According to a recent Realtor.com survey, the average down payment in the fourth quarter was $30,250, which was around $3,000 more than the previous year but only somewhat less than the third quarter’s amount. The largest down payments in the history of the records, both in terms of total dollars and as a percentage of the buying price, occurred last year. In the fourth quarter of 2024, down payments were 3.4 percentage points greater than they were prior to the pandemic (2019 Q4), highlighting the trend toward larger down payments.

“As inventory recovers, the housing market is very slowly tilting toward more balance between buyers and sellers. But down payments are still high—hitting an annual record in 2024,” said Danielle Hale, Chief Economist at Realtor.com. “Today’s home sales are skewed toward higher-end homes, and this means larger down payments from more financially prepared, high-earning buyers as entry-level and lower-earning buyers sit out. Additionally, higher mortgage rates give homebuyers good reason to limit their loan size and interest costs, by putting more down upfront. As long as the market remains tilted toward buyers who are less sensitive to home prices and mortgage rates, down payments are likely to remain relatively high.”

| Primary Residence | Avg Down Payment as % of Purchase Price | Med. Down Payment ($ amt) | ||||||

| 2021 Q4 | 2022 Q4 | 2023 Q4 | 2024 Q4 | 2021 Q4 | 2022 Q4 | 2023 Q4 | 2024 Q4 | |

| U.S. | 12.7% | 13.5% | 14.2% | 14.4% | $24,000 | $25,200 | $27,100 | $30,250 |

In 2024, buyers paid an average of $29,900 and 14.4% of the purchase price, up from 14.2% and $27,200 in 2023. Since the housing market is not anticipated to change significantly in the upcoming months, the current down payment trends are probably going to continue.

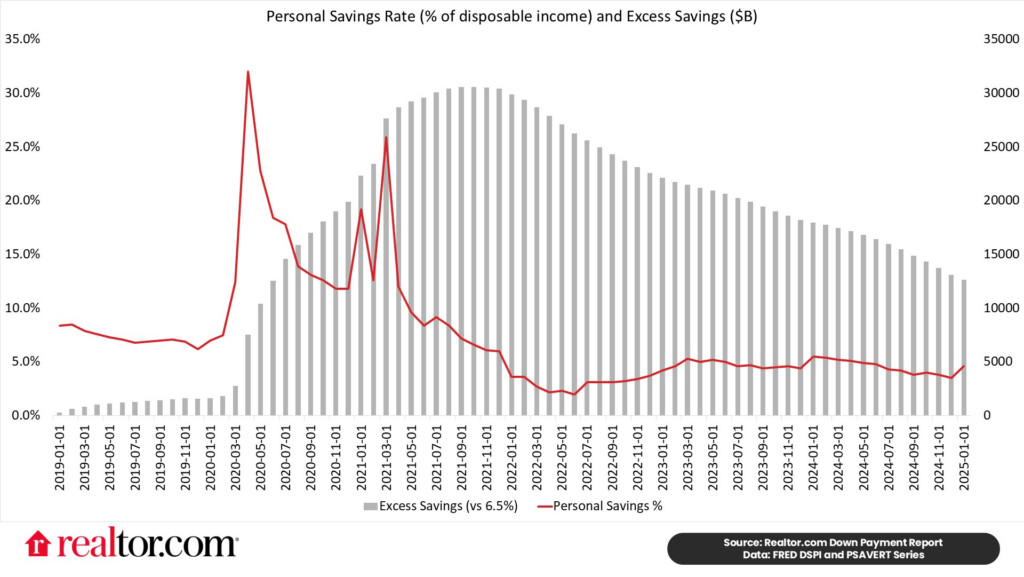

Savings from the pandemic have been used by homebuyers to support higher down payments and consumer expenditure. Consumers saved 6.5% of their disposable income in the three years prior to the pandemic, but during the pandemic, that percentage jumped to over 30% and remained above the pre-pandemic average for more than 20 months.

“As mortgage rates ease, a more diverse set of buyers, in terms of budgets, will likely enter the market, and the incentive to minimize their home loan will soften,” Hale said. “However, if for-sale inventory fails to keep up with increased buyer demand, down payments could climb once again as the result of increased competition.”

The average down payment amount is still more than double the pre-pandemic median, and the average down payment as a percentage of purchase price was more than three percentage points higher, even though the savings rate has decreased since the pandemic highs, which would typically indicate that buyers would find it more difficult to save for a sizable down payment.

Some homebuyers, particularly those who also benefit from near-record high existing home equity that might increase a down payment, are probably helped by still sizable accumulations of crisis savings.

The median sale price and median down payment amount have increased as a result of rising housing activity in the high-priced segment and declining activity in the lower-priced sectors. While fewer homes sold for less than $750,000 in 2024 than in 2023 (down 9.3%), sales of homes in the $750,000+ price range increased by 7.4%.

Although they are still below the 2007 peak, modest down payments—those usually made by first-time homebuyers or those who use government-backed lending choices like FHA or VA loans—saw an increase in payments as well.

The 30th percentile down payment, which is a good indicator of small down payments, was $8,200 in Q4 2024. This was less than one-third of the median down payment amount, up 6.5% from the previous year but lower than the peak of $10,300 in the second quarter of 2022. Even the low end of down payments increased significantly in the fiercely competitive pandemic-era market as purchasers increased their down payments due to competition and the pandemic-era savings boost. The average modest down payment prior to the epidemic in 2019 was $4,600, which was over $4,000 less than what was observed in 2024.

To read more, click here.