that younger Americans are losing their momentum when it comes to homeownership, as 26.1% of Gen Zers owned their home in 2024, essentially a total flat from 2023 (26.3%), and 2022 (26.2%). Before that, the Gen Z homeownership rate had increased each year since Gen Zers started aging into potential homeownership in 2017 (except 2022, when it remained flat).

That same sentiment also rings true for millennials, as 54.9% of millennials owned their home last year, essentially unchanged from 2023, when it was 54.8%. Prior to 2024, the millennial homeownership rate had increased each year since 2012.

As for older Americans, their homeownership rate increased slightly in 2024, as 72.9% of Gen Xers owned their home in 2024, up from 72% in 2023. And 79.6% of baby boomers owned their home, up from 78.8%. Those small increases are fairly standard for older generations.

Mortgage rates began rising rapidly in 2022 after several years of record lows, with weekly average rates went from around 3% at the start of 2022 to 7% by the end of the year, and they’ve remained elevated between 6% and 7% since then. High mortgage rates were exacerbated by the fact that low inventory kept home prices stubbornly high in many parts of the country. By spring 2024, the typical homebuyer was paying roughly $2,800 per month, an all-time high.

And even though average wages have increased in recent years, too, they haven’t risen as fast as housing costs, pricing many people out of homeownership. High housing costs are a bigger obstacle for young people than older people because they’re less likely to already own a home, meaning they can’t use equity to purchase their next house.

Key Takeaways From Redfin’s Analysis

Redfin uncovered a few other reasons for the stagnation in homeownership rates for younger Americans:

- Housing supply is tight, partly because older Americans are hanging onto their homes in lieu of selling. That means younger people have fewer homes to choose from, especially desirable homes in popular neighborhoods.

- Many are choosing to remain renters as the cost of buying a home continues to rise. Conversely, the cost of renting has essentially remained flat as of late.

- Gen Zers and millennials are navigating economic uncertainty, including a potential economic slowdown and concerns about things like tariffs, the high cost of living and lack of job security. Many young people also have student loan debt.

- Some Gen Zers and millennials are prioritizing flexibility over homeownership in the aftermath of the pandemic, which increased the prevalence of remote work. Some are choosing to rent on a short-term basis, travel, or live with family.

“Homeownership is still a symbol of success and stability for many Americans, but the nation’s culture is shifting with the economic times,” said Redfin Chief Economist Daryl Fairweather. “Some young people are placing less emphasis on owning their own home because they’re prioritizing flexibility, while others continue renting because they can’t afford to buy. Buying a home is still typically a good financial investment, but for young people who don’t have the desire or means to do so, there are other viable investments that, unlike buying a home, don’t require a huge down payment. Those people might consider investing in the stock market, their own business, or education.”

Measuring Generational Home Buying Trends

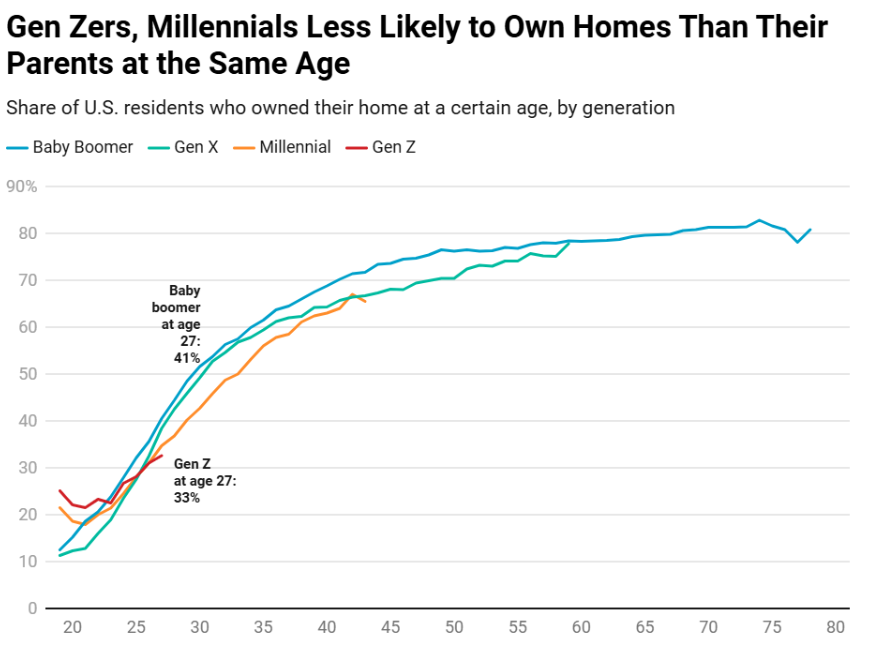

Redfin also examined homeownership data over time, which reveals that it was more common for young people to own homes in the past. For example, in an examination of 27-year-olds, 32.6% of 27-year-old Gen Zers owned their home in 2024, compared to 38.4% of Gen Xers when they were 27 and 40.5% of baby boomers when they were 27. Moving on to a millennial example, 56% of 35-year-olds owned their home in 2024, compared to 59.4% of Gen Xers and 61.5% of baby boomers when they were 35.

The comparatively low share of young homeowners today stems mostly from the same factors noted above, namely lack of affordability. But it’s also because young adults are reaching milestones later in life than they used to. For instance, the average first-time mother in the U.S. is now 27.5, up from 24.9 two decades ago.

Click here for more on Redfin’s examination of generational U.S. housing trends.