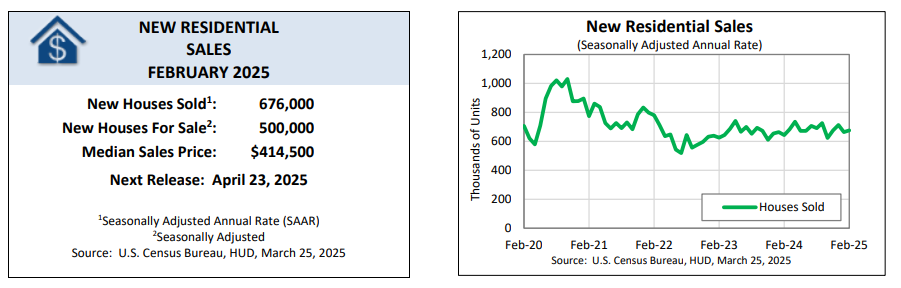

The U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD) have announced new U.S. residential sales statistics for February 2025.

Sales of new single-family houses in February 2025 were at a seasonally adjusted annual rate of 676,000, according to estimates released by the Census Bureau and HUD—this is 1.8% above the revised January rate of 664,000, and 5.1 % above the February 2024 estimate of 643,000.

“New home sales are improving but well below what’s needed, increasing 1.8% on a monthly basis to 676,000, slightly below the consensus estimate which was predicated on the fact that mortgage rates were declining in February, which is usually a boost to new-home sales,” said First American Chief Economist Mark Fleming.

“The month-over month pickup was also seen in sales of existing homes in February, as some modest relief from high mortgage rates came in the second month of the year,” added Realtor.com Senior Economist Joel Berner.

Bright MLS Chief Economist Lisa Sturtevant noted climate-related activity factoring into home sales throughout the month.

“Weather could have played a role in February new homes sales, which is reflected in regional differences,” said Sturtevant. “Sales in the Northeast were down nearly 50% year-over-year, potentially as a result of winter storms.”

HUD and the Census Bureau found that the median sales price of new houses sold in February 2025 stood at $414,500, with the average sales price at $487,100.

“Regionally, the sales volume gains were concentrated in the more affordable South and Midwest, which saw 6.6% and 20.6% pickups from January respectively, and both regions are seeing more sales activity than a year ago,” said Berner. “The pricier Northeast and West regions fell by 21.4% and 13.6% month-over-month respectively, and are well below their level from February 2024. The South was already dominating the share of new construction and new home sales, and this strong sales showing in February only adds to the clear focus on new homes in the South, with 64.8% of new home sales taking place in that region.”

In terms of for sale inventory and housing inventory, the seasonally-adjusted estimate of new houses for sale at the end of February was 500,000—marking a supply of 8.9 months at the current sales rate.

“The ‘mix’ of inventory available for sale by stage of construction is normalizing,” added Fleming. “In February, completed ready-to-occupy inventory increased to 119,000, which is up 35% compared to a year ago.”

Berner added, “With months of supply remaining in buyers’ market ranges for new builds, we continue to see more completed homes for sale than ones that haven’t been started yet. The more leisurely pace of the market allows buyers to actually visit their potential new home in its finished state instead of being forced to make a purchase on a home that doesn’t exist yet, as many did during the post-pandemic buying craze of 2021 and 2022.”

What Lies Ahead?

Gabe Abshire, Founder and CEO of Move Concierge observed some trends moving forward as Q1 2025 comes to a close.’

“We see both renters and current homeowners beginning to come off the sidelines as housing conditions improve, mainly through several homebuilder incentives, such as rate buydowns,” said Abshire. “Further, more households are currently looking for bargains regarding several home services. New home sales are a fresh property to easily add these amenities, such as additional home security, cheaper utilities, and faster Internet speeds.”

Sturtevant noted that inventory and constructions trends are to be closely watched as the year progresses.

“Overall, the inventory build-up suggests that new home buyers are starting to pull back. Sales of new homes are expected to be lower this year for at least a couple of reasons. First, the growing inventory of existing homes for sale has given buyers more options. When the existing home inventory was historically tight, some homebuyers had no choice but to look at new construction. Now, buyers have gained some leverage and have more listings to choose from,” said Sturtevant. “A second factor that is worth watching is the pace of new home construction. Right now, new home inventory is rising because there are fewer buyers and homes that were started last year are sitting vacant. But some home builders are pulling back on starts and permits for new construction as they assess the potential impacts of tariffs and immigration policies.”