After the pandemic, the U.S. renovation market surged above $600 billion and, even with a recent slowdown, is still 50% higher than it was before the outbreak. This is according to a new analysis from the Harvard Joint Center for Housing Studies (JCHS, the Center); however, the industry’s capacity to completely satisfy demand is threatened by inflation, industry fragmentation, and a lack of qualified trade workers.

The report, “Improving America’s Housing 2025,” states that while record-high property values and the aging of homes and households have contributed to the remodeling market’s extraordinary strength, much more investment is required to meet the nation’s 145 million homes’ increasing needs for energy efficiency and disaster resilience.

“Given the strong foundation and growing needs, residential remodeling is expected to remain a formidable economic sector in the years ahead,” said Chris Herbert, Managing Director of the Center. “And despite unparalleled spending in the last few years, far more investment is needed to improve energy efficiency, disaster resilience, and accessibility for the nation’s 145 million homes.”

Key findings from the report:

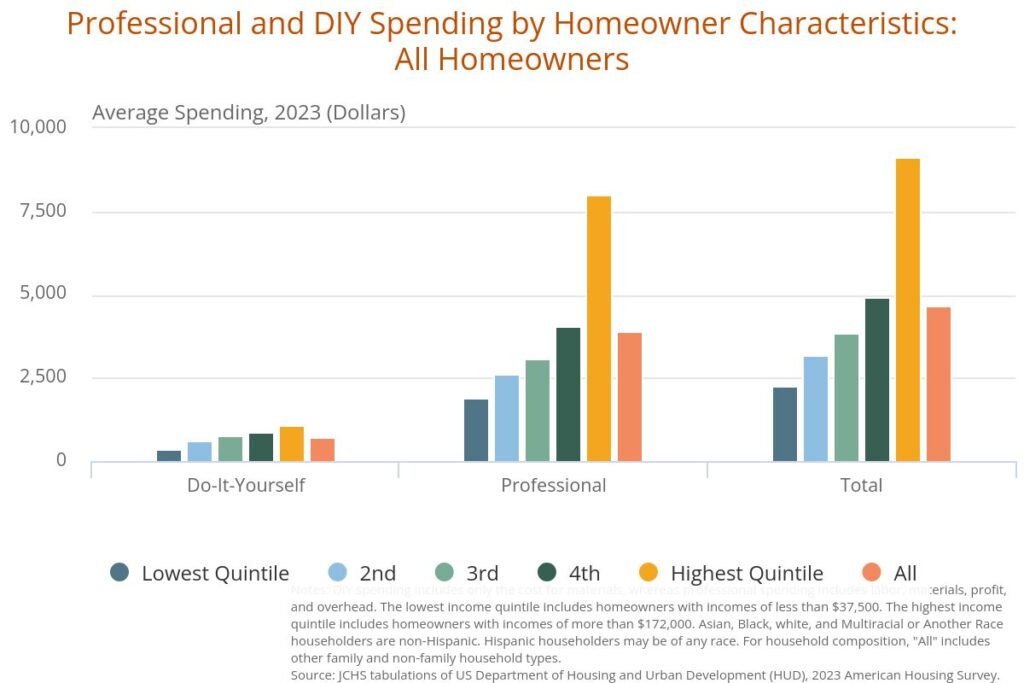

From $404 billion in 2019 to $611 billion in 2022, spending on home repair and improvement skyrocketed, and it is predicted to stay over $600 billion until 2025. In 2023, homeowners will still spend 49% of their improvement budget on replacement projects like windows, HVAC, and roofing. In 2023, homeowners spent an average of about $4,700 on upgrades, which was approximately 9% more than they did during the previous market boom in 2007.

Spending on disaster repairs has skyrocketed to $49 billion in 2022–2023, an incredible increase from $16 billion in 2002–2003, due to the increasing frequency and severity of hazard events such as hurricanes, wildfires, and flooding. Although few homes perform mitigation retrofits, the average homeowner insurance price increased by 17% between 2021 and 2023, which may serve as a catalyst for homeowners to do so.

Additionally, homeowners spent $139 billion in 2023—nearly four times as much as in 2003—on upgrades that affected residential energy use. According to Carlos Martín, Director of the Center’s Remodeling Futures Program, “every energy-related improvement presents an opportunity to cut greenhouse gas emissions, increase the efficiency of the housing stock, and reduce utility costs.”

The housing stock is older than ever, with a typical age of 44 in 2023, and significant upgrades are required to replace deteriorating components. Average maintenance spending in 2023 was 76% greater than that of homes built before 2010, and enhancement spending was 24% higher for homes built before 1980. Many low-income residents reside in homes that are structurally flawed or without of necessities like heat, electricity, or running water.

According to Sophia Wedeen, a Senior Research Analyst at the Center, “expanding improvement and repair services for these homeowners is both a market opportunity and a moral imperative. More financing tools and counseling programs can also help preserve the affordable housing stock and ensure that all households live in safe and adequate housing.”

The remodeling market’s activity and expenditure habits are still being reshaped by the changing demographics of U.S. families. Owners 65 and older accounted for 27% of all improvement expenditures in 2023, up from 14% twenty years prior. Additionally, households led by people of color make greater contributions to the home renovation industry as the population becomes more racially and ethnically diverse; in 2023, homeowners of race accounted for 23% of improvement expenditures, up from 14% in 2003. Additionally, the market proportion of immigrant owners is increasing, rising from 8% of expenditures in 2003 to 13% in 2023.

The renovation sector is still very fragmented, with a significant percentage of independent contractors and small payroll businesses, even with the recent wave of mergers and acquisitions. The business is also hindered by labor shortages and the high cost of building supplies, which includes uncertainties about the possible effects of tariffs. Most remodelers reported a lack of trained trade personnel, such as plumbers, electricians, and carpenters, between 2015 and 2023. Additionally, the industry is strongly dependent on foreign-born workers; in 2023, immigrants made up a record-breaking 34% of the labor force in the construction trades.

The renovation sector has both potential and challenges in the foreseeable future. On the one hand, the market is anticipated to be constrained by high borrowing rates, poor home sales, and a continuing lack of skilled craft labor. The aging of the housing stock, high levels of home equity, and a persistent trend toward remote employment will all encourage large investments in house renovation, especially from homeowners who would rather update their current residences than move.

To read the full report. click here.